Enlarge image

PR

Department of Rev. 12/21

Taxation

hio

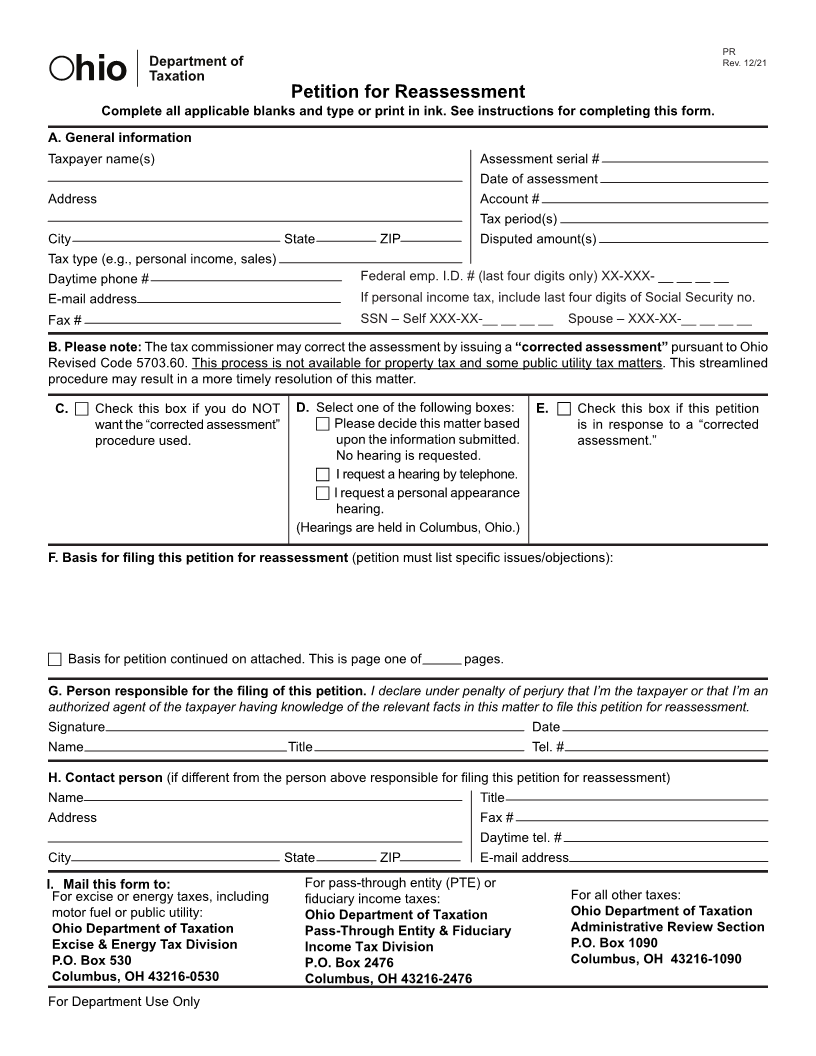

Petition for Reassessment

Complete all applicable blanks and type or print in ink. See instructions for completing this form.

A. General information

Taxpayer name(s) Assessment serial #

Date of assessment

Address Account #

Tax period(s)

City State ZIP Disputed amount(s)

Tax type (e.g., personal income, sales)

Daytime phone # Federal emp. I.D. # (last four digits only) XX-XXX- __ __ __ __

E-mail address If personal income tax, include last four digits of Social Security no.

Fax # SSN – Self XXX-XX-__ __ __ __ Spouse – XXX-XX-__ __ __ __

B. Please note: The tax commissioner may correct the assessment by issuing a “corrected assessment” pursuant to Ohio

Revised Code 5703.60. This process is not available for property tax and some public utility tax matters. This streamlined

procedure may result in a more timely resolution of this matter.

C. Check this box if you do NOT D. Select one of the following boxes: E. Check this box if this petition

want the “corrected assessment” Please decide this matter based is in response to a “corrected

procedure used. upon the information submitted. assessment.”

No hearing is requested.

I request a hearing by telephone.

I request a personal appearance

hearing.

(Hearings are held in Columbus, Ohio.)

F. Basis for filing this petition for reassessment (petition must list specific issues/objections):

Basis for petition continued on attached. This is page one of pages.

G. Person responsible for the filing of this petition. I declare under penalty of perjury that I’m the taxpayer or that I’m an

authorized agent of the taxpayer having knowledge of the relevant facts in this matter to file this petition for reassessment.

Signature Date

Name Title Tel. #

H. Contact person (if different from the person above responsible for filing this petition for reassessment)

Name Title

Address Fax #

Daytime tel. #

City State ZIP E-mail address

I. Mail this form to: For pass-through entity (PTE) or

For excise or energy taxes, including fiduciary income taxes: For all other taxes:

motor fuel or public utility: Ohio Department of Taxation Ohio Department of Taxation

Ohio Department of Taxation Pass-Through Entity & Fiduciary Administrative Review Section

Excise & Energy Tax Division Income Tax Division P.O. Box 1090

P.O. Box 530 P.O. Box 2476 Columbus, OH 43216-1090

Columbus, OH 43216-0530 Columbus, OH 43216-2476

For Department Use Only