Enlarge image

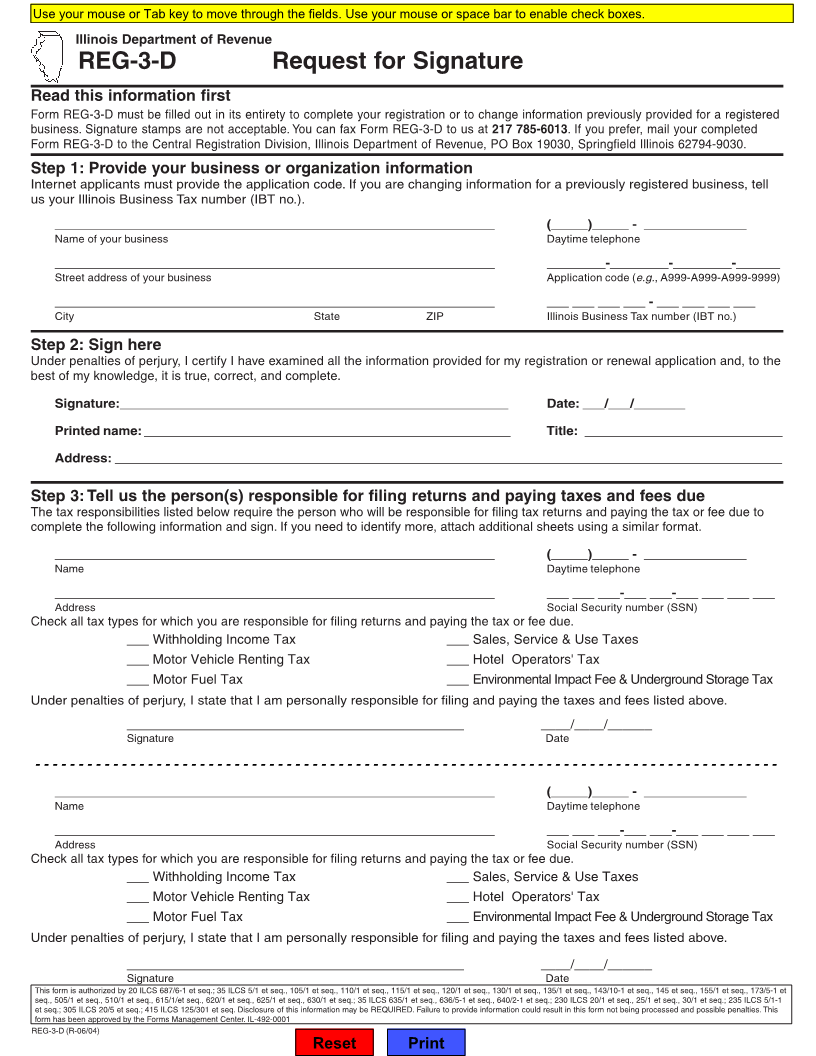

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REG-3-D Request for Signature

Read this information first

Form REG-3-D must be filled out in its entirety to complete your registration or to change information previously provided for a registered

business. Signature stamps are not acceptable. You can fax Form REG-3-D to us at 217 785-6013. If you prefer, mail your completed

Form REG-3-D to the Central Registration Division, Illinois Department of Revenue, PO Box 19030, Springfield Illinois 62794-9030.

Step 1: Provide your business or organization information

Internet applicants must provide the application code. If you are changing information for a previously registered business, tell

us your Illinois Business Tax number (IBT no.).

____________________________________________________________ (_____)_____ - ______________

Name of your business Daytime telephone

____________________________________________________________ ________-________-________-______

Street address of your business Application code (e.g., A999-A999-A999-9999)

____________________________________________________________ ___ ___ ___ ___ - ___ ___ ___ ___

City State ZIP Illinois Business Tax number (IBT no.)

Step 2: Sign here

Under penalties of perjury, I certify I have examined all the information provided for my registration or renewal application and, to the

best of my knowledge, it is true, correct, and complete.

Signature:_____________________________________________________ Date: ___/___/_______

Printed name: __________________________________________________ Title: ___________________________

Address: ___________________________________________________________________________________________

Step 3: Tell us the person(s) responsible for filing returns and paying taxes and fees due

The tax responsibilities listed below require the person who will be responsible for filing tax returns and paying the tax or fee due to

complete the following information and sign. If you need to identify more, attach additional sheets using a similar format.

____________________________________________________________ (_____)_____ - ______________

Name Daytime telephone

____________________________________________________________ ___ ___ ___-___ ___-___ ___ ___ ___

Address Social Security number (SSN)

Check all tax types for which you are responsible for filing returns and paying the tax or fee due.

___ Withholding Income Tax ___ Sales, Service & Use Taxes

___ Motor Vehicle Renting Tax ___ Hotel Operators' Tax

___ Motor Fuel Tax ___ Environmental Impact Fee & Underground Storage Tax

Under penalties of perjury, I state that I am personally responsible for filing and paying the taxes and fees listed above.

______________________________________________ ____/____/______

Signature Date

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

____________________________________________________________ (_____)_____ - ______________

Name Daytime telephone

____________________________________________________________ ___ ___ ___-___ ___-___ ___ ___ ___

Address Social Security number (SSN)

Check all tax types for which you are responsible for filing returns and paying the tax or fee due.

___ Withholding Income Tax ___ Sales, Service & Use Taxes

___ Motor Vehicle Renting Tax ___ Hotel Operators' Tax

___ Motor Fuel Tax ___ Environmental Impact Fee & Underground Storage Tax

Under penalties of perjury, I state that I am personally responsible for filing and paying the taxes and fees listed above.

______________________________________________ ____/____/______

Signature Date

This form is authorized by 20 ILCS 687/6-1 et seq.; 35 ILCS 5/1 et seq., 105/1 et seq., 110/1 et seq., 115/1 et seq., 120/1 et seq., 130/1 et seq., 135/1 et seq., 143/10-1 et seq., 145 et seq., 155/1 et seq., 173/5-1 et

seq., 505/1 et seq., 510/1 et seq., 615/1/et seq., 620/1 et seq., 625/1 et seq., 630/1 et seq.; 35 ILCS 635/1 et seq., 636/5-1 et seq., 640/2-1 et seq.; 230 ILCS 20/1 et seq., 25/1 et seq., 30/1 et seq.; 235 ILCS 5/1-1

et seq.; 305 ILCS 20/5 et seq.; 415 ILCS 125/301 et seq. Disclosure of this information may be REQUIRED. Failure to provide information could result in this form not being processed and possible penalties. This

form has been approved by the Forms Management Center. IL-492-0001

REG-3-D (R-06/04)

Reset Print