Enlarge image

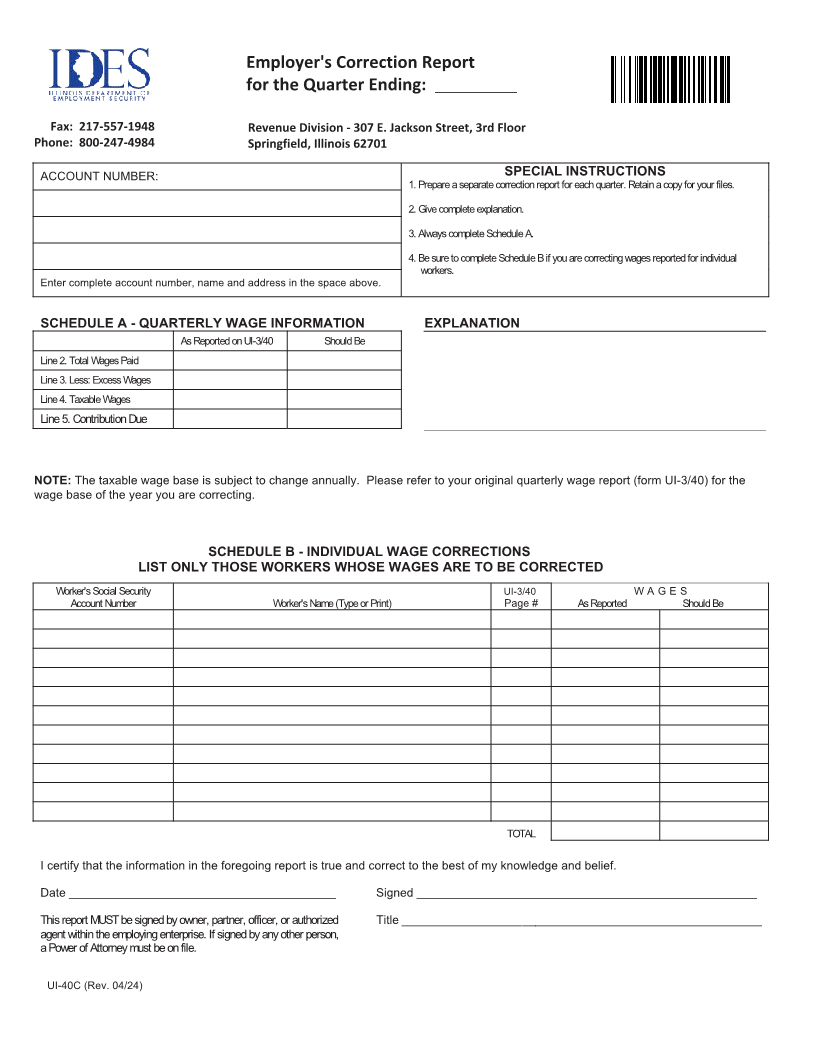

Employer's Correction Report

for the Quarter Ending:

Fax: 217-557-1948 Revenue Division - 307 E. Jackson Street, 3rd Floor

Phone: 800-247-4984 Springfield, Illinois 62701

ACCOUNT NUMBER: SPECIAL INSTRUCTIONS

1. Prepare a separate correction report for each quarter. Retain a copy for your files.

2. Give complete explanation.

3. Always complete Schedule A.

4. Be sure to complete Schedule B if you are correcting wages reported for individual

workers.

Enter complete account number, name and address in the space above.

SCHEDULE A - QUARTERLY WAGE INFORMATION EXPLANATION

As Reported on UI-3/40 Should Be

Line 2. Total Wages Paid

Line 3. Less: Excess Wages

Line 4. Taxable Wages

Line 5. Contribution Due

NOTE: The taxable wage base is subject to change annually. Please refer to your original quarterly wage report (form UI-3/40) for the

wage base of the year you are correcting.

SCHEDULE B - INDIVIDUAL WAGE CORRECTIONS

LIST ONLY THOSE WORKERS WHOSE WAGES ARE TO BE CORRECTED

Worker's Social Security UI-3/40 W A G E S

Account Number Worker's Name (Type or Print) Page # As Reported Should Be

TOTAL

I certify that the information in the foregoing report is true and correct to the best of my knowledge and belief.

Date ________________________________________ Signed ___________________________________________________

This report MUST be signed by owner, partner, officer, or authorized Title ______________________________________________________

agent within the employing enterprise. If signed by any other person,

a Power of Attorney must be on file.

UI-40C (Rev.04/24)