Enlarge image

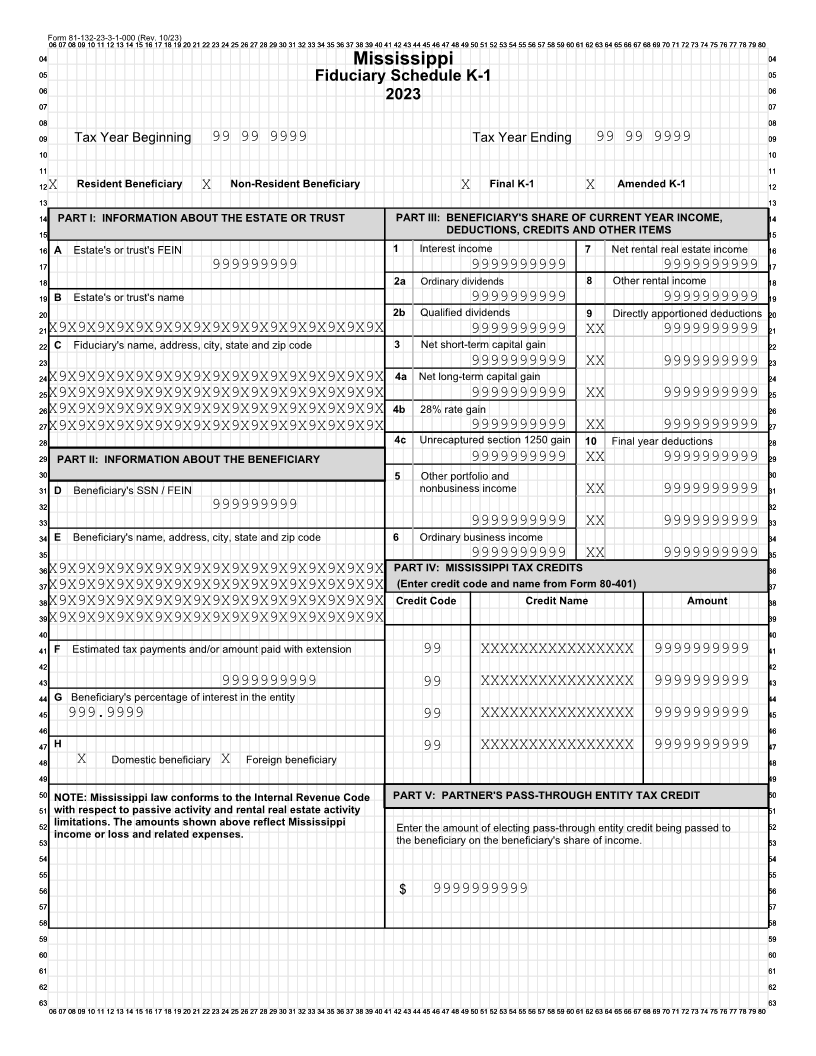

Form0606 0707 08081-132-23-3-1-00009 10 11 12 13 14 15(Rev.16 1710/23)18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

0404 Mississippi 0404

0505 Fiduciary Schedule K-1 0505

0606 0606

2023

0707 0707

0808 0808

0909 Tax Year Beginning 99 99 9999 Tax Year Ending 99 99 9999 0909

1010 1010

1111 1111

1212X Resident Beneficiary X Non-Resident Beneficiary X Final K-1 X Amended K-1 1212

1313 1313

1414 PART I: INFORMATION ABOUT THE ESTATE OR TRUST PART III: BENEFICIARY'S SHARE OF CURRENT YEAR INCOME, 1414

1515 DEDUCTIONS, CREDITS AND OTHER ITEMS 1515

1616 A Estate's or trust's FEIN 1 Interest income 7 Net rental real estate income 1616

1717 999999999 9999999999 9999999999 1717

1818 2a Ordinary dividends 8 Other rental income 1818

1919 B Estate's or trust's name 9999999999 9999999999 1919

2020 2b Qualified dividends 9 Directly apportioned deductions 2020

2121X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 9999999999 XX 9999999999 2121

2222 C Fiduciary's name, address, city, state and zip code 3 Net short-term capital gain 2222

2323 9999999999 XX 9999999999 2323

2424X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 4a Net long-term capital gain 2424

2525X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 9999999999 XX 9999999999 2525

2626X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 4b 28% rate gain 2626

2727X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 9999999999 XX 9999999999 2727

2828 4c Unrecaptured section 1250 gain 10 Final year deductions 2828

2929 PART II: INFORMATION ABOUT THE BENEFICIARY 9999999999 XX 9999999999 2929

3030 5 Other portfolio and 3030

3131 D Beneficiary's SSN / FEIN nonbusiness income XX 9999999999 3131

3232 999999999 3232

3333 9999999999 XX 9999999999 3333

3434 E Beneficiary's name, address, city, state and zip code 6 Ordinary business income 3434

3535 9999999999 XX 9999999999 3535

3636X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X PART IV: MISSISSIPPI TAX CREDITS 3636

3737X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X (Enter credit code and name from Form 80-401) 3737

3838X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X Credit Code Credit Name Amount 3838

3939X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 3939

4040 4040

4141 F Estimated tax payments and/or amount paid with extension 99 XXXXXXXXXXXXXXXX 9999999999 4141

4242 4242

4343 9999999999 99 XXXXXXXXXXXXXXXX 9999999999 4343

4444 G Beneficiary's percentage of interest in the entity 4444

4545 999.9999 99 XXXXXXXXXXXXXXXX 9999999999 4545

4646 4646

4747 H 99 XXXXXXXXXXXXXXXX 9999999999 4747

4848 X Domestic beneficiary X Foreign beneficiary 4848

4949 4949

5050 NOTE: Mississippi law conforms to the Internal Revenue Code PART V: PARTNER'S PASS-THROUGH ENTITY TAX CREDIT 5050

5151 with respect to passive activity and rental real estate activity 5151

5252 limitations. The amounts shown above reflect Mississippi Enter the amount of electing pass-through entity credit being passed to 5252

income or loss and related expenses.

5353 the beneficiary on the beneficiary's share of income. 5353

5454 5454

5555 5555

5656 $ 9999999999 5656

5757 5757

5858 5858

5959 5959

6060 6060

6161 6161

6262 6262

6363 6363

0606 0707 080 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80