Enlarge image

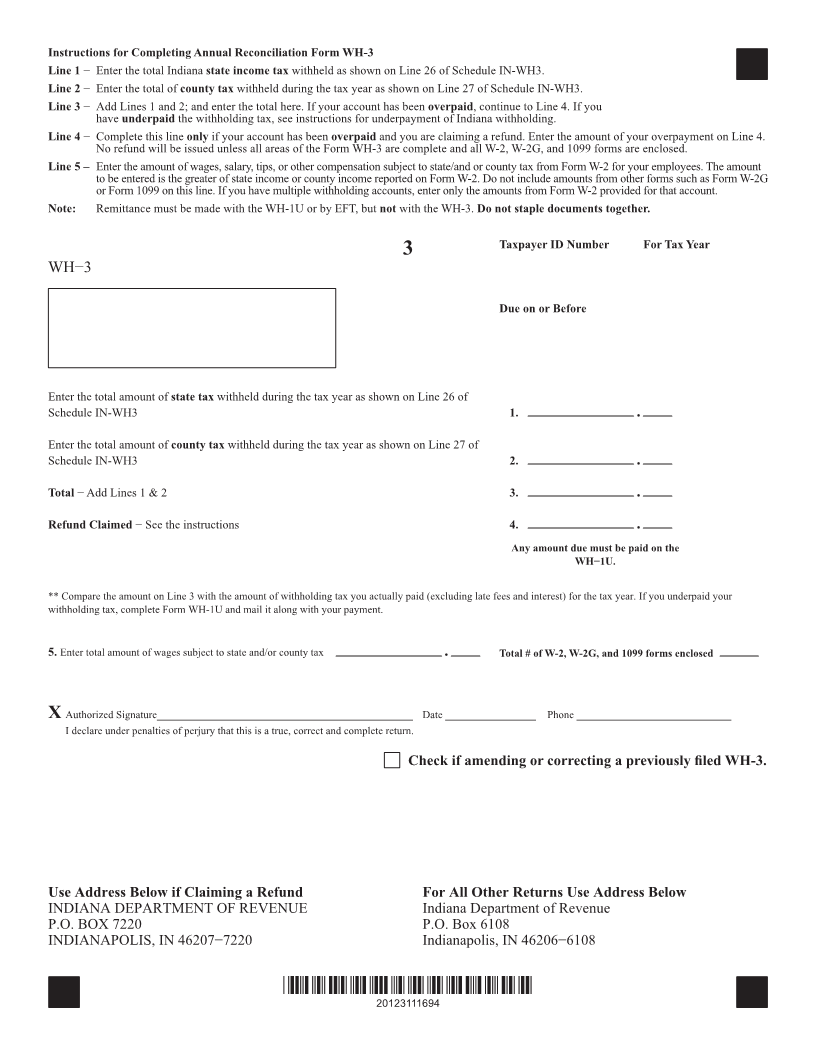

Form WH-3, WH-1U

State Form 962 Indiana Department of Revenue

Annual Withholding Reconciliation Tax Form WH-3

This packet contains form WH-3 for reconciling taxes withheld on employees. Your WH-3 return is due on the date printed on the form.

Make sure the information on this page is correct and complete.

Payments must be made with U.S. funds.

Please do not include check stubs when

mailing your payments.

Location

Taxpayer ID

Filing Period

Letter ID

Date Issued

(This form must be filed even if no tax was withheld. Give this packet to your tax preparer, if you use one. Do not throw this packet away.)

• No tax is due: A return must be filed by the taxpayer even when no tax is due unless the Indiana tax account has been properly closed. If no

return is filed, an estimated return will be filed by the Department using the best information available (IC 6-8.1-10-3). A tax liability notice will

be issued.

• Electronic Filing: Pursuant to IC 6-3-4-16.5, any employer that files a combined total of more than 25 W-2, W-2G, and 1099 forms in a

calendar year is required to file those forms and the WH-3 electronically. This law applies to all withholding statements filed after December 31,

2012.

To be considered as an electronic filing method, you must use the INTIME portal or DOR’s bulk SFTP process.

If your withholding file size is 10MB or less, you will manually enter or batch upload via intime.dor.in.gov.

If your withholding file size is larger than 10MB, your file must be uploaded via bulk SFTP (Secure File Transfer Protocol). For more

information about DOR’s bulk SFTP process, visit www.in.gov/dor/business-tax/bulk-filing-your-indiana-business-taxes.

• Closed Business: Do not write changes on the tax return. Instead, complete and file Form BC-100 or close your business at intime.dor.in.gov.

• Who Should File: This form should be filed by all withholding agents who withhold state and/or county income tax from employees and

nonresident contractors during the calendar year.

• When To File: Form WH-3, Schedule IN-WH-3, and state copies of Form W-2, W-2G, (also Form 1099 if state withholding is included) must

be filed on or before the last day in January.

• Late Filings: A penalty of $10 will be charged per W-2, W-2G, and 1099 statement not included or that is filed past the due date. An extension

of time to file may be requested. The Department will accept a copy of the federal withholding extension (8809) to submit Form WH-3.

• Pay by (EFT) Electronic Funds Transfer: To remit an underpayment by EFT, initiate a supplemental payment for the tax year’s final period.

What’s new for Form WH3

You will no longer be required to provide the breakdown of county tax withheld for each county when filing Form WH-3.

You must complete Schedule IN-WH3 if you file your Form WH-3 by paper.

State Form 962

(R36 / 7-23)