Enlarge image

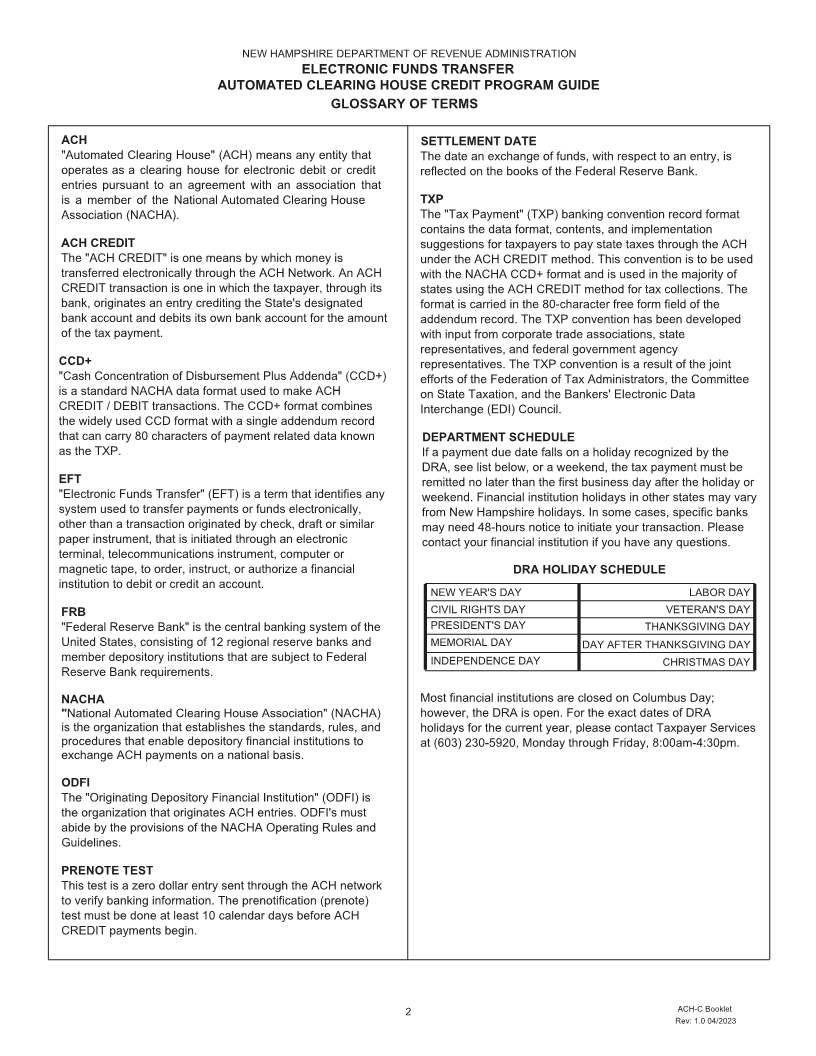

NH DEPARTMENT OF REVENUE ADMINISTRATION

109 PLEASANT STREET

PO BOX 637

CONCORD NH 03302-0637

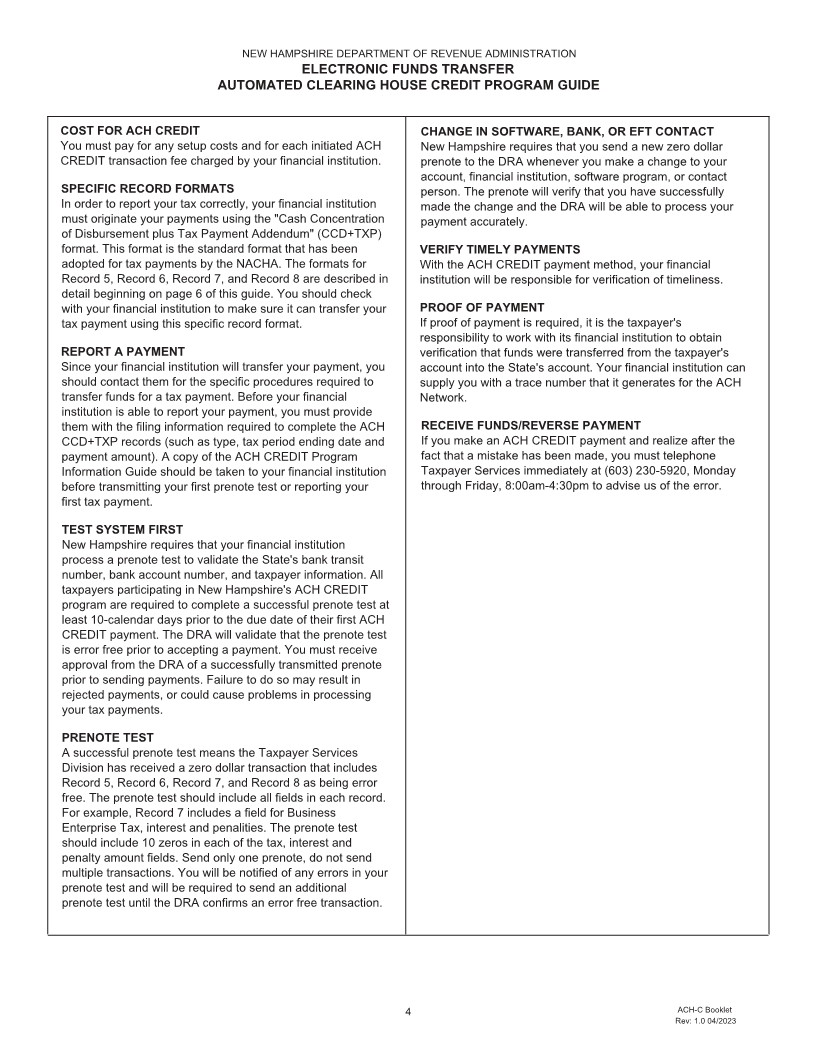

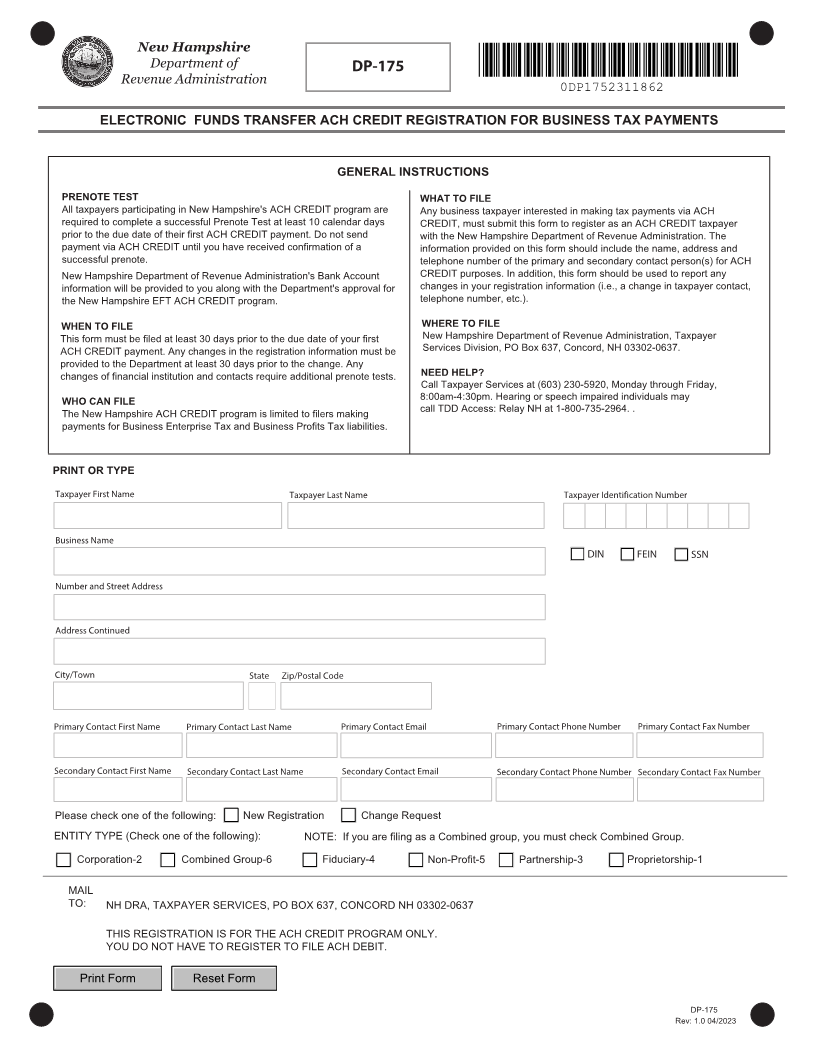

All taxpayers participating in New Hampshire's Automated Clearing House

NEW HAMPSHIRE DEPARTMENT OF (ACH) CREDIT program are required to complete a successful Prenote

REVENUE ADMINISTRATION (DRA) Test at least 10 calendar days prior to the due date of their first ACH

CREDIT payment. Do not send payment via ACH CREDIT until you have

ELECTRONIC FUNDS TRANSFER received confirmation of a successful prenote.

ACH (AUTOMATED CLEARING HOUSE) New Hampshire Department of Revenue Administration's Bank Account

CREDIT PROGRAM GUIDE information will be provided to you along with the Department's approval

for the New Hampshire Electronic Funds Transfer (EFT) ACH CREDIT

program.

This Booklet Contains:

ACH Credit Program This program guide is designed to assist with making payments for Business

Participation Guidelines Profits Tax and Business Enterprise Tax using the ACH CREDIT transaction

method. This method is the standard established by the Electronic Payment

Association (NACHA) a national organization for the electronic transfer of

Registration Information & Form

funds between financial institutions using the Automated Clearing House

Payment Options Network.

