- 3 -

Enlarge image

|

in

2 in is of

on the the less

have days

prior at LATE within wages

line Payments month included from Attorney worker. quarter excess

of to thereof 6C

thirty FOR is amount in

amount interest day. the whichever and agent of the Total

each

wages deemed first fraction the of paid

6B,

net

in the add per or Power during

the deducted

are month, PENALTY enter 6A, a

be authorized wages

date, Number performed.

enter of date $10,000 THE underpayment Lines

excess 2% preceding For per or worker

report,

due may person, were

plus

included include and due month each less. this line officer Security each

$2,500

12/365 is 5B other non-taxable

the the

not 2 at (Exception: or for previous for to UITaxRates

Do of this or

interest

wages after $10 any 5A partner, any Social services and

paid

Line the on by

day wages is

by received. whichever for line line6D. when

taxable /employers/

complete

Enter remittance of owner, wages of

- worker. from computed days last total shown on by signed

3,590 Line not month payment sum If both ides

3 paid 30 was of penalty the

the

each $5,000, total

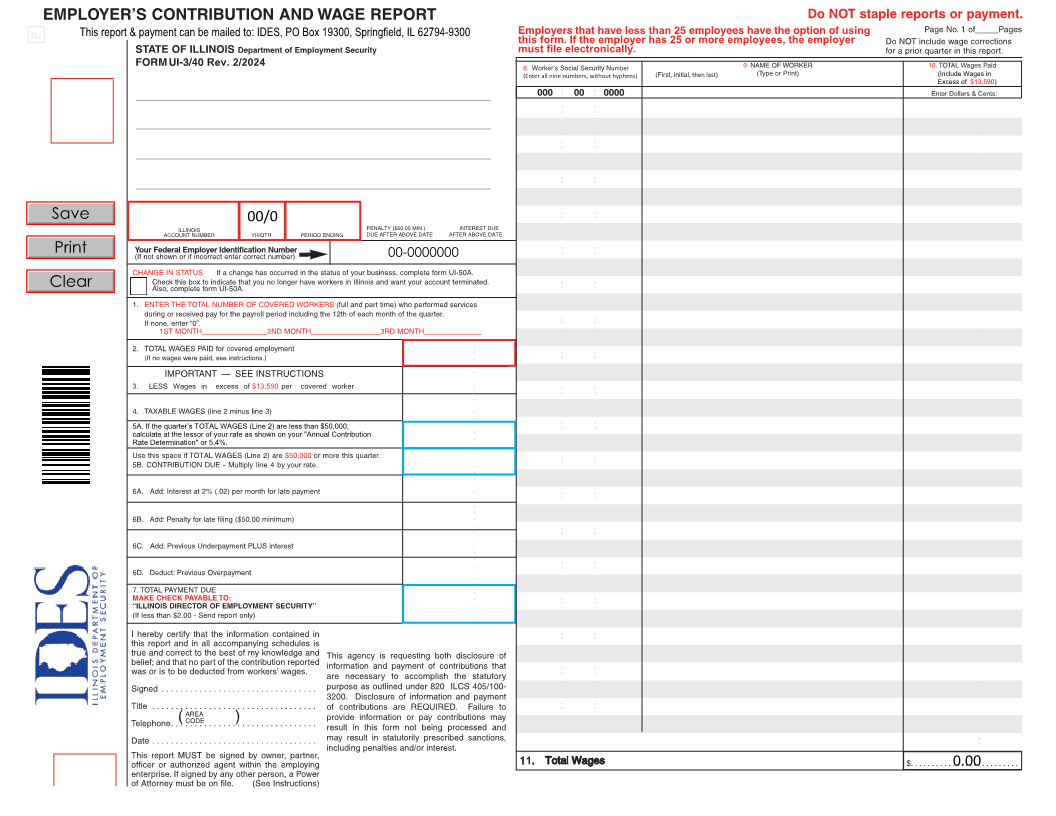

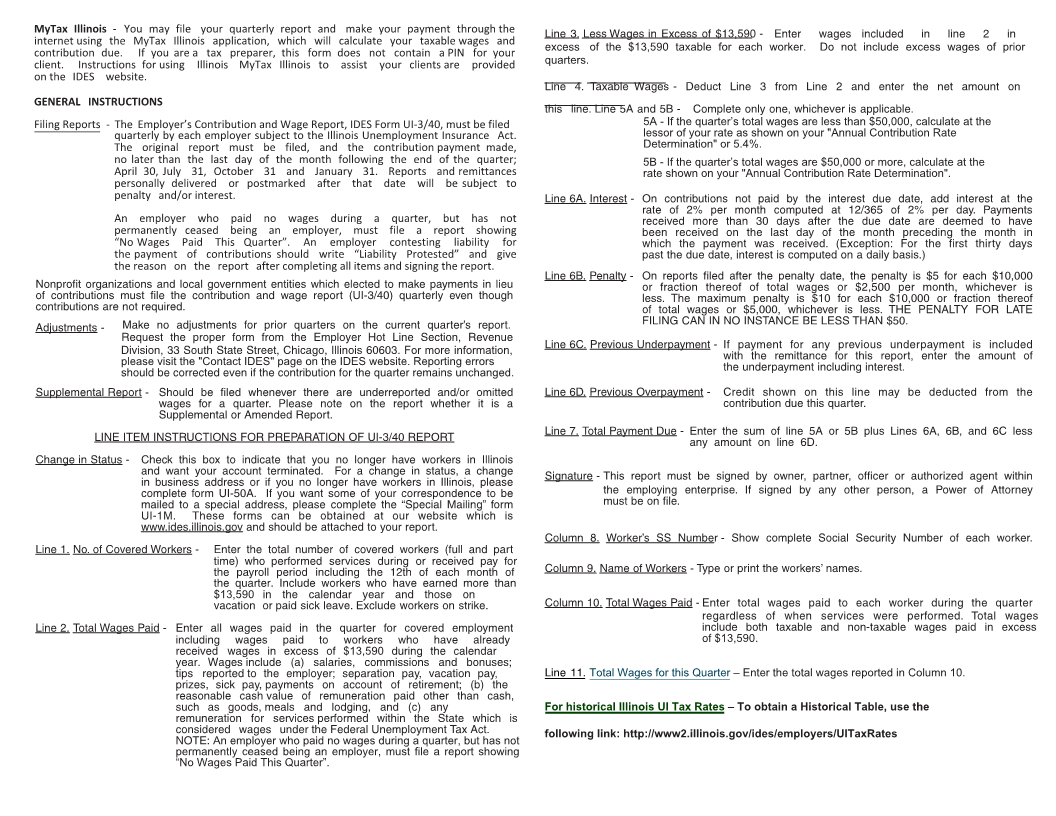

Show – Enter the total wages reported in Column 10.

than on or If with the underpayment including interest. Credit contribution due this quarter. the – To obtain a Historical Table, use the

for - amount signed - $13,590.

per thereof -

payment

taxable - - 2% more maximum be - Enter regardless include of

Deduct Complete only one, whichever is applicable. wages Enter any enterprise. - Type or print the workers’ names. .illinois.gov/

contributions of received the - Number 2

The must

fraction total SS

5A - If the quarter’s total wages are less than $50,000, calculate at the lessor of your rate as shown on your "Annual Contribution Rate Determination" or 5.4%. 5B - If the quarter’s total wages are $50,000 or more, calculate at the rate shown on your "Annual Contribution Rate Determination". On rate received been which past the due date, interest is computed on a daily basis.) On reports filed after the penalty date, the penalty is $5 for each $10,000 or less. of FILING CAN IN NO INSTANCE BE LESS THAN $50.

$13,590 Wages - - report employing

the This the must be on file. Worker’s Name of Workers Total Wages Paid

-

Less Wages in Excess of $1 of Taxable Line 5A and 5B Interest Penalty Previous Underpayment Previous Overpayment 8. Total Wages for this Quarter

Total Payment Due

4. line.

Line 3. excess quarters. Line this Line 6A. Line 6B. Line 6C. Line 6D. Line 7. Signature Column Column 9. Column 10. Line 11. For historical Illinois UI Tax Rates following link: http://www

to a is of is

and your Act. not for give is part the

made,

already

for provided quarter; has showing though report. omitted it Illinois pay, which

and Revenue in which and month on bonuses; (b) cash,

through the liability even unchanged. employment calendar than

be subject (full

a PIN of the and remittances but and/or received pay for each have and State

quarter’s whether any

payment clients are end will a Section, workers website of those the vacation other

