- 3 -

Enlarge image

|

*61212232V*

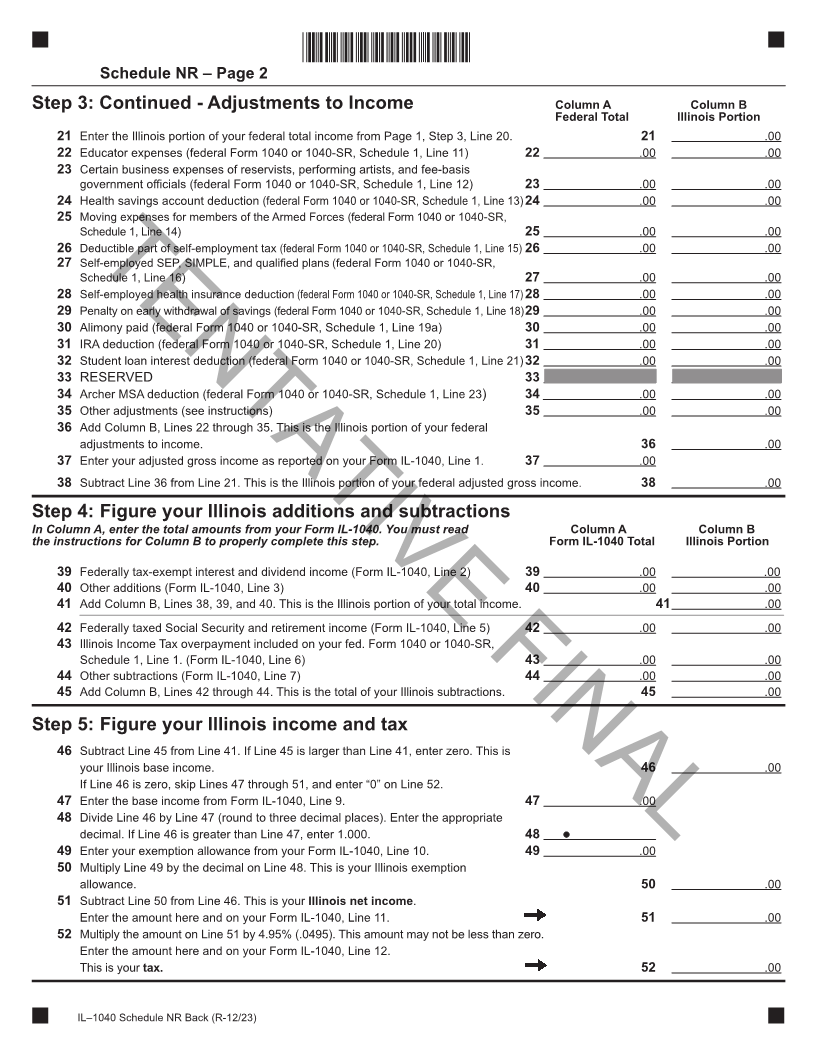

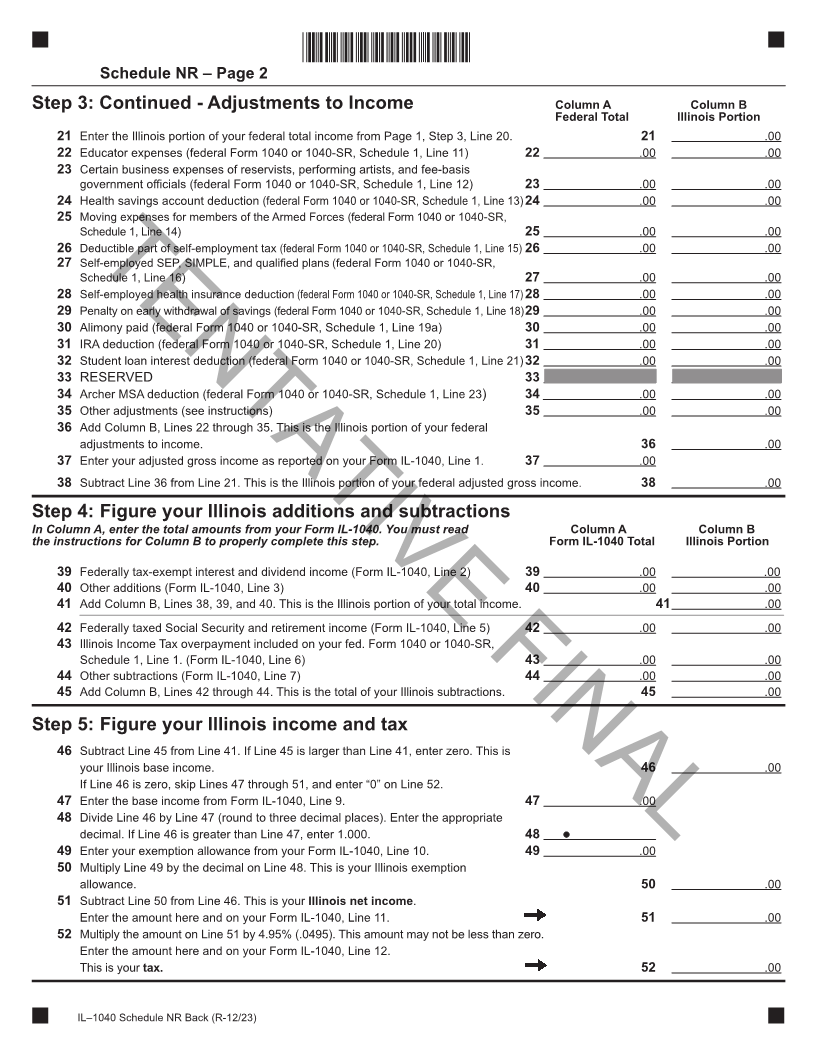

Schedule NR – Page 2

Step 3: Continued - Adjustments to Income Column A Column B

Federal Total Illinois Portion

21 Enter the Illinois portion of your federal total income from Page 1, Step 3, Line 20. 21 .00

22 Educator expenses (federal Form 1040 or 1040-SR, Schedule 1, Line 11) 22 .00 .00

23 Certain business expenses of reservists, performing artists, and fee-basis

government officials (federal Form 1040 or 1040-SR, Schedule 1, Line 12) 23 .00 .00

24 Health savings account deduction (federal Form 1040 or 1040-SR, Schedule 1, Line 13) 24 .00 .00

25 Moving expenses for members of the Armed Forces (federal Form 1040 or 1040-SR,

Schedule 1, Line 14) 25 .00 .00

26 Deductible part of self-employment tax (federal Form 1040 or 1040-SR, Schedule 1, Line 15) 26 .00 .00

27 Self-employed SEP, SIMPLE, and qualified plans (federal Form 1040 or 1040-SR,

TENTATIVE Schedule 1, Line 16) 27 FINAL.00 .00

28 Self-employed health insurance deduction (federal Form 1040 or 1040-SR, Schedule 1, Line 17) 28 .00 .00

29 Penalty on early withdrawal of savings (federal Form 1040 or 1040-SR, Schedule 1, Line 18) 29 .00 .00

30 Alimony paid (federal Form 1040 or 1040-SR, Schedule 1, Line 19a) 30 .00 .00

31 IRA deduction (federal Form 1040 or 1040-SR, Schedule 1, Line 20) 31 .00 .00

32 Student loan interest deduction (federal Form 1040 or 1040-SR, Schedule 1, Line 21) 32 .00 .00

33 RESERVED 33 .00 .00

34 Archer MSA deduction (federal Form 1040 or 1040-SR, Schedule 1, Line 23) 34 .00 .00

35 Other adjustments (see instructions) 35 .00 .00

36 Add Column B, Lines 22 through 35. This is the Illinois portion of your federal

adjustments to income. 36 .00

37 Enter your adjusted gross income as reported on your Form IL-1040, Line 1. 37 .00

