Enlarge image

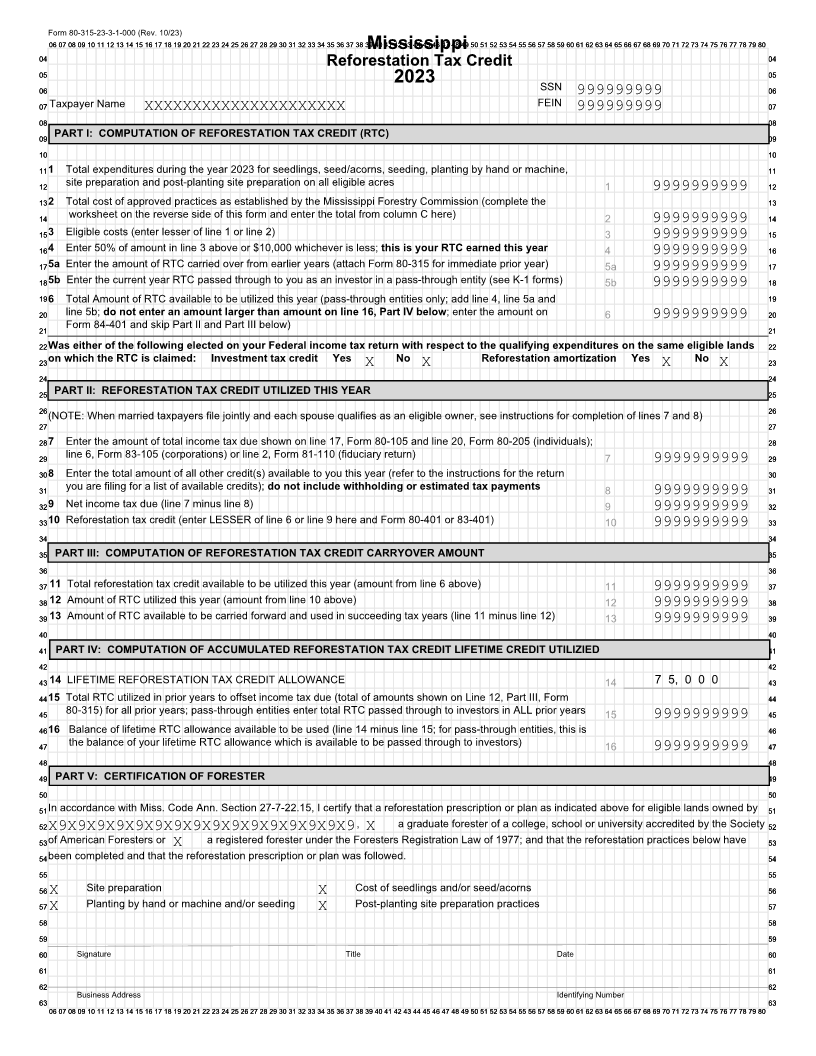

Form 80-315-23-3-1-000 (Rev. 10/23)

0606 0707 080 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39Mississippi40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

0404 Reforestation Tax Credit 0404

0505 0505

2023

0606 SSN 999999999 0606

0707 Taxpayer Name XXXXXXXXXXXXXXXXXXXXX FEIN 999999999 0707

0808 0808

0909 PART I: COMPUTATION OF REFORESTATION TAX CREDIT (RTC) 0909

1010 1010

11111 Total expenditures during the year 2023 for seedlings, seed/acorns, seeding, planting by hand or machine, 1111

1212 site preparation and post-planting site preparation on all eligible acres 1 9999999999 1212

13132 Total cost of approved practices as established by the Mississippi Forestry Commission (complete the 1313

1414 worksheet on the reverse side of this form and enter the total from column C here) 2 9999999999 1414

15153 Eligible costs (enter lesser of line 1 or line 2) 3 9999999999 1515

16164 Enter 50% of amount in line 3 above or $10,000 whichever is less; this is your RTC earned this year 4 9999999999 1616

