Enlarge image

Reset Form

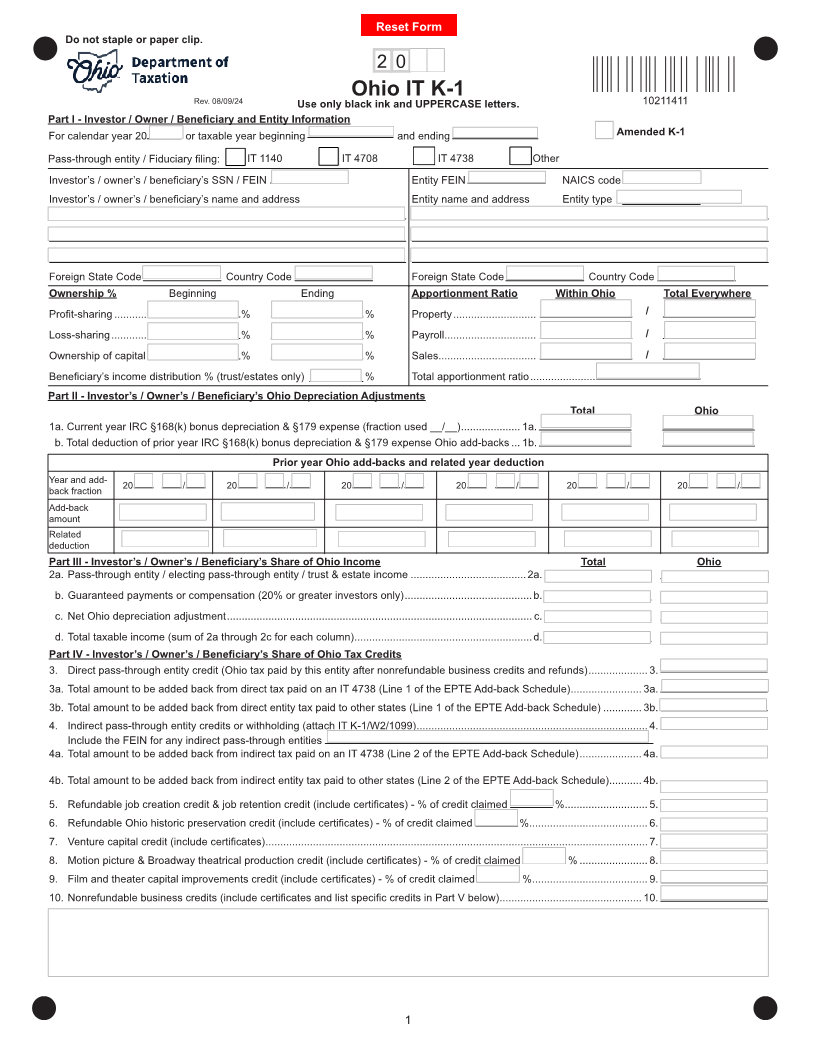

Do not staple or paper clip.

2 0

Rev. 08/09/24 Ohio IT K-1 10211411

Use only black ink and UPPERCASE letters.

Part I - Investor / Owner / Beneficiary and Entity Information

For calendar year 20 or taxable year beginning and ending Amended K-1

Pass-through entity / Fiduciary filing: IT 1140 IT 4708 IT 4738 Other

Investor’s / owner’s / beneficiary’s SSN / FEIN Entity FEIN NAICS code

Investor’s / owner’s / beneficiary’s name and address Entity name and address Entity type

Foreign State Code Country Code Foreign State Code Country Code

Ownership % Beginning Ending Apportionment Ratio Within Ohio Total Everywhere

Profit-sharing ........... % % Property ............................ /

Loss-sharing ............ % % Payroll............................... /

Ownership of capital % % Sales................................. /

Beneficiary’s income distribution % (trust/estates only) % Total apportionment ratio ......................

Part II - Investor’s / Owner’s / Beneficiary’s Ohio Depreciation Adjustments

Total Ohio

1a. Current year IRC §168(k) bonus depreciation & §179 expense (fraction used __/__) .................... 1a.

b. Total deduction of prior year IRC §168(k) bonus depreciation & §179 expense Ohio add-backs ... 1b.

Prior year Ohio add-backs and related year deduction

Year and add- 20 / 20 / 20 / 20 / 20 / 20 /

back fraction

Add-back

amount

Related

deduction

Part III - Investor’s / Owner’s / Beneficiary’s Share of Ohio Income Total Ohio

2a. Pass-through entity / electing pass-through entity / trust & estate income .......................................2a.

b. Guaranteed payments or compensation (20% or greater investors only) ...........................................b.

c. Net Ohio depreciation adjustment ....................................................................................................... c.

d. Total taxable income (sum of 2a through 2c for each column) ............................................................d.

Part IV - Investor’s / Owner’s / Beneficiary’s Share of Ohio Tax Credits

3. Direct pass-through entity credit (Ohio tax paid by this entity after nonrefundable business credits and refunds) .................... 3.

3a. Total amount to be added back from direct tax paid on an IT 4738 (Line 1 of the EPTE Add-back Schedule) ........................ 3a.

3b. Total amount to be added back from direct entity tax paid to other states (Line 1 of the EPTE Add-back Schedule) ............. 3b.

4. Indirect pass-through entity credits or withholding (attach IT K-1/W2/1099) .............................................................................. 4.

Include the FEIN for any indirect pass-through entities

4a. Total amount to be added back from indirect tax paid on an IT 4738 (Line 2 of the EPTE Add-back Schedule) ..................... 4a.

4b. Total amount to be added back from indirect entity tax paid to other states (Line 2 of the EPTE Add-back Schedule) ........... 4b.

5. Refundable job creation credit & job retention credit (include certificates) - % of credit claimed % ............................ 5.

6. Refundable Ohio historic preservation credit (include certificates) - % of credit claimed % ........................................ 6.

7. Venture capital credit (include certificates) .................................................................................................................................7.

8. Motion picture & Broadway theatrical production credit (include certificates) - % of credit claimed % ....................... 8.

9. Film and theater capital improvements credit (include certificates) - % of credit claimed % ....................................... 9.

10. Nonrefundable business credits (include certificates and list specific credits in Part V below) ................................................ 10.

1