Enlarge image

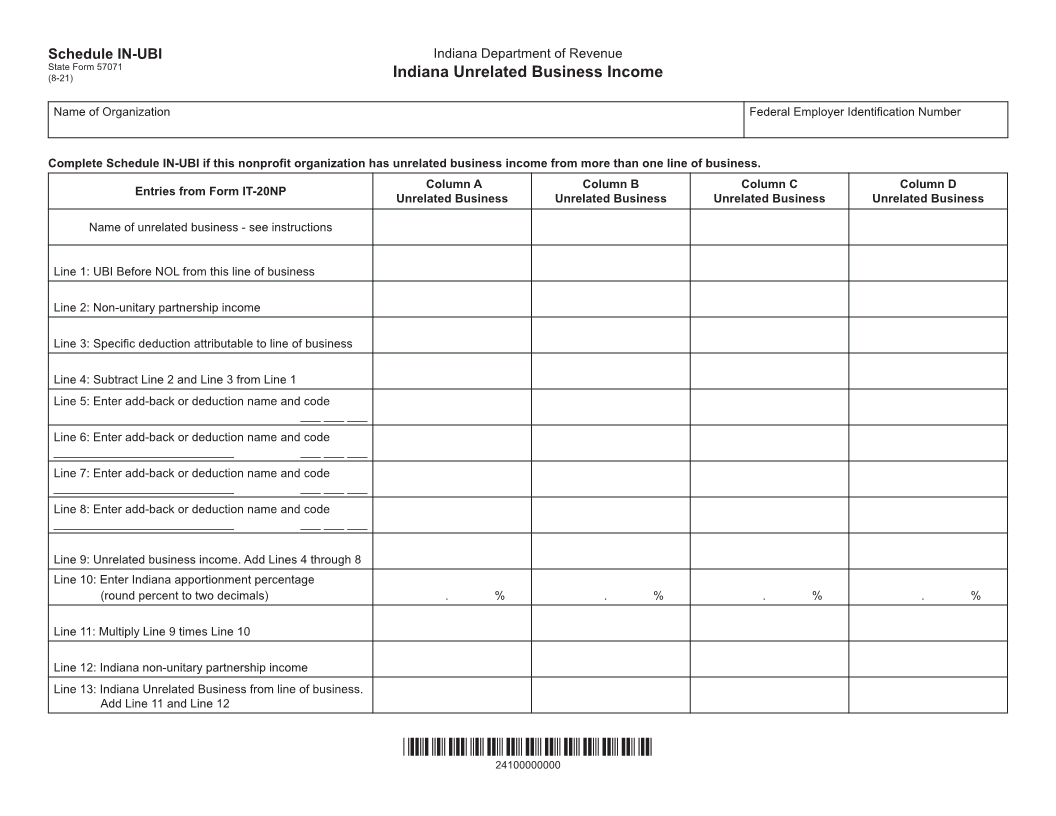

Schedule IN-UBI Indiana Department of Revenue

State Form 57071

(8-21) Indiana Unrelated Business Income

Name of Organization Federal Employer Identification Number

Complete Schedule IN-UBI if this nonprofit organization has unrelated business income from more than one line of business.

Column A Column B Column C Column D

Entries from Form IT-20NP

Unrelated Business Unrelated Business Unrelated Business Unrelated Business

Name of unrelated business - see instructions

Line 1: UBI Before NOL from this line of business

Line 2: Non-unitary partnership income

Line 3: Specific deduction attributable to line of business

Line 4: Subtract Line 2 and Line 3 from Line 1

Line 5: Enter add-back or deduction name and code

___ ___ ___

Line 6: Enter add-back or deduction name and code

___________________________ ___ ___ ___

Line 7: Enter add-back or deduction name and code

___________________________ ___ ___ ___

Line 8: Enter add-back or deduction name and code

___________________________ ___ ___ ___

Line 9: Unrelated business income. Add Lines 4 through 8

Line 10: Enter Indiana apportionment percentage

(round percent to two decimals) . % . % . % . %

Line 11: Multiply Line 9 times Line 10

Line 12: Indiana non-unitary partnership income

Line 13: Indiana Unrelated Business from line of business.

Add Line 11 and Line 12

*24100000000*

24100000000