17175a Enter the amount of RTC carried over from earlier years (attach Form 80-315 for immediate prior year) 5a 9999999999 1717

18185b Enter the current year RTC passed through to you as an investor in a pass-through entity (see K-1 forms) 5b 9999999999 1818

19196 Total Amount of RTC available to be utilized this year (pass-through entities only; add line 4, line 5a and 1919

2020 line 5b; do not enter an amount larger than amount on line 16, Part IV below; enter the amount on 6 9999999999 2020

2121 Form 84-401 and skip Part II and Part III below) 2121

2222Was either of the following elected on your Federal income tax return with respect to the qualifying expenditures on the same eligible lands 2222

2323on which the RTC is claimed: Investment tax credit Yes No Reforestation amortization Yes No 2323

XX XX

2424 2424

2525 PART II: REFORESTATION TAX CREDIT UTILIZED THIS YEAR 2525

2626(NOTE: When married taxpayers file jointly and each spouse qualifies as an eligible owner, see instructions for completion of lines 7 and 8) 2626

2727 2727

28287 Enter the amount of total income tax due shown on line 17, Form 80-105 and line 20, Form 80-205 (individuals); 2828

2929 line 6, Form 83-105 (corporations) or line 2, Form 81-110 (fiduciary return) 7 9999999999 2929

30308 Enter the total amount of all other credit(s) available to you this year (refer to the instructions for the return 3030

3131 you are filing for a list of available credits); do not include withholding or estimated tax payments 8 9999999999 3131

32329 Net income tax due (line 7 minus line 8) 9 9999999999 3232

333310 Reforestation tax credit (enter LESSER of line 6 or line 9 here and Form 80-401 or 83-401) 10 9999999999 3333

3434 3434

3535 PART III: COMPUTATION OF REFORESTATION TAX CREDIT CARRYOVER AMOUNT 3535

3636 3636

3737 11 Total reforestation tax credit available to be utilized this year (amount from line 6 above) 11 9999999999 3737

3838 12 Amount of RTC utilized this year (amount from line 10 above) 12 9999999999 3838

3939 13 Amount of RTC available to be carried forward and used in succeeding tax years (line 11 minus line 12) 13 9999999999 3939

4040 4040

4141 PART IV: COMPUTATION OF ACCUMULATED REFORESTATION TAX CREDIT LIFETIME CREDIT UTILIZIED 4141

4242 4242

4343 14 LIFETIME REFORESTATION TAX CREDIT ALLOWANCE 14 7 5, 0 0 0 4343

444415 Total RTC utilized in prior years to offset income tax due (total of amounts shown on Line 12, Part III, Form 4444

4545 80-315) for all prior years; pass-through entities enter total RTC passed through to investors in ALL prior years 15 9999999999 4545

464616 Balance of lifetime RTC allowance available to be used (line 14 minus line 15; for pass-through entities, this is 4646

4747 the balance of your lifetime RTC allowance which is available to be passed through to investors) 16 9999999999 4747

4848 4848

4949 PART V: CERTIFICATION OF FORESTER 4949

5050 5050

5151In accordance with Miss. Code Ann. Section 27-7-22.15, I certify that a reforestation prescription or plan as indicated above for eligible lands owned by 5151

5252 X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9, X a graduate forester of a college, school or university accredited by the Society 5252

5353of American Foresters or X a registered forester under the Foresters Registration Law of 1977; and that the reforestation practices below have 5353

5454been completed and that the reforestation prescription or plan was followed. 5454

5555 5555

5656 X Site preparation X Cost of seedlings and/or seed/acorns 5656

5757 X Planting by hand or machine and/or seeding X Post-planting site preparation practices 5757

5858 5858

5959 5959

6060 Signature Title Date 6060

6161 6161

6262 6262

Business Address Identifying Number

6363 6363

06 07 006 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80