Enlarge image

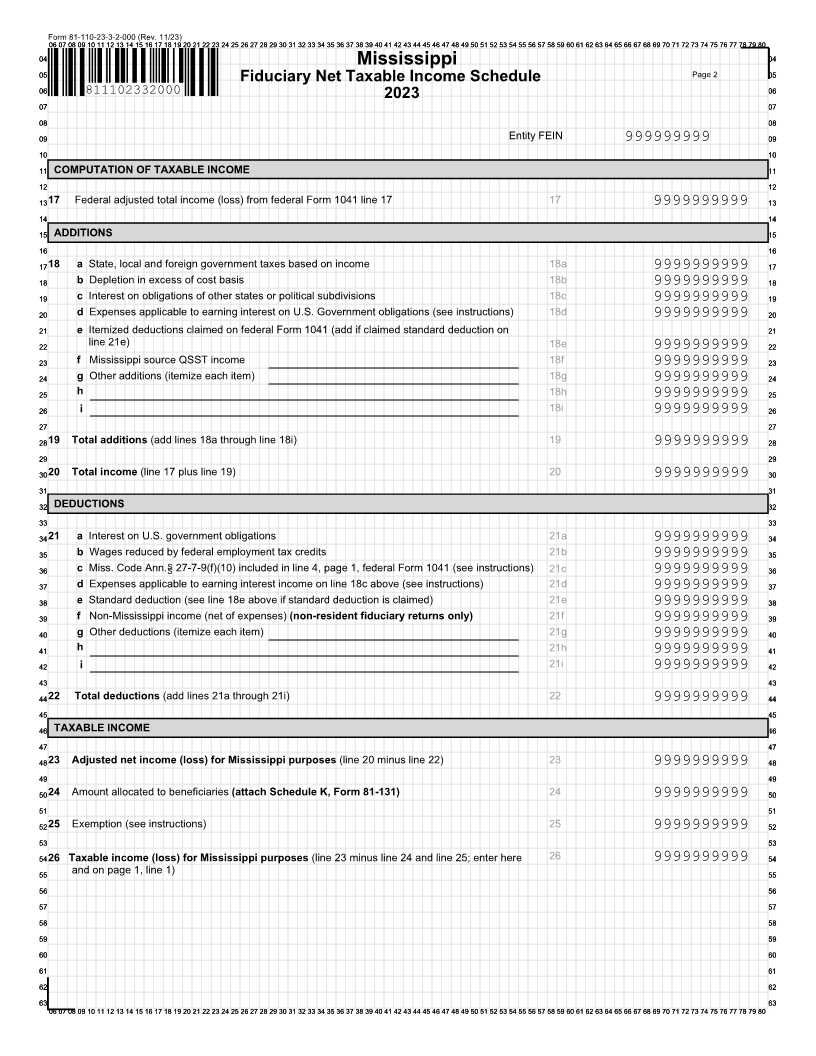

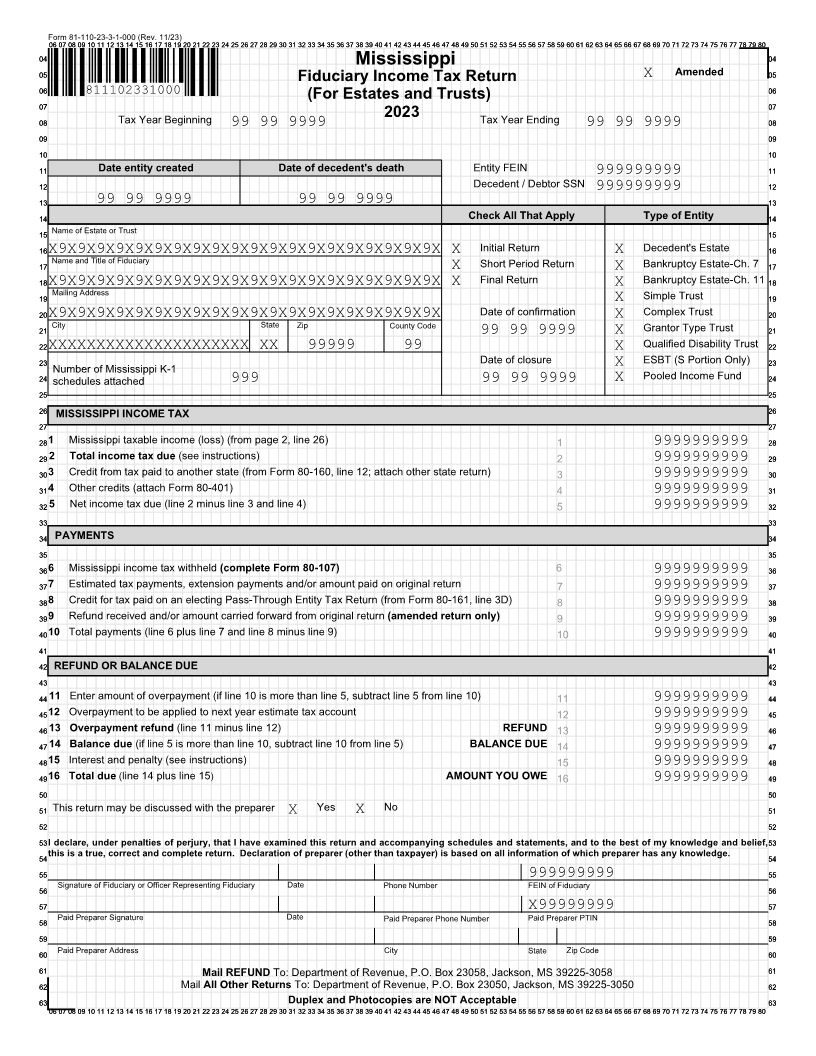

Form 81-110-23-3-1-000 (Rev. 1 /23) 0606 0707 080 09 10 11 12 13 14 15 16 17118 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 0404 Mississippi 0404 Amended 0505 Fiduciary Income Tax Return X 0505 0606 811102331000 0606 (For Estates and Trusts) 0707 0707 2023 0808 Tax Year Beginning 99 99 9999 Tax Year Ending 99 99 9999 0808 0909 0909 1010 1010 1111 Date entity created Date of decedent's death Entity FEIN 999999999 1111 1212 Decedent / Debtor SSN 999999999 1212 1313 99 99 9999 99 99 9999 1313 1414 Check All That Apply Type of Entity 1414 1515 Name of Estate or Trust 1515 1616X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X Initial Return X Decedent's Estate 1616 1717 Name and Title of Fiduciary X Short Period Return X Bankruptcy Estate-Ch. 7 1717 1818X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X X Final Return X Bankruptcy Estate-Ch. 11 1818 1919 Mailing Address Simple Trust 1919 X 2020X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X Date of confirmation X Complex Trust 2020 2121 City State Zip County Code Grantor Type Trust 2121 99 99 9999 X 2222XXXXXXXXXXXXXXXXXXXXX XX 99999 99 X Qualified Disability Trust 2222 2323 Date of closure X ESBT (S Portion Only) 2323 Number of Mississippi K-1 2424 schedules attached 999 99 99 9999 X Pooled Income Fund 2424 2525 2525 2626 MISSISSIPPI INCOME TAX 2626 2727 2727 28281 Mississippi taxable income (loss) (from page 2, line 26) 1 9999999999 2828 2929 2 Total income tax due (see instructions) 2 9999999999 2929 30303 Credit from tax paid to another state (from Form 80-160, line 1 ; attach other state return)2 3 9999999999 3030 31314 Other credits (attach Form 80-401) 4 9999999999 3131 3232 5 Net income tax due (line 2 minus line 3 and line 4) 5 9999999999 3232 3333 3333 3434 PAYMENTS 3434 3535 3535 36366 Mississippi income tax withheld (complete