Enlarge image

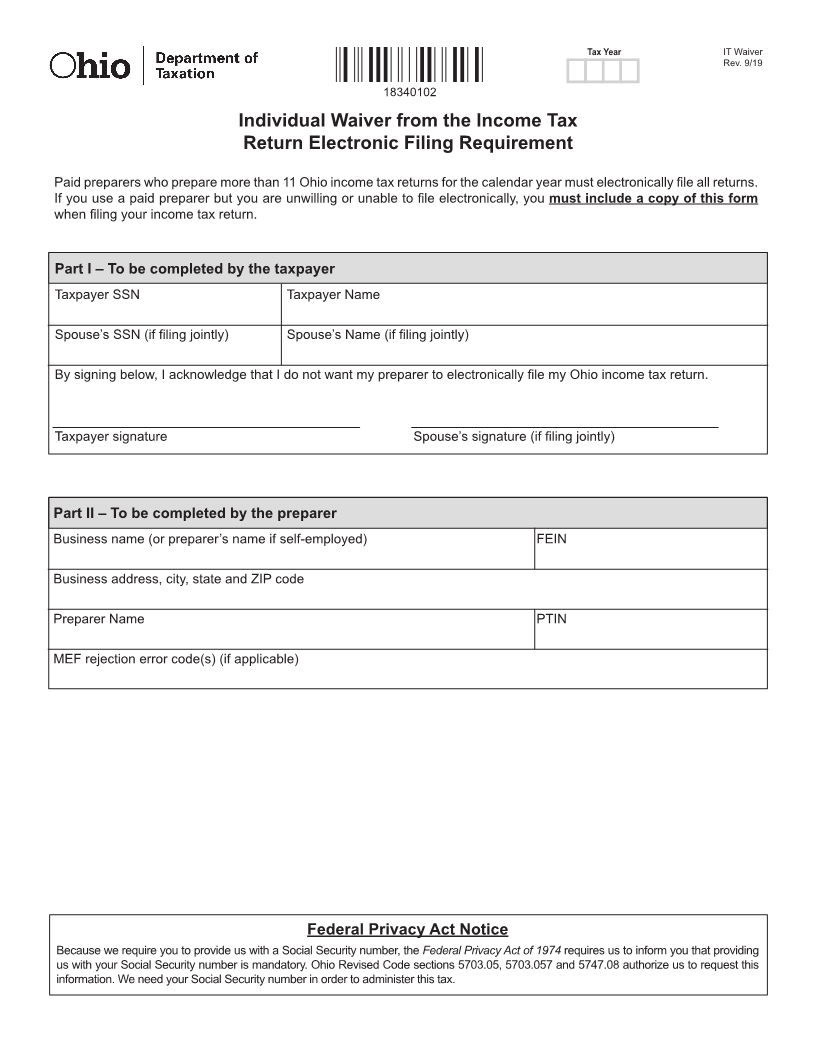

Tax Year IT Waiver

Rev. 9/19

18340102

Individual Waiver from the Income Tax

Return Electronic Filing Requirement

Paid preparers who prepare more than 11 Ohio income tax returns for the calendar year must electronically file all returns.

If you use a paid preparer but you are unwilling or unable to file electronically, you must include a copy of this form

when filing your income tax return.

Part I – To be completed by the taxpayer

Taxpayer SSN Taxpayer Name

Spouse’s SSN (if filing jointly) Spouse’s Name (if filing jointly)

By signing below, I acknowledge that I do not want my preparer to electronically file my Ohio income tax return.

Taxpayer signature Spouse’s signature (if filing jointly)

Part II – To be completed by the preparer

Business name (or preparer’s name if self-employed) FEIN

Business address, city, state and ZIP code

Preparer Name PTIN

MEF rejection error code(s) (if applicable)

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that providing

us with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this

information. We need your Social Security number in order to administer this tax.