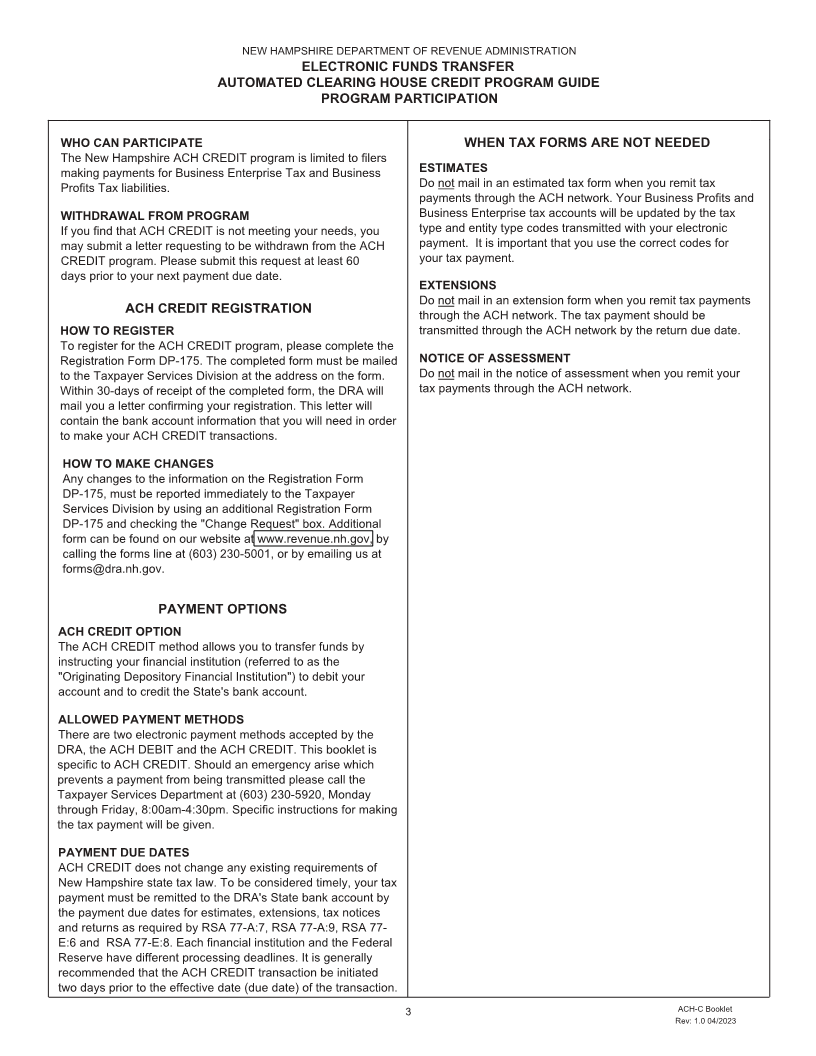

Form DP-175 The New Hampshire ACH CREDIT program is limited to filers making

payments for Business Enterprise Tax and Business Profits Tax liabilities.

EFT ACH Credit Registration for

