- 12 -

Enlarge image

|

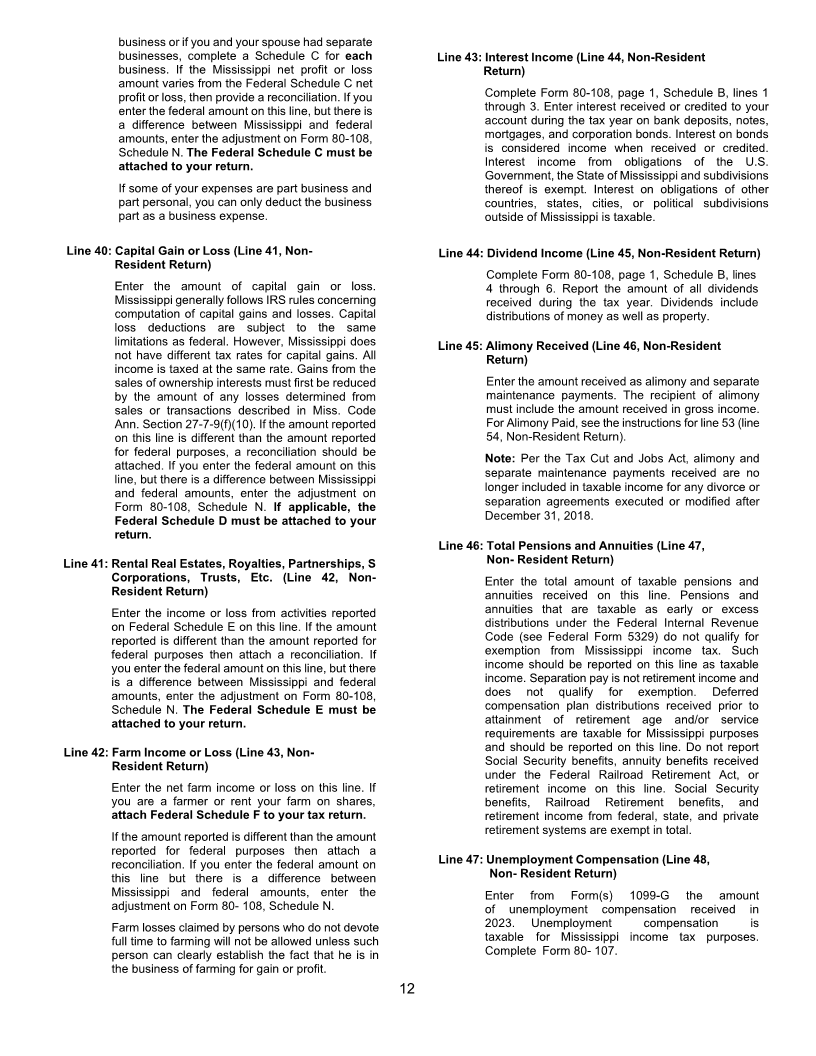

business or if you and your spouse had separate

businesses, complete a Schedule C for each Line 43: Interest Income (Line 44, Non-Resident

business. If the Mississippi net profit or loss Return)

amount varies from the Federal Schedule C net

profit or loss, then provide a reconciliation. If you Complete Form 80-108, page 1, Schedule B, lines 1

enter the federal amount on this line, but there is through 3. Enter interest received or credited to your

a difference between Mississippi and federal account during the tax year on bank deposits, notes,

amounts, enter the adjustment on Form 80-108, mortgages, and corporation bonds. Interest on bonds

Schedule N. The Federal Schedule C must be is considered income when received or credited.

attached to your return. Interest income from obligations of the U.S.

Government, the State of Mississippi and subdivisions

If some of your expenses are part business and thereof is exempt. Interest on obligations of other

part personal, you can only deduct the business countries, states, cities, or political subdivisions

part as a business expense. outside of Mississippi is taxable.

Line 40: Capital Gain or Loss (Line 41, Non- Line 44: Dividend Income (Line 45, Non-Resident Return)

Resident Return)

Complete Form 80-108, page 1, Schedule B, lines

Enter the amount of capital gain or loss. 4 through 6. Report the amount of all dividends

Mississippi generally follows IRS rules concerning received during the tax year. Dividends include

computation of capital gains and losses. Capital distributions of money as well as property.

loss deductions are subject to the same

limitations as federal. However, Mississippi does Line 45: Alimony Received (Line 46, Non-Resident

not have different tax rates for capital gains. All Return)

income is taxed at the same rate. Gains from the

sales of ownership interests must first be reduced Enter the amount received as alimony and separate

by the amount of any losses determined from maintenance payments. The recipient of alimony

sales or transactions described in Miss. Code must include the amount received in gross income.

Ann. Section 27-7-9(f)(10). If the amount reported For Alimony Paid, see the instructions for line 53 (line

on this line is different than the amount reported 54, Non-Resident Return).

for federal purposes, a reconciliation should be Per the Tax Cut and Jobs Act, alimony and

attached. If you enter the federal amount on this Note:

line, but there is a difference between Mississippi separate maintenance payments received are no

and federal amounts, enter the adjustment on longer included in taxable income for any divorce or

Form 80-108, Schedule N. If applicable, the separation agreements executed or modified after

Federal Schedule D must be attached to your December 31, 2018.

return.

Line 46: Total Pensions and Annuities (Line 47,

Line 41: Rental Real Estates, Royalties, Partnerships, S Non- Resident Return)

Corporations, Trusts, Etc. (Line 42, Non- Enter the total amount of taxable pensions and

Resident Return) annuities received on this line. Pensions and

Enter the income or loss from activities reported annuities that are taxable as early or excess

on Federal Schedule E on this line. If the amount distributions under the Federal Internal Revenue

reported is different than the amount reported for Code (see Federal Form 5329) do not qualify for

federal purposes then attach a reconciliation. If exemption from Mississippi income tax. Such

you enter the federal amount on this line, but there income should be reported on this line as taxable

is a difference between Mississippi and federal income. Separation pay is not retirement income and

amounts, enter the adjustment on Form 80-108, does not qualify for exemption. Deferred

Schedule N. The Federal Schedule E must be compensation plan distributions received prior to

attached to your return. attainment of retirement age and/or service

requirements are taxable for Mississippi purposes

Line 42: Farm Income or Loss (Line 43, Non- and should be reported on this line. Do not report

Resident Return) Social Security benefits, annuity benefits received

under the Federal Railroad Retirement Act, or

Enter the net farm income or loss on this line. If retirement income on this line. Social Security

you are a farmer or rent your farm on shares, benefits, Railroad Retirement benefits, and

attach Federal Schedule F to your tax return. retirement income from federal, state, and private

retirement systems are exempt in total.

If the amount reported is different than the amount

reported for federal purposes then attach a

reconciliation. If you enter the federal amount on Line 47: Unemployment Compensation (Line 48,

this line but there is a difference between Non- Resident Return)

Mississippi and federal amounts, enter the Enter from Form(s) 1099-G the amount

adjustment on Form 80- 108, Schedule N. of unemployment compensation received in

Farm losses claimed by persons who do not devote 2023. Unemployment compensation is

full time to farming will not be allowed unless such taxable for Mississippi income tax purposes.

person can clearly establish the fact that he is in Complete Form 80- 107.

the business of farming for gain or profit.

12

|