Enlarge image

Illinois Department of Revenue

January 2024

Publication 131

Withholding Income Tax Payment and Filing Requirements

The information in this publication About this publication

is current as of the date of the This publication guides an employer or payer in paying and reporting Illinois

publication. Please visit our website at Withholding Income Tax. You need to know this information if you are an employer or

tax.illinois.gov to verify you have the withholding agent.

most current revision. The objectives of this publication are to explain

This publication is written in the plain • when and how to make your payments and file your returns, and

English style so the tax information is • the different payment schedules.

easier to understand. As a result, we

do not directly quote Illinois statutes Related publications:

and the Illinois Administrative Code. • Publication 121, Illinois Income Tax Withholding for Household Employees.

The contents of this publication are • Publication 130, Who is Required to Withhold Illinois Income Tax.

informational only and do not take • Booklet IL-700-T, Illinois Withholding Income Tax Tables

the place of statutes, rules, and court • Publication 131-D, Withholding Income Tax Payment and Return Due Dates

decisions.

Contents

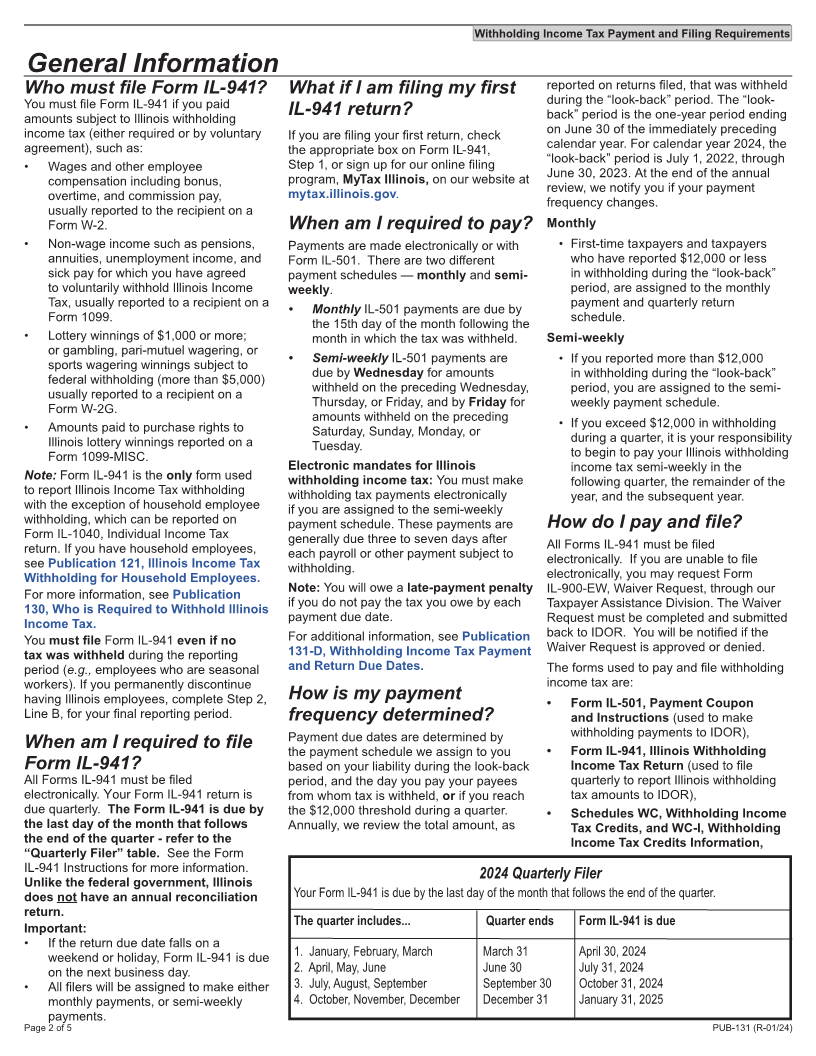

Who must file Form IL-941? .........................................................................................2

When am I required to file Form IL-941? ......................................................................2

What if I am filing my first IL-941 return? ......................................................................2

When am I required to pay? ........................................................................................2

For information or forms How is my payment frequency determined? ................................................................2

• Visit our website at tax.illinois.gov How do I pay and file? ..................................................................................................2

