Enlarge image

Illinois Department of Revenue

Publication 103

Penalties and Interest for Illinois Taxes

The information in this publication is About this publication

current as of the date of the publication.

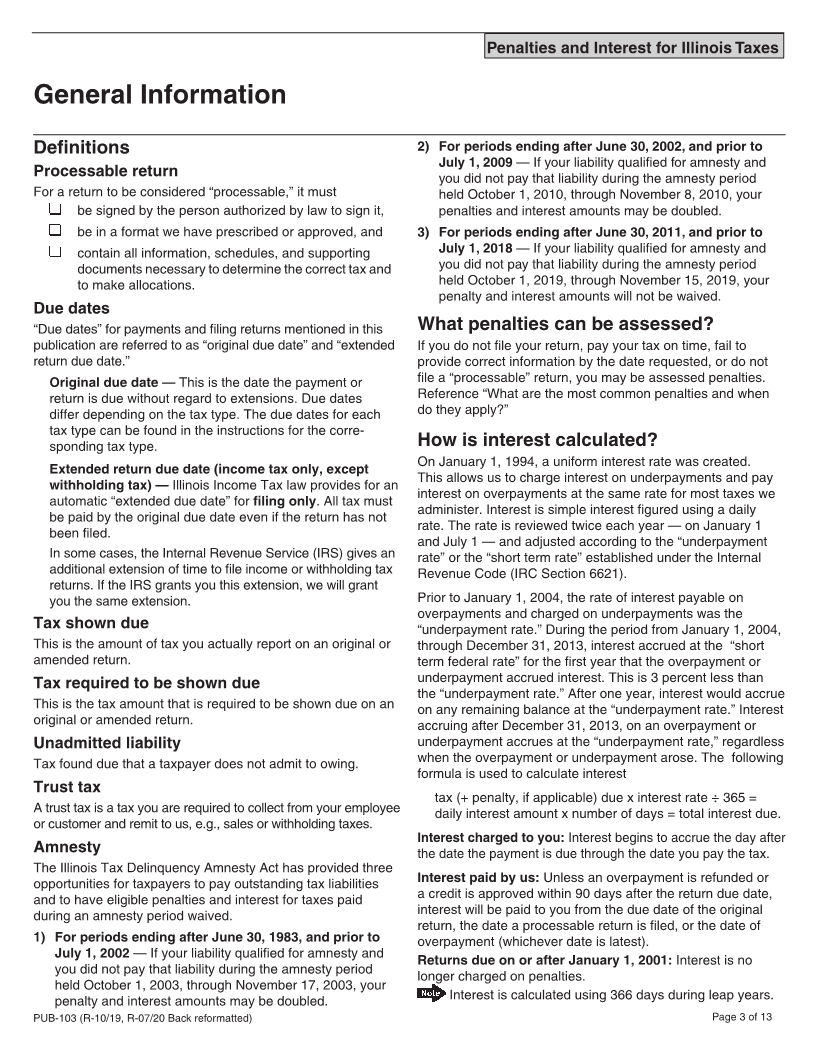

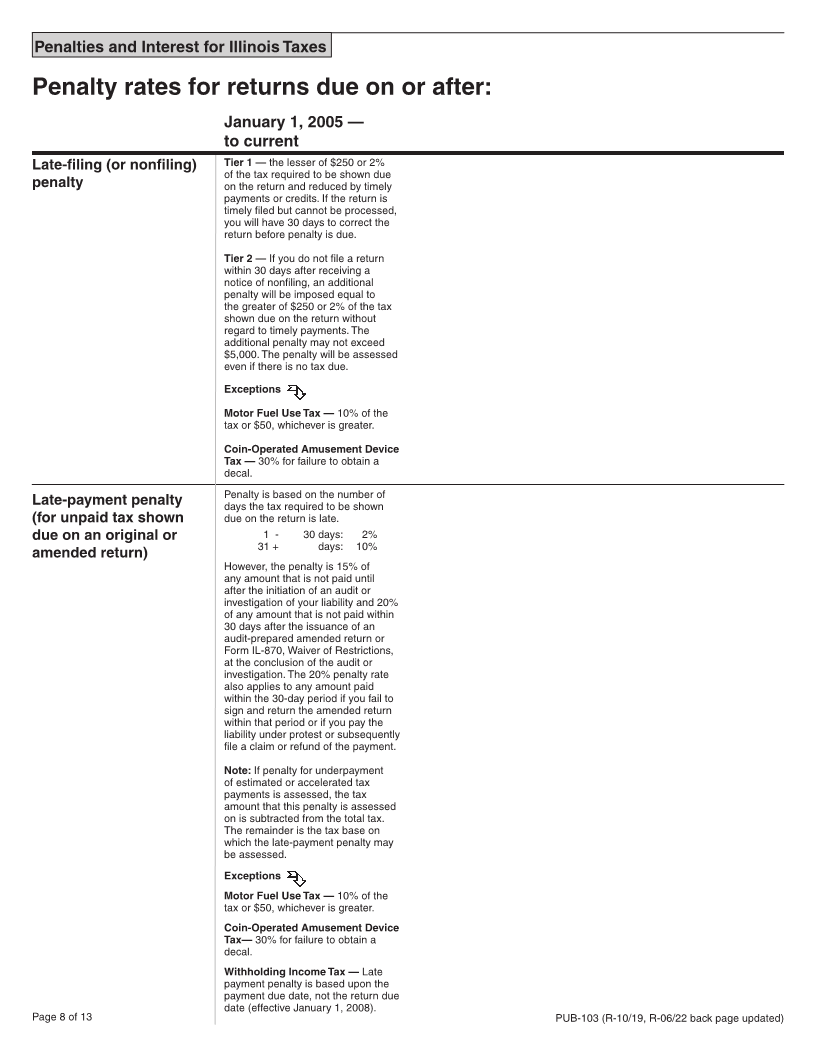

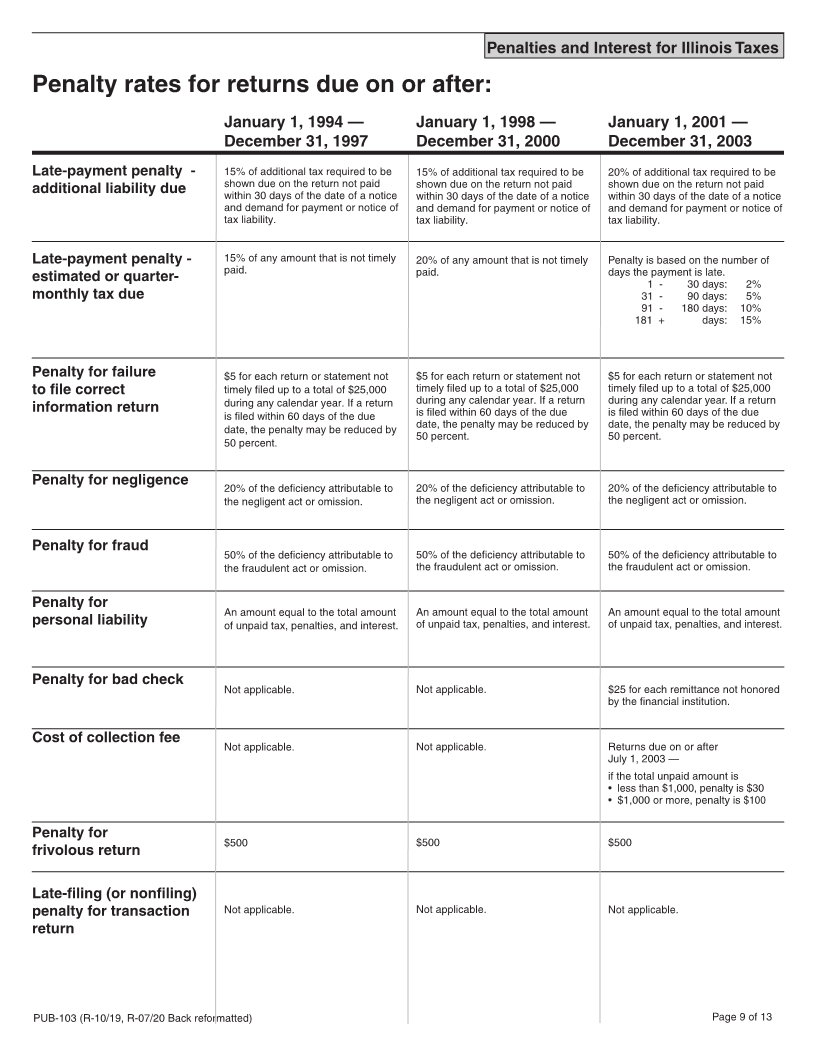

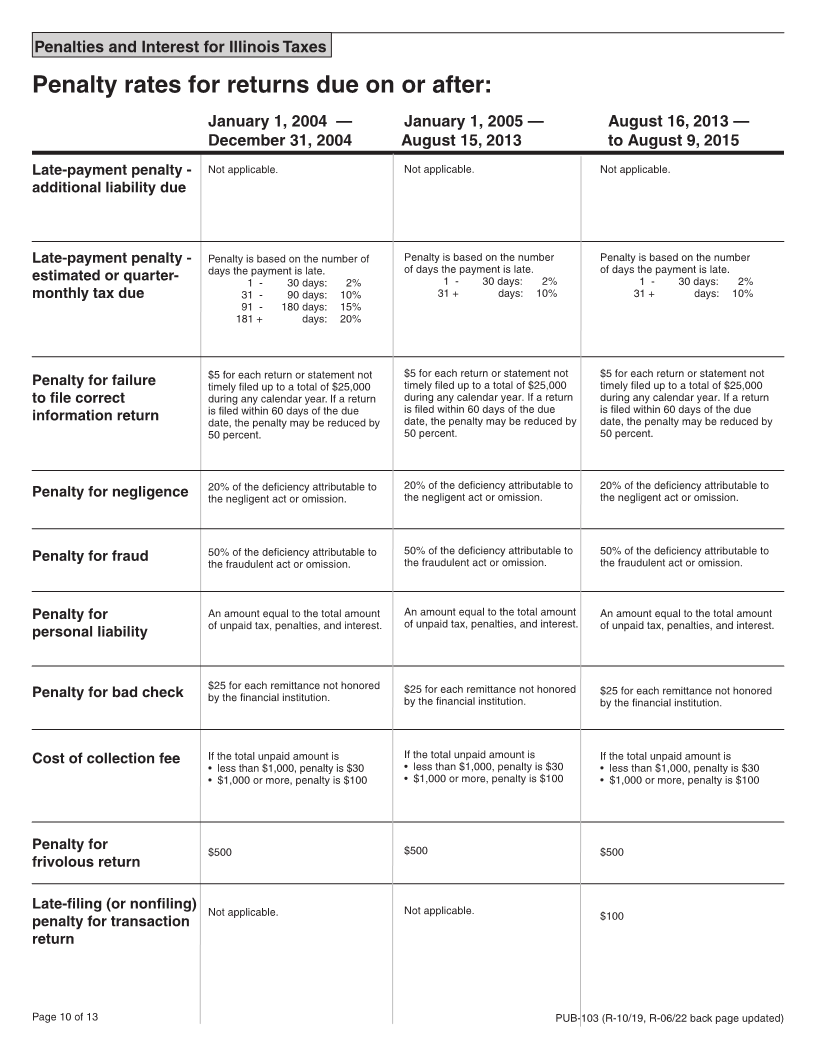

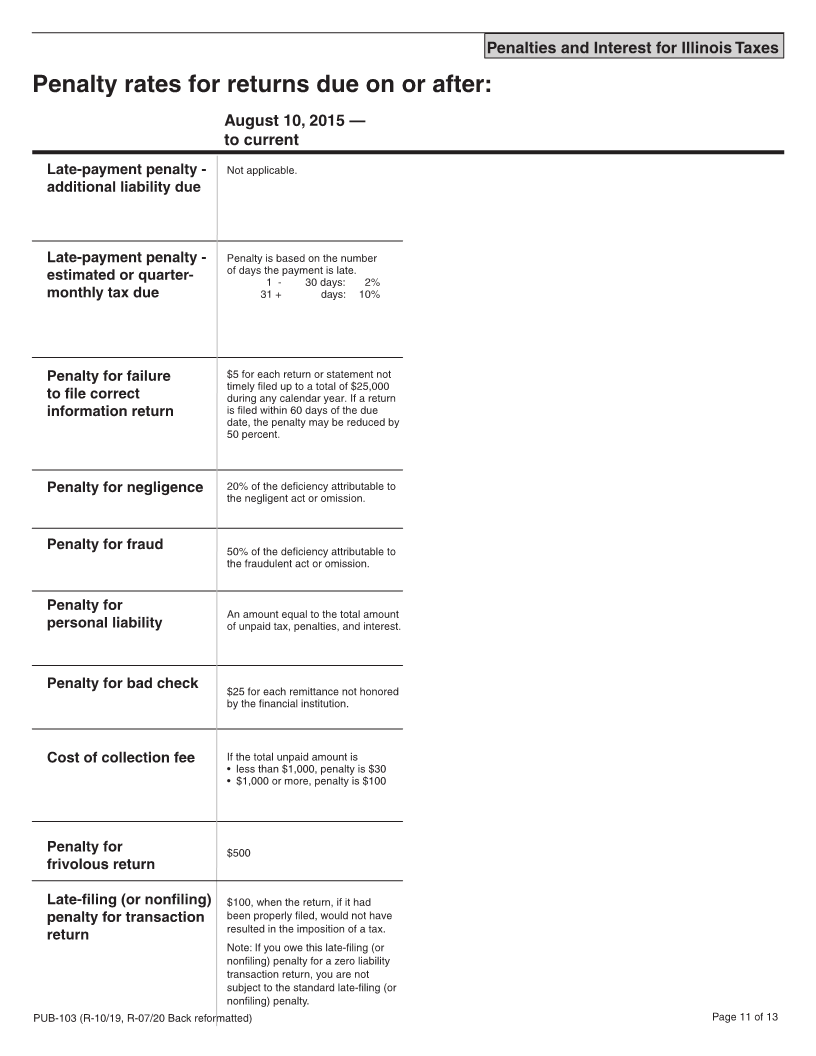

Please visit our website at The purpose of this publication is to explain penalties and interest assessed on returns

due on or after January 1, 1994. If you need penalty or interest information for earlier

tax.illinois.gov to verify you have the

liabilities, see the appropriate tax act. The objectives of this publication are to

most current revision.

