- 2 -

Enlarge image

|

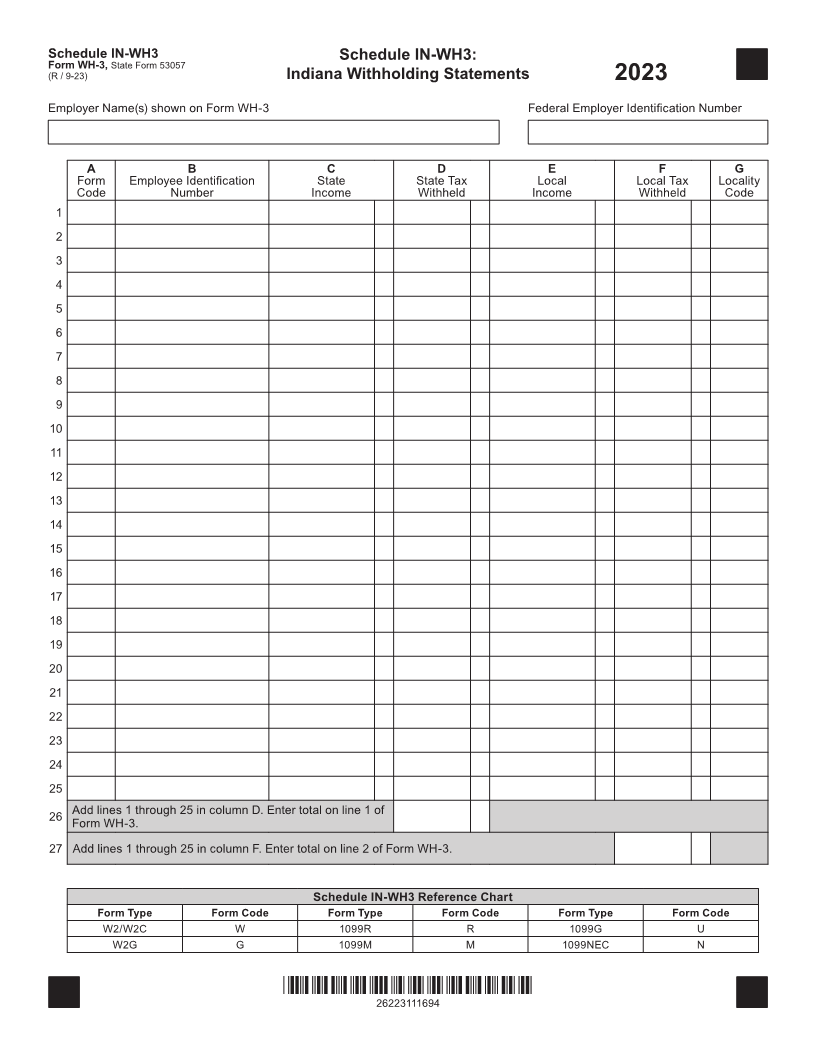

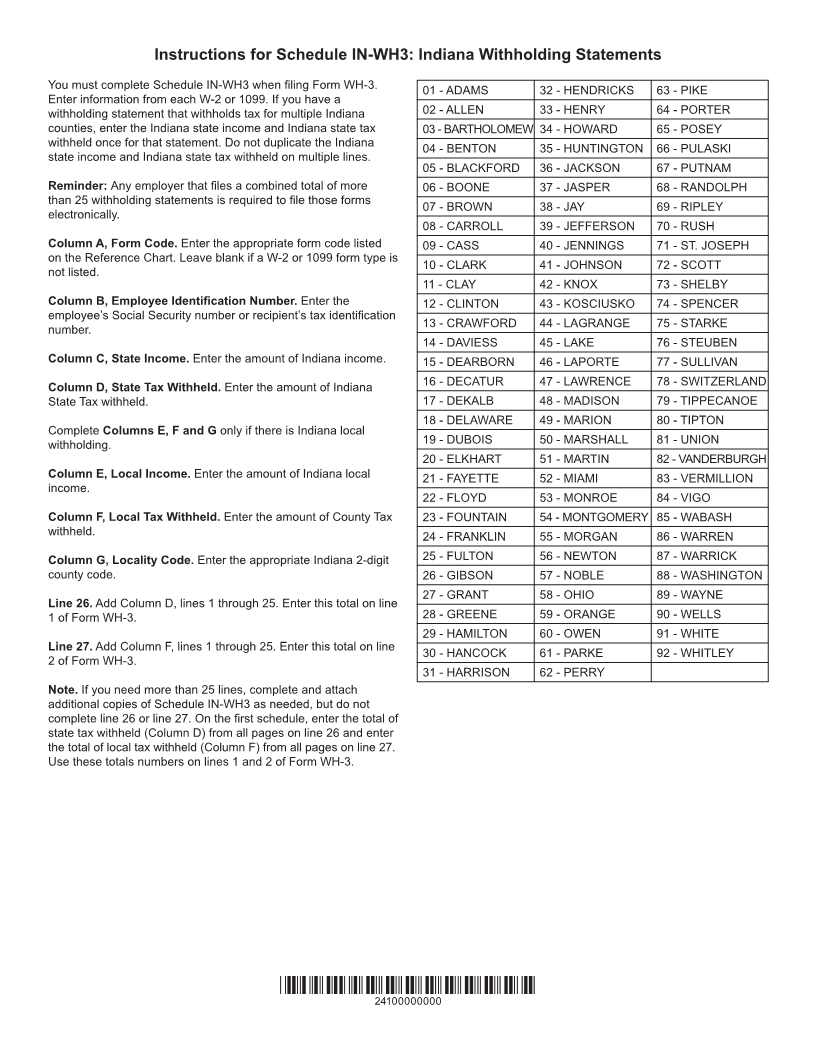

Instructions for Schedule IN-WH3: Indiana Withholding Statements

You must complete Schedule IN-WH3 when filing Form WH-3. 01 - ADAMS 32 - HENDRICKS 63 - PIKE

Enter information from each W-2 or 1099. If you have a

withholding statement that withholds tax for multiple Indiana 02 - ALLEN 33 - HENRY 64 - PORTER

counties, enter the Indiana state income and Indiana state tax 03 - BARTHOLOMEW 34 - HOWARD 65 - POSEY

withheld once for that statement. Do not duplicate the Indiana 04 - BENTON 35 - HUNTINGTON 66 - PULASKI

state income and Indiana state tax withheld on multiple lines.

05 - BLACKFORD 36 - JACKSON 67 - PUTNAM

Reminder: Any employer that files a combined total of more 06 - BOONE 37 - JASPER 68 - RANDOLPH

than 25 withholding statements is required to file those forms

07 - BROWN 38 - JAY 69 - RIPLEY

electronically.

08 - CARROLL 39 - JEFFERSON 70 - RUSH

Column A, Form Code. Enter the appropriate form code listed 09 - CASS 40 - JENNINGS 71 - ST. JOSEPH

on the Reference Chart. Leave blank if a W-2 or 1099 form type is

10 - CLARK 41 - JOHNSON 72 - SCOTT

not listed.

11 - CLAY 42 - KNOX 73 - SHELBY

Column B, Employee Identification Number. Enter the 12 - CLINTON 43 - KOSCIUSKO 74 - SPENCER

employee’s Social Security number or recipient’s tax identification

number. 13 - CRAWFORD 44 - LAGRANGE 75 - STARKE

14 - DAVIESS 45 - LAKE 76 - STEUBEN

Column C, State Income. Enter the amount of Indiana income. 15 - DEARBORN 46 - LAPORTE 77 - SULLIVAN

