Enlarge image

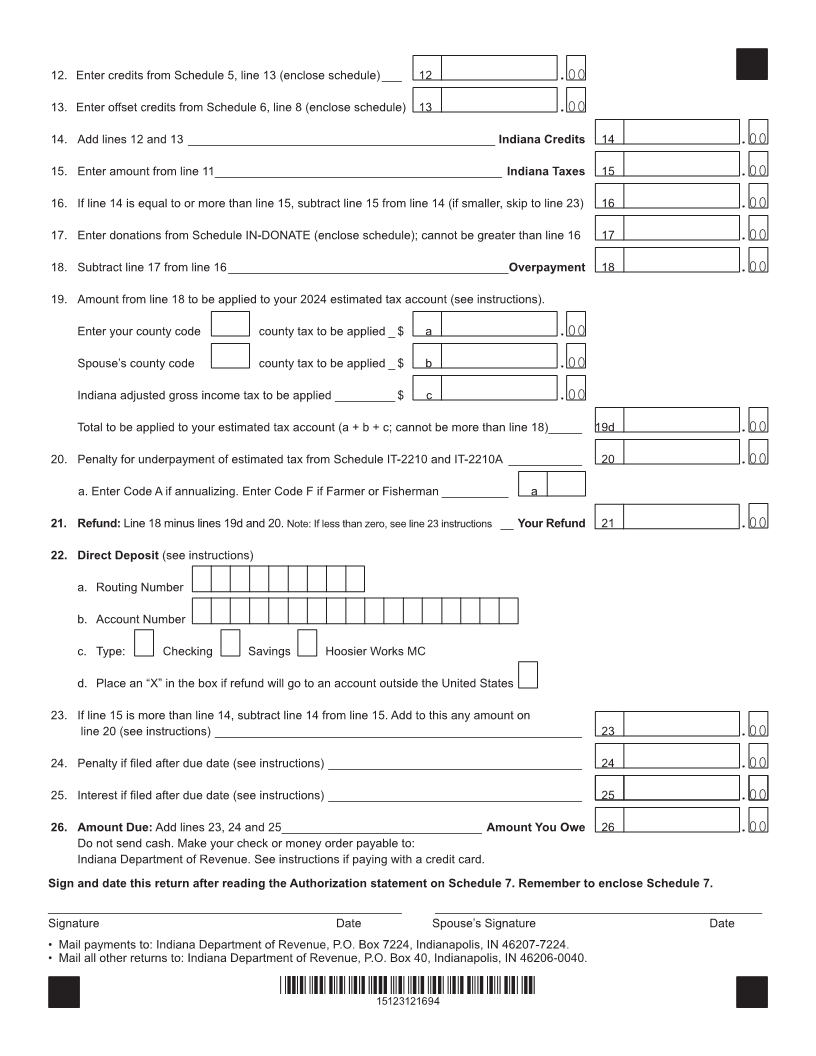

Form Indiana Full-Year Resident

Due April 15, 2024

IT-40 2023 Individual Income Tax Return

State Form 154

(R22 / 9-23) If filing for a fiscal year, enter the dates (see instructions) (MM/DD/YYYY):

Place “X” in box

from to: if amending

Your Social Spouse’s Social

Security Number Security Number

Place “X” in box if applying for ITIN Place “X” in box if applying for ITIN

Your first name Initial Last name Suffix

If filing a joint return, spouse’s first name Initial Last name Suffix

Present address (number and street or rural route)

Place “X” in box if you are

married filing separately.

City State ZIP/Postal code

Foreign country 2-character code (see instructions)

Enter below the 2-digit county code numbers (found on the back of Schedule CT-40) for the county where you lived and

worked on Jan. 1, 2023.

County where County where County where County where

you lived you worked spouse lived spouse worked

Round all entries

1. Enter your federal adjusted gross income from your federal

income tax return, Form 1040 or Form 1040-SR, line 11 _____________________ Federal AGI 1 .00

2. Enter amount from Schedule 1, line 7, and enclose Schedule 1 ________ Indiana Add-Backs 2 .00

3. Add line 1 and line 2 ____________________________________________________________ 3 .00

4. Enter amount from Schedule 2, line 12, and enclose Schedule 2 _______ Indiana Deductions 4 .00

5. Subtract line 4 from line 3 ________________________________________________________ 5 .00

6. Complete Schedule 3. Enter amount from Schedule 3, line 7,

and enclose Schedule 3 _______________________________________ Indiana Exemptions 6 .00

7. Subtract line 6 from line 5 ____________________________ Indiana Adjusted Gross Income 7 .00

8. State adjusted gross income tax: multiply line 7 by 3.15% (.0315)

(if answer is less than zero, leave blank) ____________________ 8 .00

9. County tax. Enter county tax due from Schedule CT-40

(if answer is less than zero, leave blank) ____________________ 9 .00

10. Other taxes. Enter amount from Schedule 4, line 4 (enclose schedule) 10 .00

11. Add lines 8, 9 and 10. Enter total here and on line 15 on the back ___________ Indiana Taxes 11 .00

*15123111694*

15123111694