Enlarge image

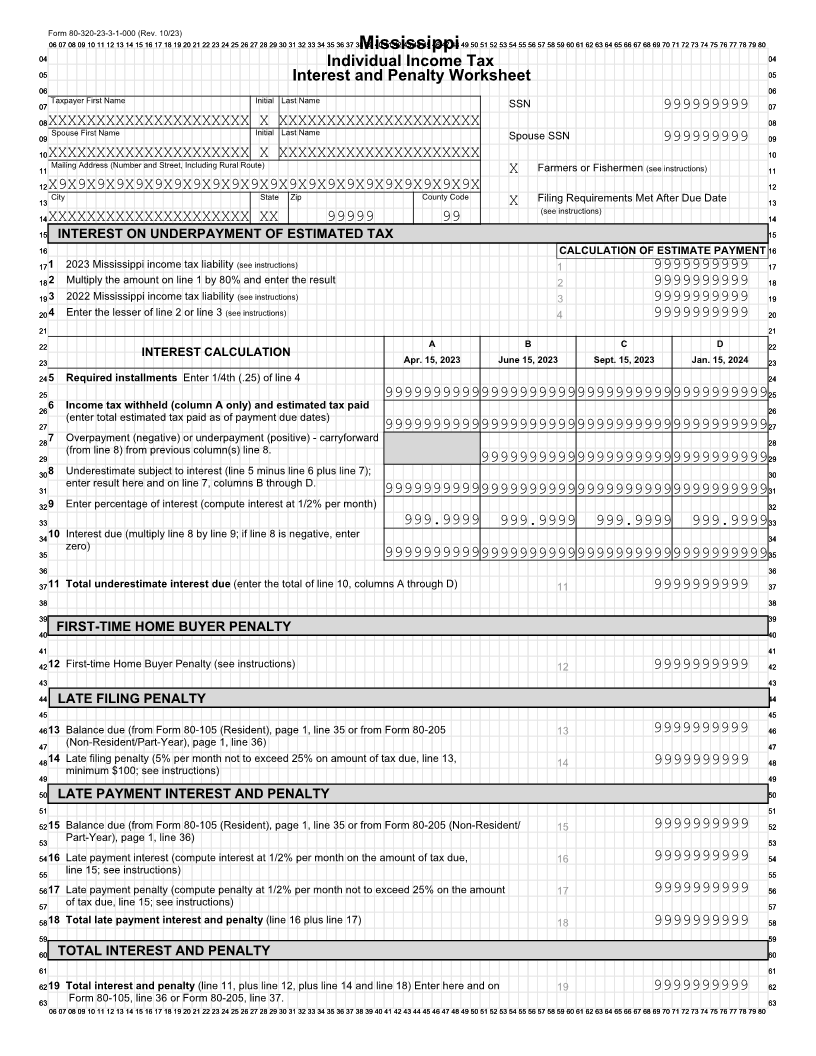

Form 80-320-23-3-1-000 (Rev. 10/23)

0606 0707 080 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38Mississippi39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

0404 Individual Income Tax 0404

0505 Interest and Penalty Worksheet 0505

0606 0606

0707 Taxpayer First Name Initial Last Name SSN 0707

999999999

0808XXXXXXXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXX 0808

0909 Spouse First Name Initial Last Name Spouse SSN 0909

999999999

1010XXXXXXXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXX 1010

1111 Mailing Address (Number and Street, Including Rural Route) Farmers or Fishermen (see instructions) 1111

X

1212X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 1212

1313 City State Zip County Code Filing Requirements Met After Due Date 1313

X (see instructions)

1414XXXXXXXXXXXXXXXXXXXXX XX 99999 99 1414

1515 INTEREST ON UNDERPAYMENT OF ESTIMATED TAX 1515

1616 CALCULATION OF ESTIMATE PAYMENT 1616

17171 2023 Mississippi income tax liability (see instructions) 1 9999999999 1717

18182 Multiply the amount on line 1 by 80% and enter the result 2 9999999999 1818

19193 2022 Mississippi income tax liability (see instructions) 3 9999999999 1919

20204 Enter the lesser of line 2 or line 3 (see instructions) 4 9999999999 2020

2121 2121

2222 A B C D 2222

INTEREST CALCULATION

2323 Apr. 15, 2023 June 15, 2023 Sept. 15, 2023 Jan. 15, 2024 2323

24245 Required installments Enter 1/4th (.25) of line 4 2424

2525 9999999999 9999999999 9999999999 9999999999 2525

26266 Income tax withheld (column A only) and estimated tax paid 2626

(enter total estimated tax paid as of payment due dates)

2727 9999999999999999999999999999999999999999 2727

28287 Overpayment (negative) or underpayment (positive) - carryforward 2828

(from line 8) from previous column(s) line 8.

2929 9999999999 9999999999 9999999999 2929

30308 Underestimate subject to interest (line 5 minus line 6 plus line 7); 3030

3131 enter result here and on line 7, columns B through D. 3131

9999999999999999999999999999999999999999

32329 Enter percentage of interest (compute interest at 1/2% per month) 3232

3333 999.9999 999.9999 999.9999 999.9999 3333

343410 Interest due (multiply line 8 by line 9; if line 8 is negative, enter 3434

zero)

3535 9999999999999999999999999999999999999999 3535

3636 3636

373711 Total underestimate interest due (enter the total of line 10, columns A through D) 11 9999999999 3737

3838 3838

3939 3939

4040 FIRST-TIME HOME BUYER PENALTY 4040

4141 4141

424212 First-time Home Buyer Penalty (see instructions) 12 9999999999 4242

4343 4343

4444 LATE FILING PENALTY 4444

4545 4545

464613 Balance due (from Form 80-105 (Resident), page 1, line 35 or from Form 80-205 13 9999999999 4646

4747 (Non-Resident/Part-Year), page 1, line 36) 4747

484814 Late filing penalty (5% per month not to exceed 25% on amount of tax due, line 13, 14 9999999999 4848

minimum $100; see instructions)

4949 4949

5050 LATE PAYMENT INTEREST AND PENALTY 5050

5151 5151

525215 Balance due (from Form 80-105 (Resident), page 1, line 35 or from Form 80-205 (Non-Resident/ 15 9999999999 5252

5353 Part-Year), page 1, line 36) 5353

545416 Late payment interest (compute interest at 1/2% per month on the amount of tax due, 16 9999999999 5454

5555 line 15; see instructions) 5555

565617 Late payment penalty (compute penalty at 1/2% per month not to exceed 25% on the amount 17 9999999999 5656

5757 of tax due, line 15; see instructions) 5757

585818 Total late payment interest and penalty (line 16 plus line 17) 18 9999999999 5858

5959 5959

6060 TOTAL INTEREST AND PENALTY 6060

6161 6161

626219 Total interest and penalty (line 11, plus line 12, plus line 14 and line 18) Enter here and on 19 9999999999 6262

6363 Form 80-105, line 36 or Form 80-205, line 37. 6363

0606 0707 080 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80