Enlarge image

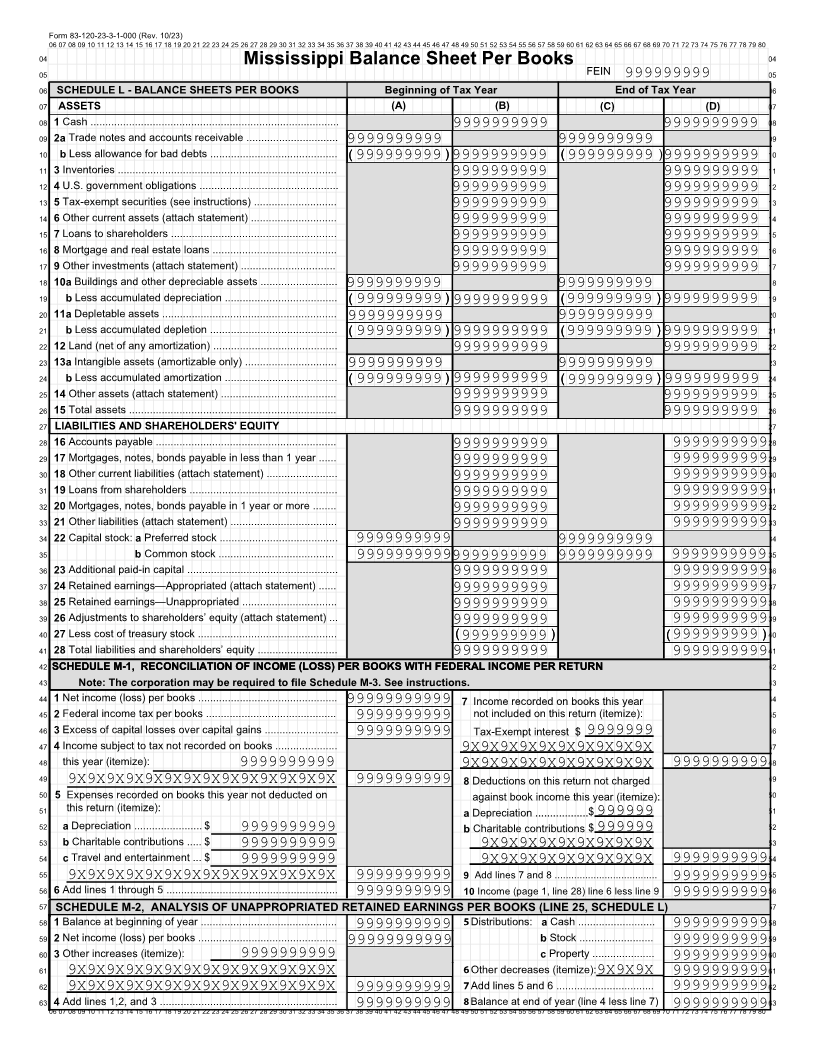

Form 83-120-23-3-1-000 (Rev. 10/23) 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 04 Mississippi Balance Sheet Per Books 04 05 FEIN 999999999 05 06 SCHEDULE L - BALANCE SHEETS PER BOOKS Beginning of Tax Year End of Tax Year 06 07 ASSETS (A) (B) (C) (D) 07 08 1 Cash .................................................................................... 9999999999 9999999999 08 09 2a Trade notes and accounts receivable ............................... 9999999999 9999999999 09 10 b Less allowance for bad debts ........................................... ( ( 999999999 ) ) 9999999999 ( ( 999999999 9999999999) 10 11 3 Inventories .......................................................................... 9999999999 9999999999 11 12 4 U.S. government obligations ............................................... 9999999999 9999999999 12 13 5 Tax-exempt securities (see instructions) ............................ 9999999999 9999999999 13 14 6 Other current assets (attach statement) ............................. 9999999999 9999999999 14 15 7 Loans to shareholders ........................................................ 9999999999 9999999999 15 16 8 Mortgage and real estate loans .......................................... 9999999999 9999999999 16 17 9 Other investments (attach statement) ................................ 9999999999 9999999999 17 18 10a Buildings and other depreciable assets .......................... 9999999999 9999999999 18 19 b Less accumulated depreciation ...................................... ( ( 999999999 ) ) 9999999999 ( (999999999 9999999999) ) 19 20 11a Depletable assets ........................................................... 9999999999 9999999999 20 21 b Less accumulated depletion ........................................... ( ( 999999999 ) ) 9999999999 ( (999999999 9999999999) ) 21 22 12 Land (net of any amortization) .......................................... 9999999999 9999999999 22 23 13a Intangible assets (amortizable only) ............................... 9999999999 9999999999 23 24 b Less accumulated amortization ...................................... ( ( 999999999 ) ) 9999999999 ( ( 999999999 9999999999) ) 24 25 14 Other assets (attach statement) ....................................... 9999999999 9999999999 25 26 15 Total assets ...................................................................... 9999999999 9999999999 26 27 LIABILITIES AND SHAREHOLDERS' EQUITY 27 28 16 Accounts payable ............................................................. 9999999999 9999999999 28 29 17 Mortgages, notes, bonds payable in less than 1 year ...... 9999999999 9999999999 29 30 18 Other current liabilities (attach statement) ........................ 9999999999 9999999999 30 31 19 Loans from shareholders .................................................. 9999999999 9999999999 31 32 20 Mortgages, notes, bonds payable in 1 year or more ........ 9999999999 9999999999 32 33 21 Other liabilities (attach statement) .................................... 9999999999 9999999999 33 34 22 Capital stock: Preferred stock ........................................a 9999999999 9999999999 34 35 b Common stock ....................................... 