Enlarge image

CAT CS

Rev. 7/19

P.O. Box 16158

Columbus, OH 43216-6158

Commercial Activity Tax Credit Schedule

CAT account number (of primary reporting entity) FEIN/SSN

Reporting member’s name

Street address (number and street)

City State ZIP code

Period covered (MM/DD/YY) to (MM/DD/YY)

(Quarter for which this report is being submitted)

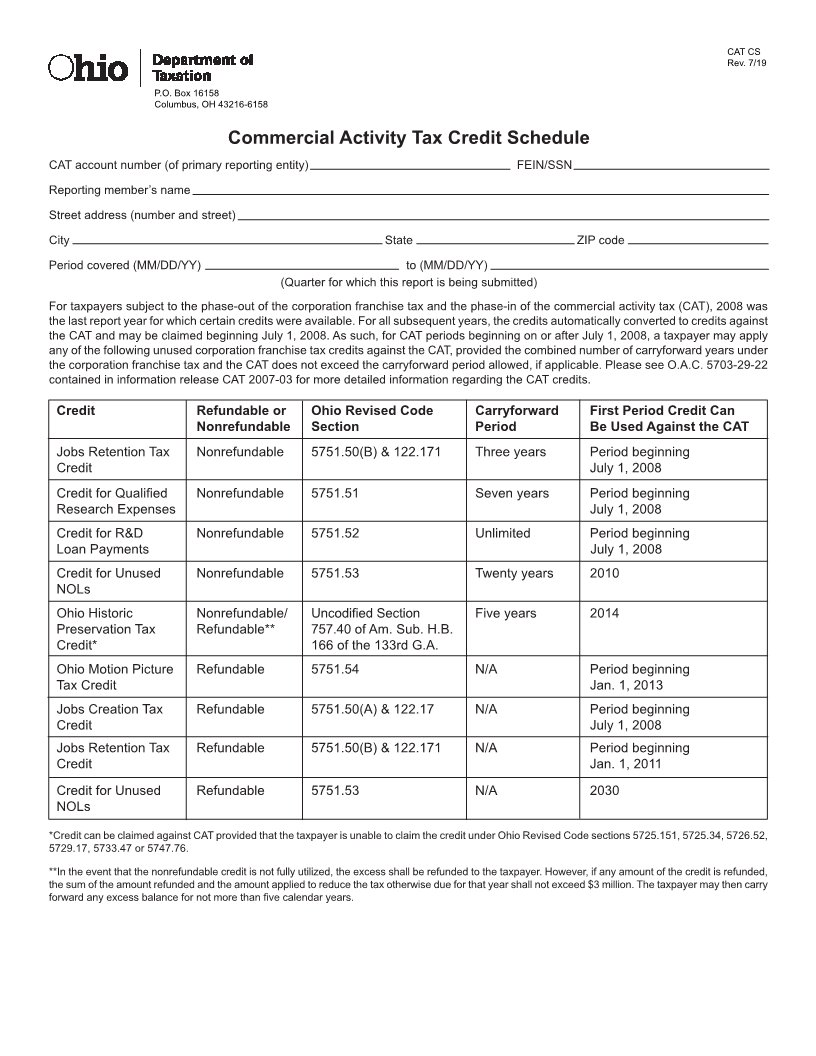

For taxpayers subject to the phase-out of the corporation franchise tax and the phase-in of the commercial activity tax (CAT), 2008 was

the last report year for which certain credits were available. For all subsequent years, the credits automatically converted to credits against

the CAT and may be claimed beginning July 1, 2008. As such, for CAT periods beginning on or after July 1, 2008, a taxpayer may apply

any of the following unused corporation franchise tax credits against the CAT, provided the combined number of carryforward years under

the corporation franchise tax and the CAT does not exceed the carryforward period allowed, if applicable. Please see O.A.C. 5703-29-22

contained in information release CAT 2007-03 for more detailed information regarding the CAT credits.

Credit Refundable or Ohio Revised Code Carryforward First Period Credit Can

Nonrefundable Section Period Be Used Against the CAT

Jobs Retention Tax Nonrefundable 5751.50(B) & 122.171 Three years Period beginning

Credit July 1, 2008

Credit for Qualified Nonrefundable 5751.51 Seven years Period beginning

Research Expenses July 1, 2008

Credit for R&D Nonrefundable 5751.52 Unlimited Period beginning

Loan Payments July 1, 2008

Credit for Unused Nonrefundable 5751.53 Twenty years 2010

NOLs

Ohio Historic Nonrefundable/ Uncodified Section Five years 2014

Preservation Tax Refundable** 757.40 of Am. Sub. H.B.

Credit* 166 of the 133rd G.A.

Ohio Motion Picture Refundable 5751.54 N/A Period beginning

Tax Credit Jan. 1, 2013

Jobs Creation Tax Refundable 5751.50(A) & 122.17 N/A Period beginning

Credit July 1, 2008

Jobs Retention Tax Refundable 5751.50(B) & 122.171 N/A Period beginning

Credit Jan. 1, 2011

Credit for Unused Refundable 5751.53 N/A 2030

NOLs

*Credit can be claimed against CAT provided that the taxpayer is unable to claim the credit under Ohio Revised Code sections 5725.151, 5725.34, 5726.52,

5729.17, 5733.47 or 5747.76.

**In the event that the nonrefundable credit is not fully utilized, the excess shall be refunded to the taxpayer. However, if any amount of the credit is refunded,

the sum of the amount refunded and the amount applied to reduce the tax otherwise due for that year shall not exceed $3 million. The taxpayer may then carry

forward any excess balance for not more than five calendar years.