38 Subtract Line 36 from Line 21. This is the Illinois portion of your federal adjusted gross income. 38 .00

Step 4: Figure your Illinois additions and subtractions

In Column A, enter the total amounts from your Form IL-1040. You must read Column A Column B

the instructions for Column B to properly complete this step. Form IL-1040 Total Illinois Portion

39 Federally tax-exempt interest and dividend income (Form IL-1040, Line 2) 39 .00 .00

40 Other additions (Form IL-1040, Line 3) 40 .00 .00

41 Add Column B, Lines 38, 39, and 40. This is the Illinois portion of your total income. 41 .00

42 Federally taxed Social Security and retirement income (Form IL-1040, Line 5) 42 .00 .00

43 Illinois Income Tax overpayment included on your fed. Form 1040 or 1040-SR,

Schedule 1, Line 1. (Form IL-1040, Line 6) 43 .00 .00

44 Other subtractions (Form IL-1040, Line 7) 44 .00 .00

45 Add Column B, Lines 42 through 44. This is the total of your Illinois subtractions. 45 .00

Step 5: Figure your Illinois income and tax

46 Subtract Line 45 from Line 41. If Line 45 is larger than Line 41, enter zero. This is

your Illinois base income. 46 .00

If Line 46 is zero, skip Lines 47 through 51, and enter “0” on Line 52.

47 Enter the base income from Form IL-1040, Line 9. 47 .00

48 Divide Line 46 by Line 47 (round to three decimal places). Enter the appropriate

decimal. If Line 46 is greater than Line 47, enter 1.000. 48

49 Enter your exemption allowance from your Form IL-1040, Line 10. 49 .00

50 Multiply Line 49 by the decimal on Line 48. This is your Illinois exemption

allowance. 50 .00

51 Subtract Line 50 from Line 46. This is your Illinois net income.

Enter the amount here and on your Form IL-1040, Line 11. 51 .00

52 Multiply the amount on Line 51 by 4.95% (.0495). This amount may not be less than zero.

Enter the amount here and on your Form IL-1040, Line 12.

This is your tax. 52 .00

IL–1040 Schedule NR Back (R-12/23)

|