answer general questions about penalty and interest,

This publication is written in the plain identify and define each penalty,

English style so the tax information is explain how each penalty is calculated and assessed,

easier to understand. As a result, we explain how interest is calculated, and

do not directly quote Illinois statutes

provide penalty and interest rates.

or the Illinois Administrative Code.

The contents of this publication are

informational only and do not take We encourage you to let us calculate your penalties and interest and bill you. However,

the place of statutes, rules, and court if you annualize your income to compute your estimated income tax installments, you

decisions. must complete and attach to your return Form IL-2210, Computation of Penalties for

Individuals, or Form IL-2220, Computation of Penalties for Businesses, to show when

your income was earned.

For information or forms

This publication does not cover penalties and interest assessed through the Racing

Visit our website at tax.illinois.gov Privilege Tax Act, the Property Tax Code, or the Real Estate Transfer Tax Act. For

Call 1 800 732-8866 or 217 782-3336 information on these taxes, see the appropriate tax acts.

Call our TDD (telecommunications

device for the deaf) at 1 800 544-5304

Taxpayer Bill of Rights

You have the right to call the Department of Revenue for help in resolving tax problems.

You have the right to privacy and confidentiality under most tax laws.

You have the right to respond, within specified time periods, to Department notices by asking questions, paying the

amount due, or providing proof to refute the Department’s findings.

You have the right to appeal Department decisions, in many instances, within specified time periods, by asking for

Department review, by filing a petition with the Illinois Independent Tax Tribunal, or by filing a complaint in circuit court.

If you have overpaid your taxes, you have the right, within specified time periods, to file for a credit (or, in some cases,

a refund) of that overpayment.

For more information about these rights and other Department procedures, you may write us at the following address:

Problems Resolution Office

Illinois Department of Revenue

PO Box 19014

Springfield, IL 62794-9014

Get Illinois Department of Revenue forms and information at tax.illinois.gov