Form 80-107) 6 9999999999 3636 37377 Estimated tax payments, extension payments and/or amount paid on original return 7 9999999999 3737 38388 Credit for tax paid on an electing Pass-Through Entity Tax Return (from Form 80-161, line 3D) 8 9999999999 3838 39399 Refund received and/or amount carried forward from original return (amended return only) 9 9999999999 3939 404010 Total payments (line 6 plus line 7 and line 8 minus line 9) 10 9999999999 4040 4141 4141 4242 REFUND OR BALANCE DUE 4242 4343 4343 4444 11 Enter amount of overpayment (if line 10 is more than line 5, subtract line 5 from line 10) 11 9999999999 4444 454512 Overpayment to be applied to next year estimate tax account 12 9999999999 4545 464613 Overpayment refund (line 11 minus line 12) REFUND 13 9999999999 4646 474714 Balance due (if line 5 is more than line 10, subtract line 10 from line 5) BALANCE DUE 14 9999999999 4747 484815 Interest and penalty (see instructions) 15 9999999999 4848 494916 Total due (line 14 plus line 15) AMOUNT YOU OWE 16 9999999999 4949 5050 5050 5151 This return may be discussed with the preparer X Yes X No 5151 5252 5252 5353I declare, under penalties of perjury, that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, 5353 5454this is a true, correct and complete return. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. 5454 5555 999999999 5555 5656 Signature of Fiduciary or Officer Representing Fiduciary Date Phone Number FEIN of Fiduciary 5656 5757 X99999999 5757 5858 Paid Preparer Signature Date Paid Preparer Phone Number Paid Preparer PTIN 5858 5959 5959 6060 Paid Preparer Address City State Zip Code 6060 6161 Mail REFUND To: Department of Revenue, P.O. Box 23058, Jackson, MS 39225-3058 6161 6262 Mail All Other Returns To: Department of Revenue, P.O. Box 23050, Jackson, MS 39225-3050 6262 6363 Duplex and Photocopies are NOT Acceptable 6363 0606 0707 080 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80