Enlarge image

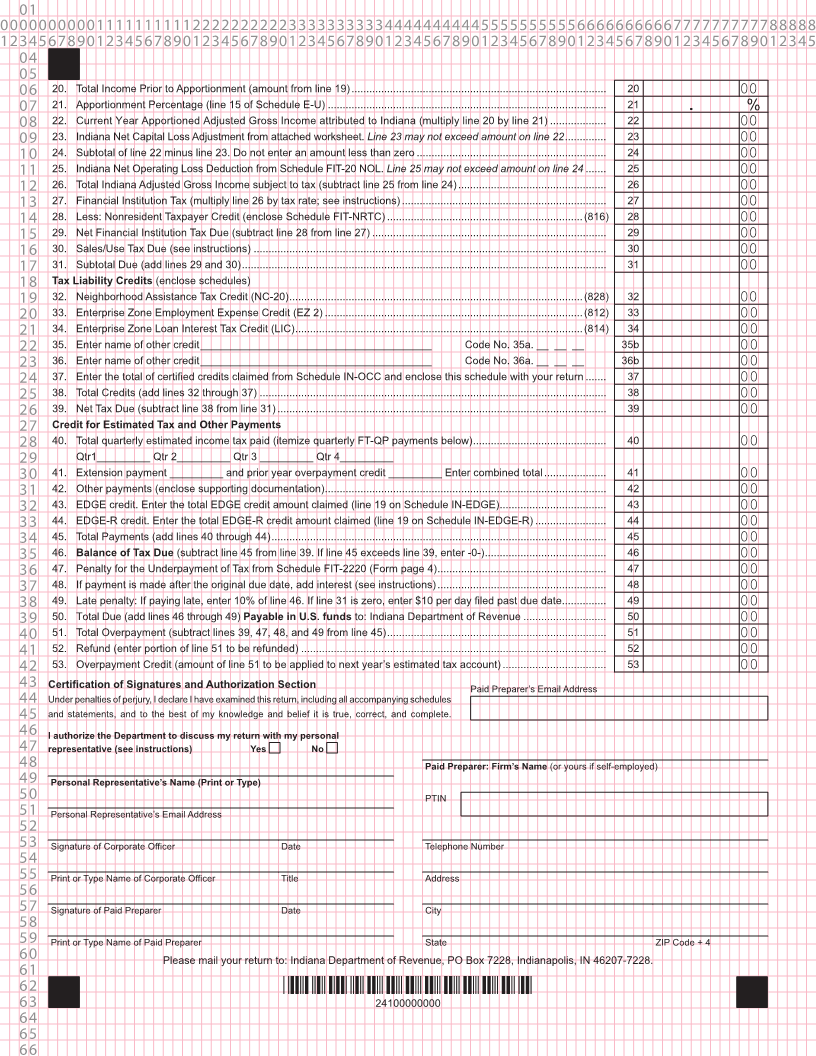

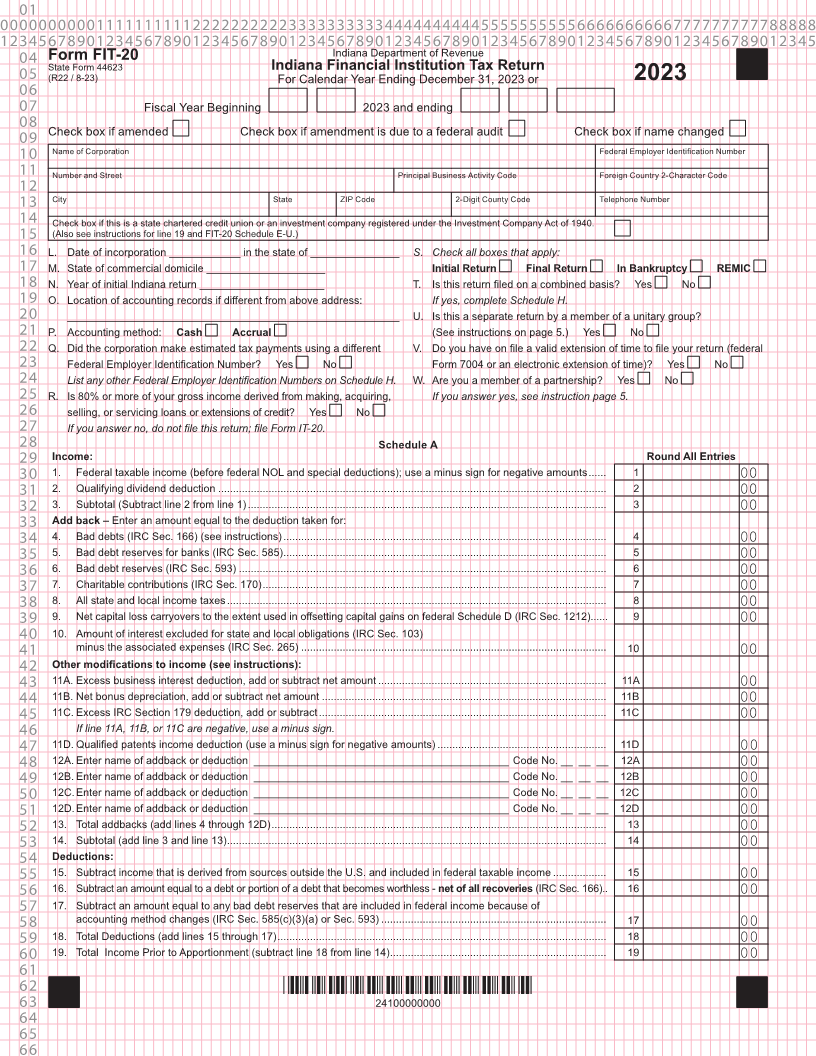

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Form FIT-20 Indiana Department of Revenue State Form 44623 Indiana Financial Institution Tax Return 05 (R22 / 8-23) For Calendar Year Ending December 31, 2023 or 2023 06 07 Fiscal Year Beginning 2023 and ending 08 Check box if amended Check box if amendment is due to a federal audit Check box if name changed 09 10 Name of Corporation Federal Employer Identification Number 11 Number and Street Principal Business Activity Code Foreign Country 2-Character Code 12 13 City State ZIP Code 2-Digit County Code Telephone Number 14 Check box if this is a state chartered credit union or an investment company registered under the Investment Company Act of 1940. 15 (Also see instructions for line 19 and FIT-20 Schedule E-U.) 16 L. Date of incorporation ____________ in the state of _______________ S. Check all boxes that apply: 17 M. State of commercial domicile ____________________ Initial Return Final Return In Bankruptcy REMIC 18 N. Year of initial Indiana return _____________________ T. Is this return filed on a combined basis? Yes No 19 O. Location of accounting records if different from above address: If yes, complete Schedule H. 20 ________________________________________________________ U. Is this a separate return by a member of a unitary group? 21 P. Accounting method: Cash Accrual (See instructions on page 5.) Yes No 22 Q. Did the corporation make estimated tax payments using a different V. Do you have on file a valid extension of time to file your return (federal 23 Federal Employer Identification Number? Yes No Form 7004 or an electronic extension of time)? Yes No 24 List any other Federal Employer Identification Numbers on Schedule H. W. Are you a member of a partnership? Yes No 25 R. Is 80% or more of your gross income derived from making, acquiring, If you answer yes, see instruction page 5. 26 selling, or servicing loans or extensions of credit? Yes No 27 If you answer no, do not file this return; file Form IT-20. 28 Schedule A 29 Income: Round All Entries 30 1. Federal taxable income (before federal NOL and special deductions); use a minus sign for negative amounts ...... 1 00 31 2. Qualifying dividend deduction ................................................................................................................................... 2 00 32 3. Subtotal (Subtract line 2 from line 1) ......................................................................................................................... 3 00 33 Add back – Enter an amount equal to the deduction taken for: 34 4. Bad debts (IRC Sec. 166) (see instructions) ............................................................................................................. 4 00 35 5. Bad debt reserves for banks (IRC Sec. 585) ............................................................................................................. 5 00 36 6. Bad debt reserves (IRC Sec. 593) ............................................................................................................................ 