Enlarge image

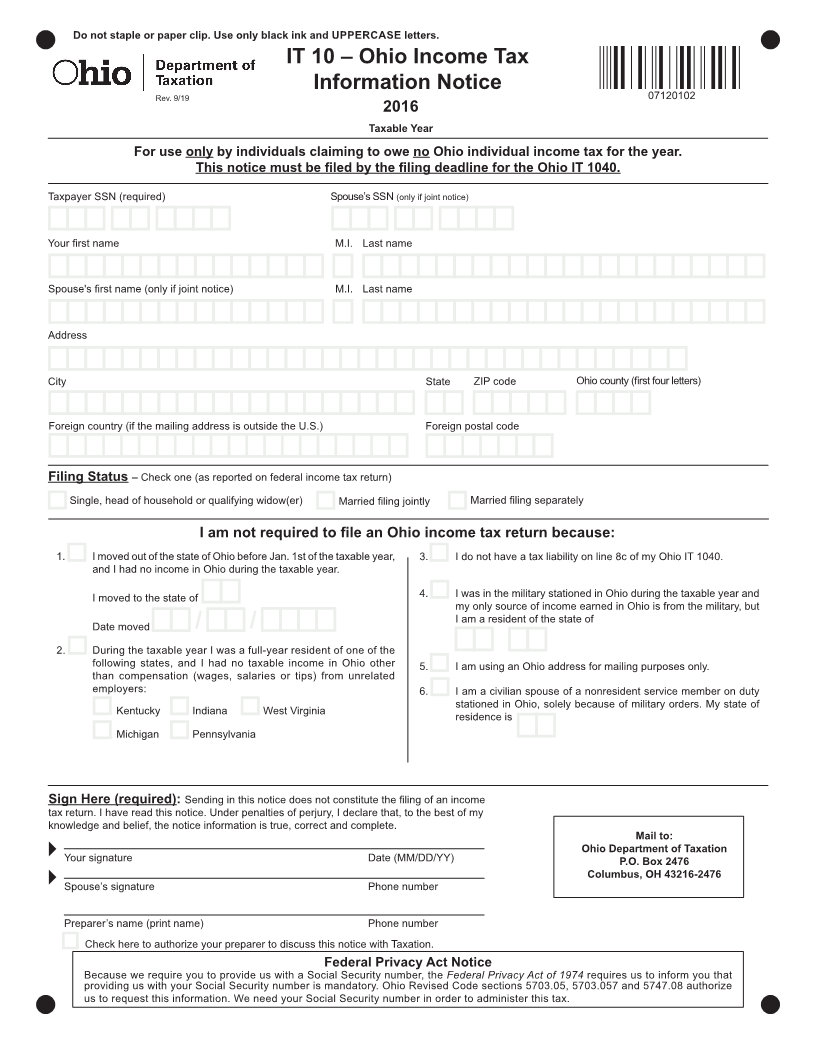

Do not staple or paper clip. Use only black ink and UPPERCASE letters.

IT 10 – Ohio Income Tax

Rev. 9/19 Information Notice 07120102

2016

Taxable Year

For use only by individuals claiming to owe no Ohio individual income tax for the year.

This notice must be filed by the filing deadline for the Ohio IT 1040.

Taxpayer SSN (required) Spouse’s SSN (only if joint notice)

Your first name M.I. Last name

Spouse's first name (only if joint notice) M.I. Last name

Address

City State ZIP code Ohio county (first four letters)

Foreign country (if the mailing address is outside the U.S.) Foreign postal code

Filing Status – Check one (as reported on federal income tax return)

Single, head of household or qualifying widow(er) Married filing jointly Married filing separately

I am not required to file an Ohio income tax return because:

1. I moved out of the state of Ohio before Jan. 1st of the taxable year, 3. I do not have a tax liability on line 8c of my Ohio IT 1040.

and I had no income in Ohio during the taxable year.

I moved to the state of 4. I was in the military stationed in Ohio during the taxable year and

my only source of income earned in Ohio is from the military, but

I am a resident of the state of

Date moved / /

2. During the taxable year I was a full-year resident of one of the

following states, and I had no taxable income in Ohio other 5. I am using an Ohio address for mailing purposes only.

than compensation (wages, salaries or tips) from unrelated

employers: 6. I am a civilian spouse of a nonresident service member on duty

stationed in Ohio, solely because of military orders. My state of

Kentucky Indiana West Virginia residence is

Michigan Pennsylvania

Sign Here (required): Sending in this notice does not constitute the filing of an income

tax return. I have read this notice. Under penalties of perjury, I declare that, to the best of my

knowledge and belief, the notice information is true, correct and complete.

Mail to:

Your signature Date (MM/DD/YY) Ohio Department of Taxation

P.O. Box 2476

Columbus, OH 43216-2476

Spouse’s signature Phone number

Preparer’s name (print name) Phone number

Check here to authorize your preparer to discuss this notice with Taxation.

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that

providing us with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize

us to request this information. We need your Social Security number in order to administer this tax.