Column D, State Tax Withheld. Enter the amount of Indiana 16 - DECATUR 47 - LAWRENCE 78 - SWITZERLAND

State Tax withheld. 17 - DEKALB 48 - MADISON 79 - TIPPECANOE

18 - DELAWARE 49 - MARION 80 - TIPTON

Complete Columns E, F and G only if there is Indiana local

withholding. 19 - DUBOIS 50 - MARSHALL 81 - UNION

20 - ELKHART 51 - MARTIN 82 - VANDERBURGH

Column E, Local Income. Enter the amount of Indiana local 21 - FAYETTE 52 - MIAMI 83 - VERMILLION

income.

22 - FLOYD 53 - MONROE 84 - VIGO

Column F, Local Tax Withheld. Enter the amount of County Tax 23 - FOUNTAIN 54 - MONTGOMERY 85 - WABASH

withheld. 24 - FRANKLIN 55 - MORGAN 86 - WARREN

Column G, Locality Code. Enter the appropriate Indiana 2-digit 25 - FULTON 56 - NEWTON 87 - WARRICK

county code. 26 - GIBSON 57 - NOBLE 88 - WASHINGTON

27 - GRANT 58 - OHIO 89 - WAYNE

Line 26. Add Column D, lines 1 through 25. Enter this total on line

1 of Form WH-3. 28 - GREENE 59 - ORANGE 90 - WELLS

29 - HAMILTON 60 - OWEN 91 - WHITE

Line 27. Add Column F, lines 1 through 25. Enter this total on line 30 - HANCOCK 61 - PARKE 92 - WHITLEY

2 of Form WH-3.

31 - HARRISON 62 - PERRY

Note. If you need more than 25 lines, complete and attach

additional copies of Schedule IN-WH3 as needed, but do not

complete line 26 or line 27. On the first schedule, enter the total of

state tax withheld (Column D) from all pages on line 26 and enter

the total of local tax withheld (Column F) from all pages on line 27.

Use these totals numbers on lines 1 and 2 of Form WH-3.

*24100000000*

24100000000

|