Enlarge image

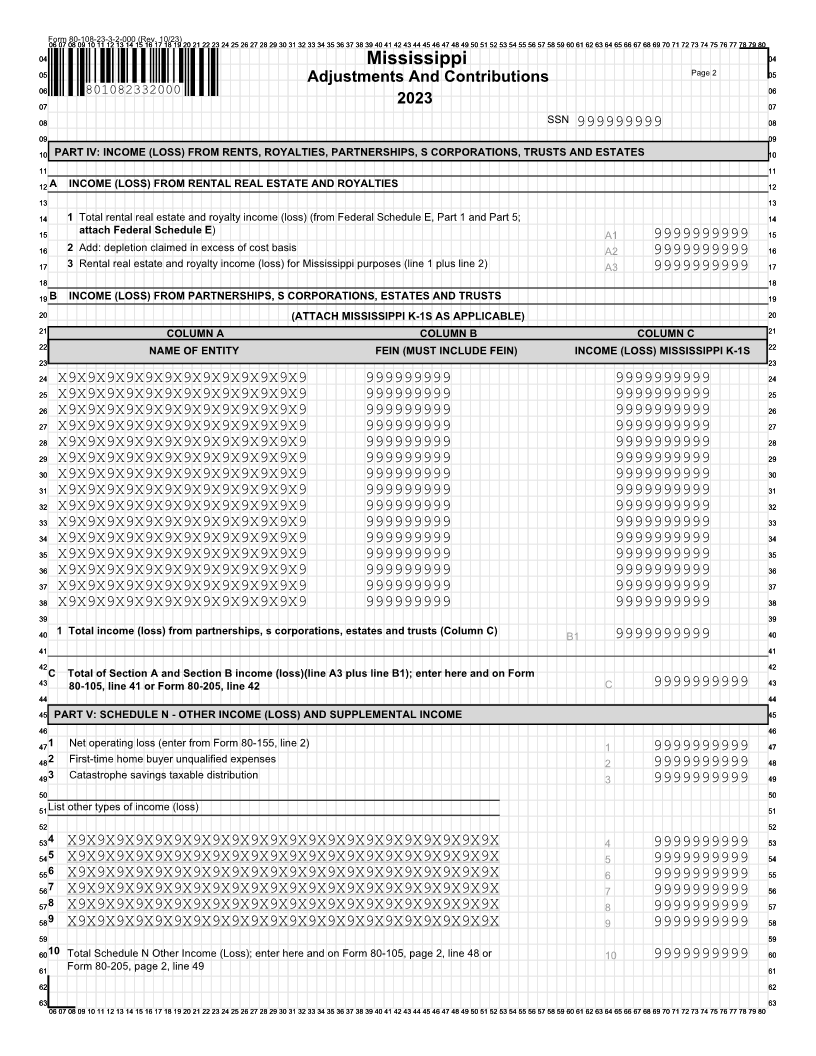

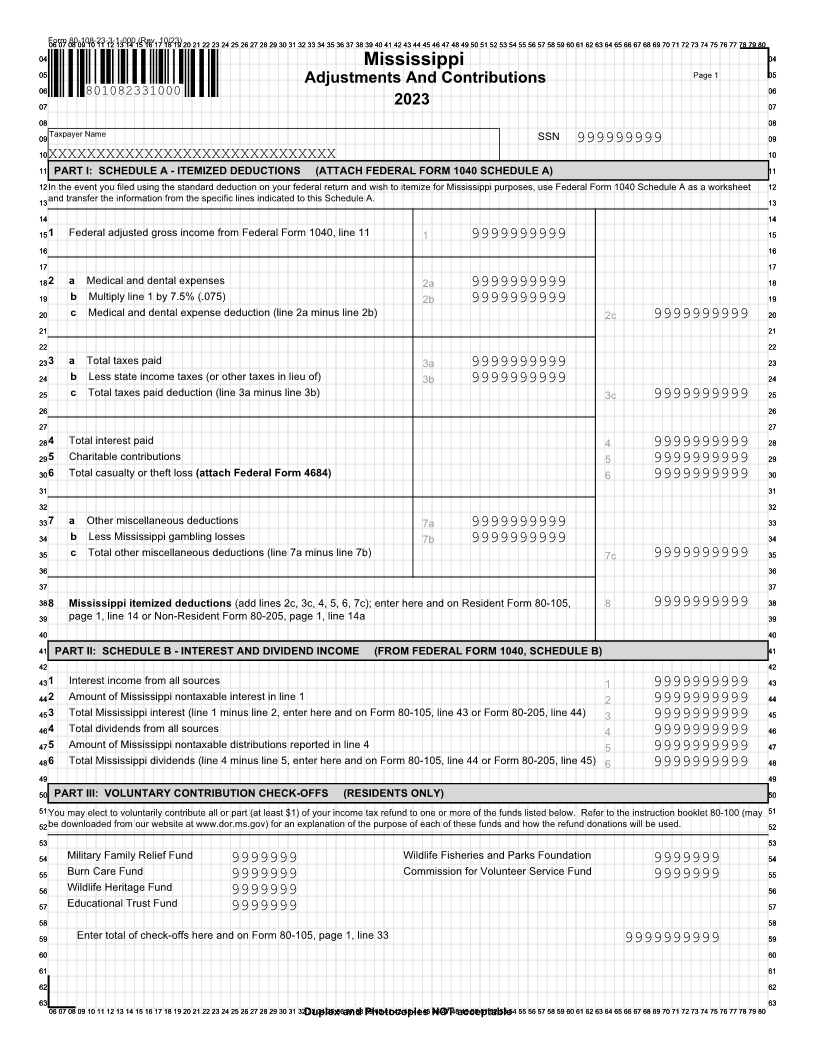

Form0606 0707 08080-108-23-3-1-00009 10 11 12 13 14 15(Rev.16 1710/23)18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

0404 Mississippi 0404

0505 Page 1 0505

Adjustments And Contributions

0606 801082331000 0606

0707 2023 0707

0808 0808

0909 Taxpayer Name SSN 0909

999999999

1010XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 1010

1111 PART I: SCHEDULE A - ITEMIZED DEDUCTIONS (ATTACH FEDERAL FORM 1040 SCHEDULE A) 1111

1212In the event you filed using the standard deduction on your federal return and wish to itemize for Mississippi purposes, use Federal Form 1040 Schedule A as a worksheet 1212

1313and transfer the information from the specific lines indicated to this Schedule A. 1313

1414 1414

15151 Federal adjusted gross income from Federal Form 1040, line 11 1 9999999999 1515

1616 1616

1717 1717

18182 a Medical and dental expenses 2a 9999999999 1818

1919 b Multiply line 1 by 7.5% (.075) 2b 9999999999 1919

2020 c Medical and dental expense deduction (line 2a minus line 2b) 2c 9999999999 2020

2121 2121

2222 2222

23233 a Total taxes paid 3a 9999999999 2323

2424 b Less state income taxes (or other taxes in lieu of) 3b 9999999999 2424

2525 c Total taxes paid deduction (line 3a minus line 3b) 3c 9999999999 2525

2626 2626

2727 2727

28284 Total interest paid 4 9999999999 2828

29295 Charitable contributions 5 9999999999 2929

30306 Total casualty or theft loss (attach Federal Form 4684) 6 9999999999 3030

3131 3131

3232 3232

33337 a Other miscellaneous deductions 7a 9999999999 3333

3434 b Less Mississippi gambling losses 7b 9999999999 3434

3535 c Total other miscellaneous deductions (line 7a minus line 7b) 7c 9999999999 3535

3636 3636

3737 3737

