Enlarge image

Illinois Department of Revenue

August 2022

Publication 130

Who is Required to Withhold Illinois Income Tax

The information in this publication About this publication

is current as of the date of the Publication 130, Who is Required to Withhold Illinois Income Tax, is about Illinois

publication. Please visit our website at income tax withholding requirements. The objectives of this publication are to identify

tax.illinois.gov to verify you have the • who is an employer or payer;

most current revision.

• who is an employee or payee;

This publication is written in the plain

• when withholding must occur;

English style so the tax information is

easier to understand. As a result, we • other withholding requirements for payments of lottery or gambling winnings and

purchases of rights to lottery winnings;

do not directly quote Illinois statutes

and the Illinois Administrative Code. • what forms you must give to employees, payees, and lottery or gambling winners;

The contents of this publication are and

informational only and do not take • what records you should keep.

the place of statutes, rules, and court

decisions. For many topics covered

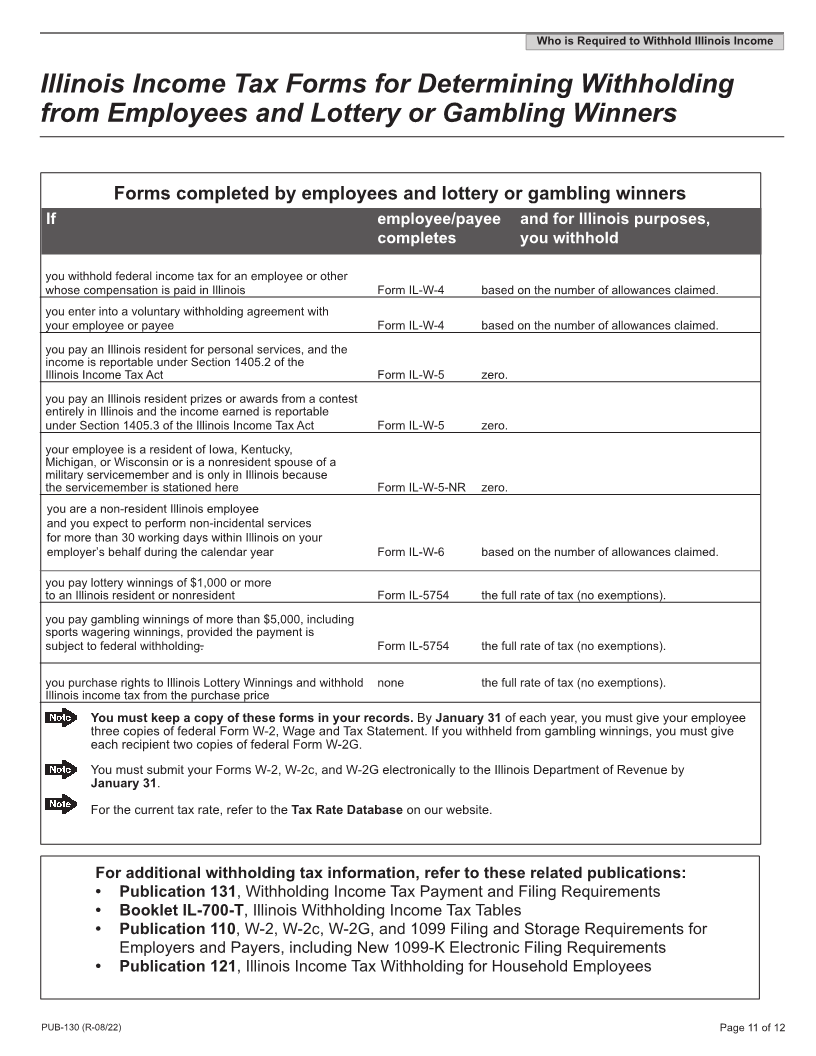

Related publications:

in this publication, we have provided

a reference to the applicable section • Publication 131, Withholding Income Tax Payment and Filing Requirements;

or part of the Illinois Administrative • Booklet IL-700-T, Illinois Withholding Income Tax Tables, to calculate withholding;

• Publication 110, W-2, W-2c, W-2G, and 1099 Filing and Storage Requirements for

Code for further clarification or more Employers and Payers, including New 1099-K Electronic Filing Requirements; and

detail. All of the sections and parts • Publication 121, Illinois Income Tax Withholding for Household Employees.

referenced can be found in Title 86 of

the Code.

Taxpayer Bill of Rights

You have the right to call the Illinois Department of Revenue (IDOR) for help in resolving tax problems.

You have the right to privacy and confidentiality under most tax laws.

You have the right to respond, within specified time periods, to IDOR notices by asking questions, paying the amount due, or

providing proof to refute the IDOR’s findings.

You have the right to appeal IDOR decisions, in many instances, within specified time periods, by asking for department

review, by filing a petition with the Illinois Independent Tax Tribunal, or by filing a complaint in circuit court.

If you have overpaid your taxes, you have the right, within specified time periods, to a credit (or, in some cases, a refund) of

that overpayment.

For more information about these rights and other IDOR procedures, you may write us at the following address:

PROBLEMS RESOLUTION OFFICE

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19014

SPRINGFIELD IL 62794-9014

Get Illinois Department of Revenue forms and information at tax.illinois.gov

PUB-130 (R-08/22)