Enlarge image

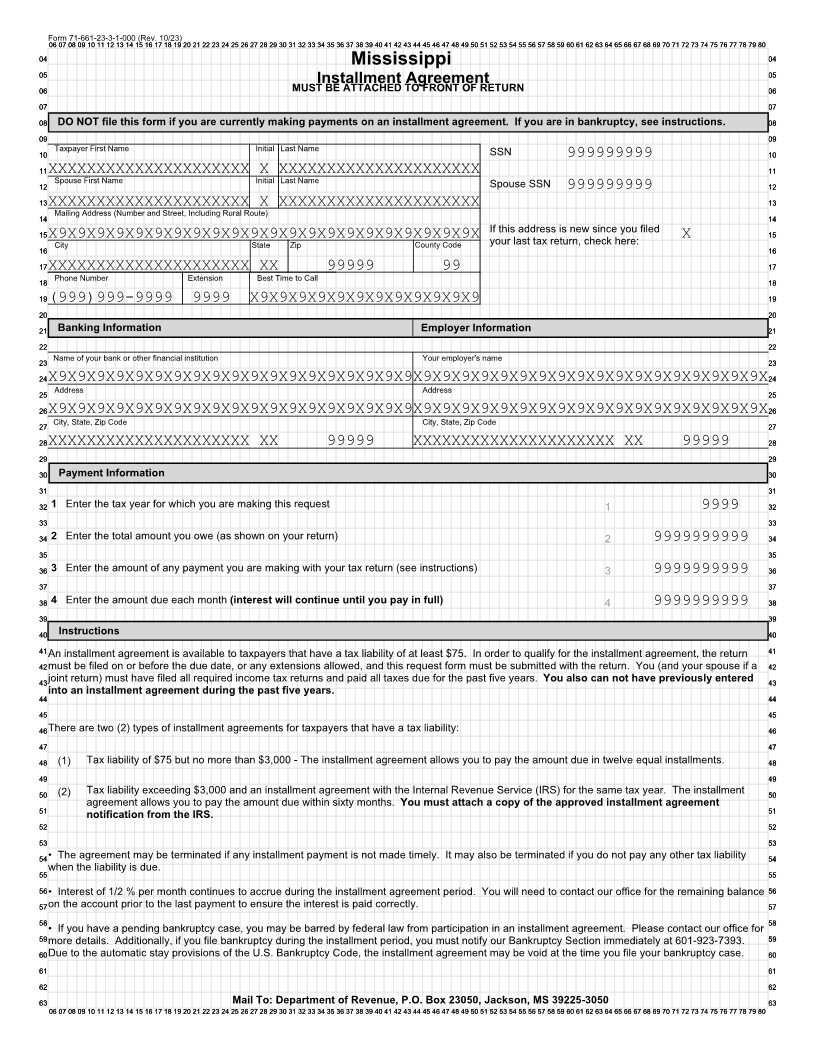

Form0606 0707 08071-661-23-3-1-00009 10 11 12 13 14 15(Rev.16 1710/23)18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

0404 Mississippi 0404

0505 0505

Installment Agreement

0606 MUST BE ATTACHED TO FRONT OF RETURN 0606

0707 0707

0808 DO NOT file this form if you are currently making payments on an installment agreement. If you are in bankruptcy, see instructions. 0808

0909 0909

1010 Taxpayer First Name Initial Last Name SSN 1010

999999999

1111XXXXXXXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXX 1111

1212 Spouse First Name Initial Last Name Spouse SSN 999999999 1212

1313XXXXXXXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXX 1313

1414 Mailing Address (Number and Street, Including Rural Route) 1414

1515 If this address is new since you filed 1515

1616X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X City State Zip County Code your last tax return, check here: X 1616

1717XXXXXXXXXXXXXXXXXXXXX XX 99999 99 1717

1818 Phone Number Extension Best Time to Call 1818

1919(999)999-9999 9999 X9X9X9X9X9X9X9X9X9X9X9X9 1919

2020 2020

2121 Banking Information Employer Information 2121

2222 2222

2323 Name of your bank or other financial institution Your employer's name 2323

2424X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X2424

2525 Address Address 2525

2626X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X2626

2727 City, State, Zip Code City, State, Zip Code 2727

2828XXXXXXXXXXXXXXXXXXXXX XX 99999 XXXXXXXXXXXXXXXXXXXXX XX 99999 2828

2929 2929

3030 Payment Information 3030

3131 3131

3232 1 Enter the tax year for which you are making this request 1 9999 3232

3333 3333

3434 2 Enter the total amount you owe (as shown on your return) 2 9999999999 3434

3535 3535

3636 3 Enter the amount of any payment you are making with your tax return (see instructions) 3 9999999999 3636

3737 3737

3838 4 Enter the amount due each month (interest will continue until you pay in full) 4 9999999999 3838

3939 3939

4040 Instructions 4040

4141An installment agreement is available to taxpayers that have a tax liability of at least $75. In order to qualify for the installment agreement, the return 4141

4242must be filed on or before the due date, or any extensions allowed, and this request form must be submitted with the return. You (and your spouse if a 4242

4343joint return) must have filed all required income tax returns and paid all taxes due for the past five years. You also can not have previously entered 4343

into an installment agreement during the past five years.

4444 4444

4545 4545

4646There are two (2) types of installment agreements for taxpayers that have a tax liability: 4646

4747 4747

4848 (1) Tax liability of $75 but no more than $3,000 - The installment agreement allows you to pay the amount due in twelve equal installments. 4848

4949 4949

5050 (2) Tax liability exceeding $3,000 and an installment agreement with the Internal Revenue Service (IRS) for the same tax year. The installment 5050

agreement allows you to pay the amount due within sixty months. You must attach a copy of the approved installment agreement

5151 notification from the IRS. 5151

5252 5252

5353 5353

5454• The agreement may be terminated if any installment payment is not made timely. It may also be terminated if you do not pay any other tax liability 5454

5555when the liability is due. 5555

5656• Interest of 1/2 % per month continues to accrue during the installment agreement period. You will need to contact our office for the remaining balance 5656

5757on the account prior to the last payment to ensure the interest is paid correctly. 5757

5858 5858

• If you have a pending bankruptcy case, you may be barred by federal law from participation in an installment agreement. Please contact our office for

5959more details. Additionally, if you file bankruptcy during the installment period, you must notify our Bankruptcy Section immediately at 601-923-7393. 5959

6060Due to the automatic stay provisions of the U.S. Bankruptcy Code, the installment agreement may be void at the time you file your bankruptcy case. 6060

6161 6161

6262 6262

6363 Mail To: Department of Revenue, P.O. Box 23050, Jackson, MS 39225-3050 6363

0606 0707 080 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80