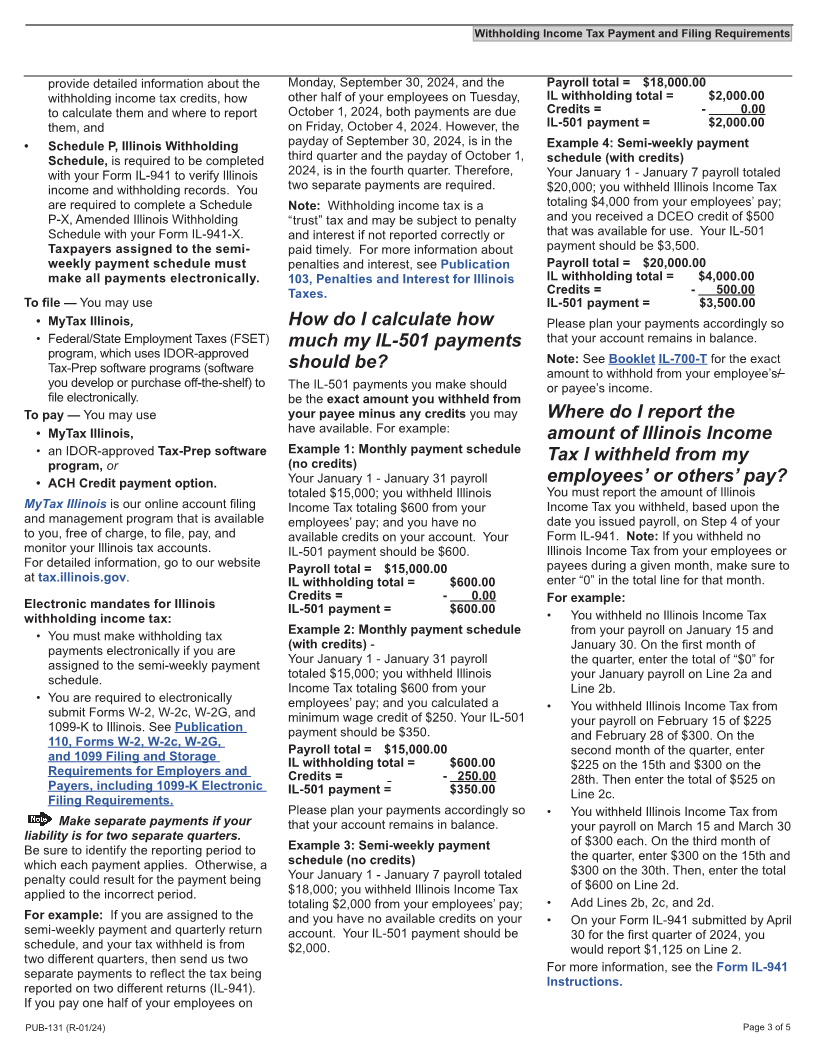

How do I calculate how much my IL-501 payments should be?...................................3

• Call 800 732-8866 or 217 782-3336

Where do I report the amount of Illinois Income Tax I

• Call TTY at 1 800 544-5304 withheld from my employees’ or others’ pay? .........................................................3

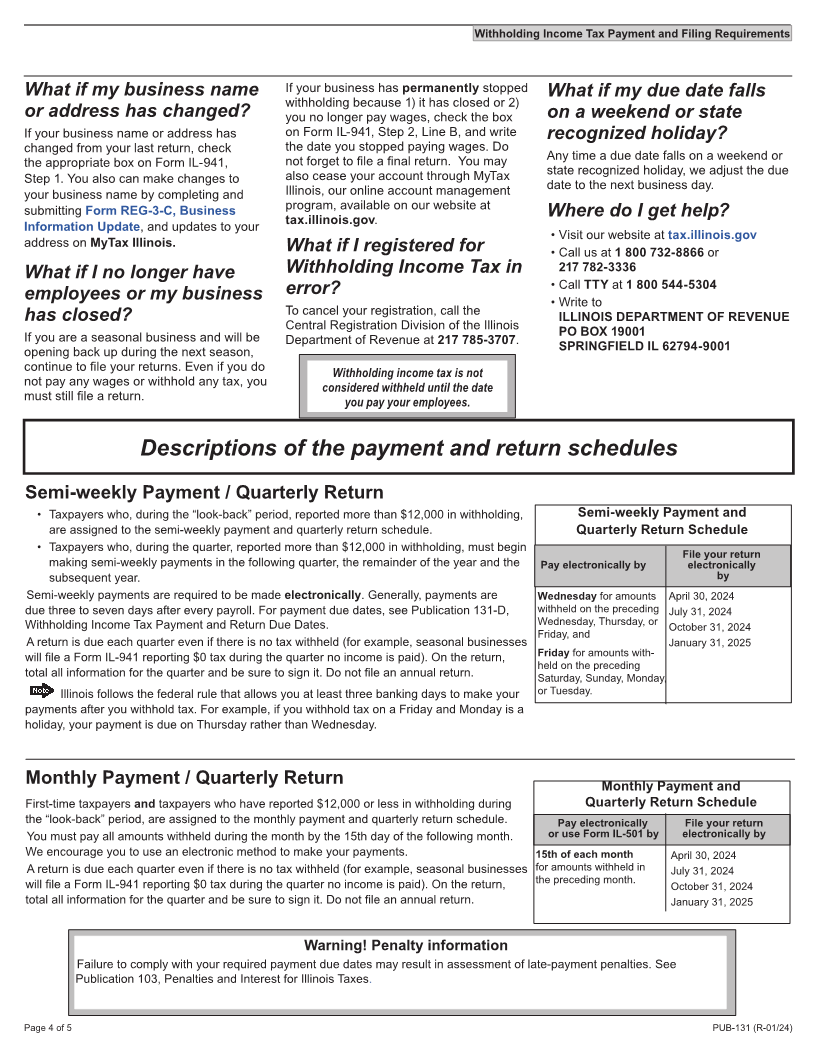

What if my business name or address has changed? .................................................. 4