38388 Mississippi itemized deductions (add lines 2c, 3c, 4, 5, 6, 7c); enter here and on Resident Form 80-105, 8 9999999999 3838

3939 page 1, line 14 or Non-Resident Form 80-205, page 1, line 14a 3939

4040 4040

4141 PART II: SCHEDULE B - INTEREST AND DIVIDEND INCOME (FROM FEDERAL FORM 1040, SCHEDULE B) 4141

4242 4242

43431 Interest income from all sources 1 9999999999 4343

44442 Amount of Mississippi nontaxable interest in line 1 2 9999999999 4444

45453 Total Mississippi interest (line 1 minus line 2, enter here and on Form 80-105, line 43 or Form 80-205, line 44) 3 9999999999 4545

46464 Total dividends from all sources 4 9999999999 4646

47475 Amount of Mississippi nontaxable distributions reported in line 4 5 9999999999 4747

48486 Total Mississippi dividends (line 4 minus line 5, enter here and on Form 80-105, line 44 or Form 80-205, line 45) 6 9999999999 4848

4949 4949

5050 PART III: VOLUNTARY CONTRIBUTION CHECK-OFFS (RESIDENTS ONLY) 5050

5151You may elect to voluntarily contribute all or part (at least $1) of your income tax refund to one or more of the funds listed below. Refer to the instruction booklet 80-100 (may 5151

5252be downloaded from our website at www.dor.ms.gov) for an explanation of the purpose of each of these funds and how the refund donations will be used. 5252

5353 5353

5454 Military Family Relief Fund 9999999 Wildlife Fisheries and Parks Foundation 9999999 5454

5555 Burn Care Fund 9999999 Commission for Volunteer Service Fund 9999999 5555

5656 Wildlife Heritage Fund 9999999 5656

5757 Educational Trust Fund 9999999 5757

5858 5858

5959 Enter total of check-offs here and on Form 80-105, page 1, line 33 9999999999 5959

6060 6060

6161 6161

6262 6262

6363 6363

0606 0707 008 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32Duplex33 34 35 36and37 38Photocopies39 40 41 42 43 44 45NOT46 47 48acceptable49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80