6 00 37 7. Charitable contributions (IRC Sec. 170) .................................................................................................................... 7 00 38 8. All state and local income taxes ................................................................................................................................ 8 00 39 9. Net capital loss carryovers to the extent used in offsetting capital gains on federal Schedule D (IRC Sec. 1212)...... 9 00 40 10. Amount of interest excluded for state and local obligations (IRC Sec. 103) 41 minus the associated expenses (IRC Sec. 265) ....................................................................................................... 10 00 42 Other modifications to income (see instructions): 43 11A. Excess business interest deduction, add or subtract net amount ............................................................................. 11A 00 44 11B. Net bonus depreciation, add or subtract net amount ................................................................................................ 11B 00 45 11C. Excess IRC Section 179 deduction, add or subtract ................................................................................................. 11C 00 46 If line 11A, 11B, or 11C are negative, use a minus sign. 47 11D. Qualified patents income deduction (use a minus sign for negative amounts) ......................................................... 11D 00 48 12A. Enter name of addback or deduction ___________________________________________ Code No. __ __ __ 12A 00 49 12B. Enter name of addback or deduction ___________________________________________ Code No. __ __ __ 12B 00 50 12C. Enter name of addback or deduction ___________________________________________ Code No. __ __ __ 12C 00 51 12D. Enter name of addback or deduction ___________________________________________ Code No. __ __ __ 12D 00 52 13. Total addbacks (add lines 4 through 12D) ................................................................................................................. 13 00 53 14. Subtotal (add line 3 and line 13) ................................................................................................................................ 14 00 54 Deductions: 55 15. Subtract income that is derived from sources outside the U.S. and included in federal taxable income .................. 15 00 56 16. Subtract an amount equal to a debt or portion of a debt that becomes worthless - net of all recoveries (IRC Sec. 166) .. 16 00 57 17. Subtract an amount equal to any bad debt reserves that are included in federal income because of 58 accounting method changes (IRC Sec. 585(c)(3)(a) or Sec. 593) ............................................................................ 17 00 59 18. Total Deductions (add lines 15 through 17) ............................................................................................................... 18 00 60 19. Total Income Prior to Apportionment (subtract line 18 from line 14) ......................................................................... 19 00 61 62 *24100000000* 63 24100000000 64 65 66