99999999999999999999 9999999999 9999999999 35 36 23 Additional paid-in capital ................................................... 9999999999 9999999999 36 37 24 Retained earnings—Appropriated (attach statement) ...... 9999999999 9999999999 37 38 25 Retained earnings—Unappropriated ................................ 9999999999 9999999999 38 39 26 Adjustments to shareholders’ equity (attach statement) ... 9999999999 9999999999 39 40 27 Less cost of treasury stock ............................................... ( ( 999999999 ) ) ( ( 999999999 ) ) 40 41 28 Total liabilities and shareholders’ equity ........................... 9999999999 9999999999 41 42 SCHEDULE M-1, RECONCILIATION OF INCOME (LOSS) PER BOOKS WITH FEDERAL INCOME PER RETURN SCHEDULE M-1, RECONCILIATION OF INCOME (LOSS) PER BOOKS WITH FEDERAL INCOME PER RETURN 42 43 Note: Note: The corporation may be required to file Schedule M-3. See instructions. 43 44 1 Net income (loss) per books ............................................... 99999999999 7 Income recorded on books this year 44 45 2 Federal income tax per books ............................................ 9999999999 not included on this return (itemize): 45 46 3 Excess of capital losses over capital gains ......................... 9999999999 Tax-Exempt interest $ 9999999 46 47 4 Income subject to tax not recorded on books ..................... 9X9X9X9X9X9X9X9X9X9X 47 48 this year (itemize): 9999999999 9X9X9X9X9X9X9X9X9X9X 9999999999 48 49 9X9X9X9X9X9X9X9X9X9X9X9X9X9X 9999999999 8 Deductions on this return not charged 49 50 5 Expenses recorded on books this year not deducted on against book income this year (itemize): 50 51 this return (itemize): a Depreciation ..................$ 999999 51 52 a Depreciation ....................... $ 9999999999 b Charitable contributions $ 999999 52 53 b Charitable contributions ..... $ 9999999999 9X9X9X9X9X9X9X9X9X 53 54 c Travel and entertainment ... $ 9999999999 9X9X9X9X9X9X9X9X9X 9999999999 54 55 9X9X9X9X9X9X9X9X9X9X9X9X9X9X 9999999999 9 Add lines 7 and 8 ..................................... 9999999999 55 56 6 Add lines 1 through 5 .......................................................... 9999999999 10 Income (page 1, line 28) line 6 less line 9 9999999999 56 57 SCHEDULE M-2, ANALYSIS OF UNAPPROPRIATED RETAINED EARNINGS PER BOOKS (LINE 25, SCHEDULE L) 57 58 1 Balance at beginning of year .............................................. 9999999999 Distributions: Cash .......................... a 9999999999 58 59 2 Net income (loss) per books ............................................... 99999999999 b Stock ......................... 9999999999 59 60 3 Other increases (itemize): 9999999999 c Property ..................... 9999999999 60 61 9X9X9X9X9X9X9X9X9X9X9X9X9X9X Other decreases (itemize): 9X9X9X 9999999999 61 62 9X9X9X9X9X9X9X9X9X9X9X9X9X9X 9999999999 Add lines 5 and 6 ................................. 9999999999 62 63 4 Add lines 1,2, and 3 ............................................................ Balance at end of year (line 4 less line 7) 63 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 389999999999 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71999999999972 73 74 75 76 77 78 79 80