What if I no longer have employees or my business has closed? ................................ 4

What if I registered for Withholding Income Tax in error? ............................................. 4

What if my due date falls on a weekend or state recognized holiday? ......................... 4

Printed by authority of the state of Illinois -

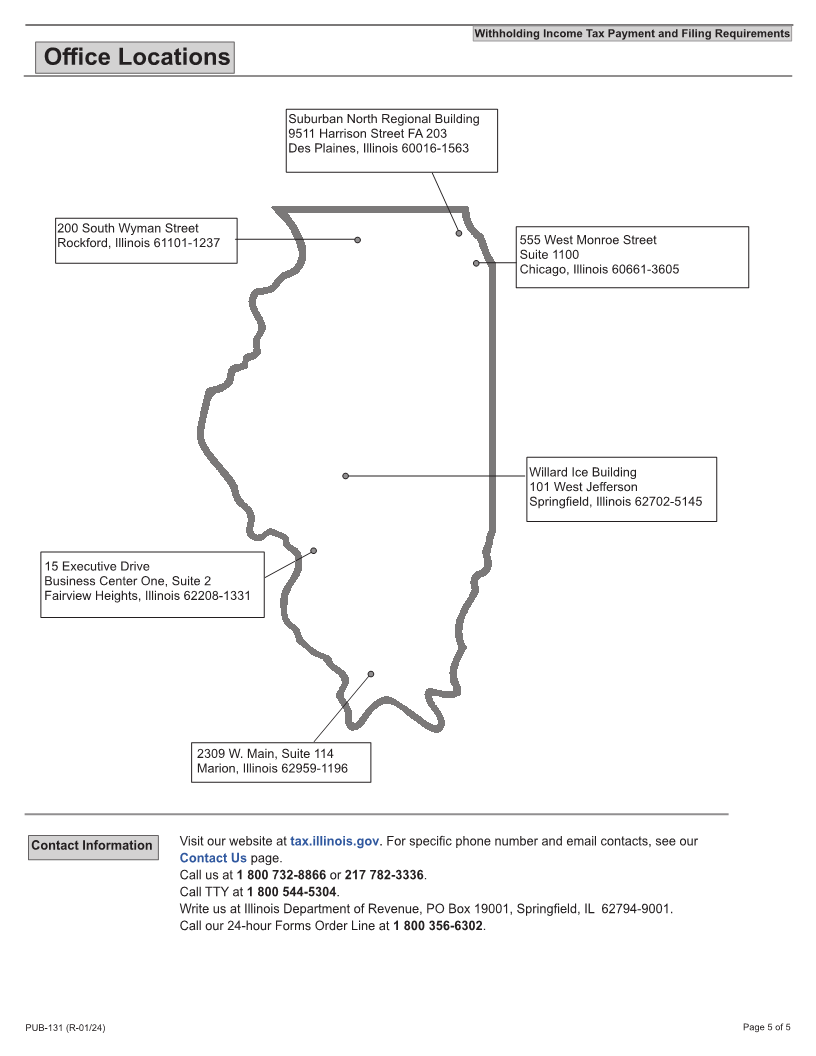

web only, 1 copy PUB-131 (R-01/24). Where do I get help? ....................................................................................................4

Descriptions of the payment and return schedules ...................................................... 4

Taxpayer Bill of Rights

• You have the right to call the Illinois Department of Independent Tax Tribunal, or by filing a complaint in

Revenue (IDOR) for help in resolving tax problems. circuit court.

• You have the right to privacy and confidentiality under • If you have overpaid your taxes, you have the right,

most tax laws. within specified time periods, to a credit (or, in some

cases, a refund) of that overpayment.

• You have the right to respond, within specified time

periods, to IDOR notices by asking questions, paying For more information about these rights and other IDOR

the amount due, or providing proof to refute IDOR’s procedures, you may write us at the following address:

findings. Problems Resolution Office

• You have the right to appeal IDOR decisions, in many Illinois Department of Revenue

instances, within specified time periods, by asking for PO Box 19014

department review, by filing a petition with the Illinois Springfield, IL 62794-9014

Get forms and other information at tax.illinois.gov