taxable wages the

quarter, report . For more information, report workers covered pay, retirement; (c)

Protested” Line

quarterly

your contain the Reports date file contesting current have our 12th and who during of paid

for and within

your your contribution payment a Hot the at the year commissions

not 31. the underreported longer covered

the that must “Liability (UI-3/40) on

make assist following on are no of quarter workers $13,590 separation account

does lodging,

during employer of on

and calculate to and January after report Employer note obtained the to salaries, remuneration performed the Federal Unemployment Tax Act.

you calendar

form An write there be number in of and

month

(a)

report will this filed, and wages employer, quarters the that the paid excess employer; under

the wage Please services

can

be of 31 no an prior from total performed services during or paid sick leave. Exclude workers on strike. paid the payments value meals

or

after completing all items and signing the report. and in

postmarked for

MyTax Quarter”. for form whenever indicate and should be attached to your report. the who include to pay,

quarterly which preparer, Illinois must day or paid being quarter. to wages wages in cash wages

forms payroll period including

wages goods,

application, last October This report filed a Enter time) the quarter. Include workers who have earned more than the $13,590 vacation all sick

your Illinois 31, who the contribution for box Wages reported as An employer who paid no wages during a quarter, but has not

proper be

report the ceased Paid contributions should of These -

file Illinois tax delivered on the adjustments the this

Enter including received year. tips prizes, reasonable such remuneration considered NOTE: permanently ceased being an employer, must file a report showing “No Wages Paid This Quarter”.

may you are a file no be corrected even if the contribution for the quarter remains Should wages Supplemental or Amended Report. -

and/or interest.

MyTax If for using original 30, July employer - Check and want your account terminated. For a change in status, a change in business address or if you no longer have workers in Illinois, please complete form UI-50A. If you want some of your correspondence to be mailed to a special address, please complete the “Special Mailing” form UI-1M. www.ides.illinois.gov

- the quarterlyThe noApril laterpersonally penalty byAn thaneachpermanently “NotheemployerWagesthepaymentreasonmust Make subjectRequest Division,pleaseshould to33thevisitSouthIllinoistheState"Contact- Street,UnemploymentIDES"Chicago,pageIllinoisonInsurance60603the IDES website. Reporting errors

You

due. website. - LINE ITEM INSTRUCTIONS FOR PREPARATION OF UI-3/40 REPORT

INSTRUCTIONS

Instructions

Illinois IDES No. of Covered Workers Total Wages Paid

contributions

MyTax internet using contribution client. on the GENERAL Filing Reports - The Employer’s Contribution and Wage Report, IDES Form UI-3/40, must be filed Nonprofit organizations and local government entities which elected to make payments in lieu of contributions are not required. Adjustments Supplemental Report Change in Status Line 1. Line 2.

|