Business Tax Payments Form New Hampshire ACH DEBIT is available to current filers of Business

Enterprise Tax, Business Profits Tax, Interest & Dividends Tax, Meals &

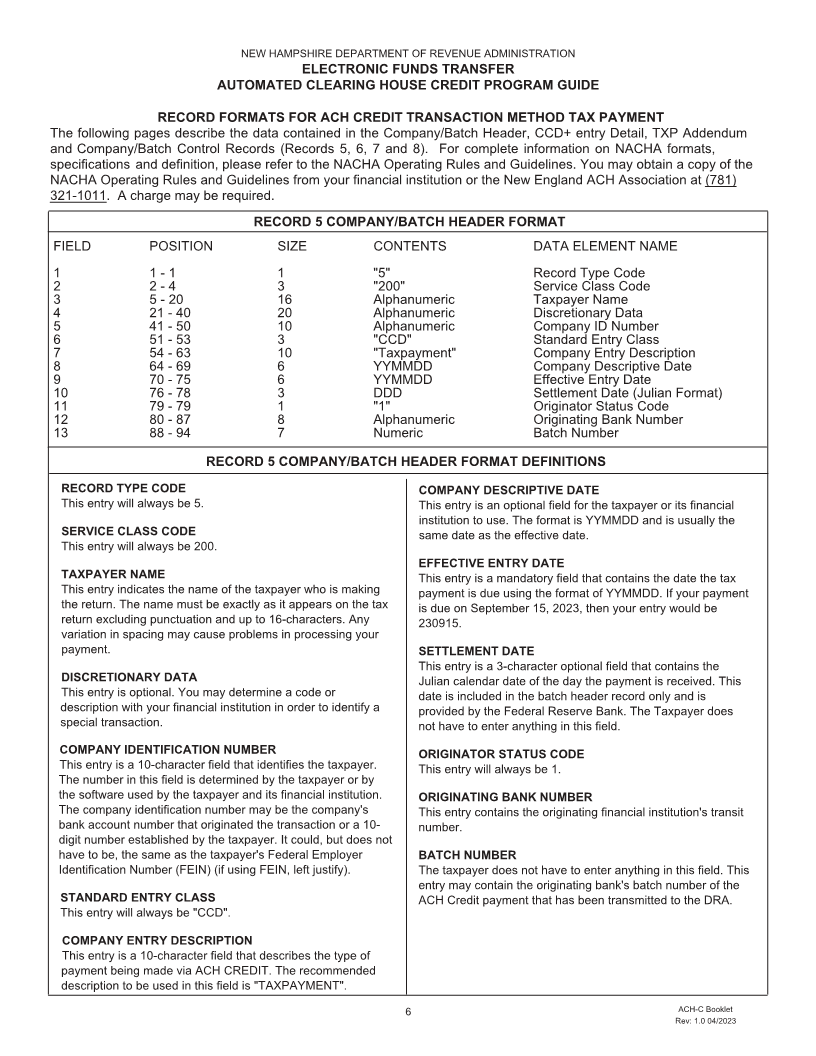

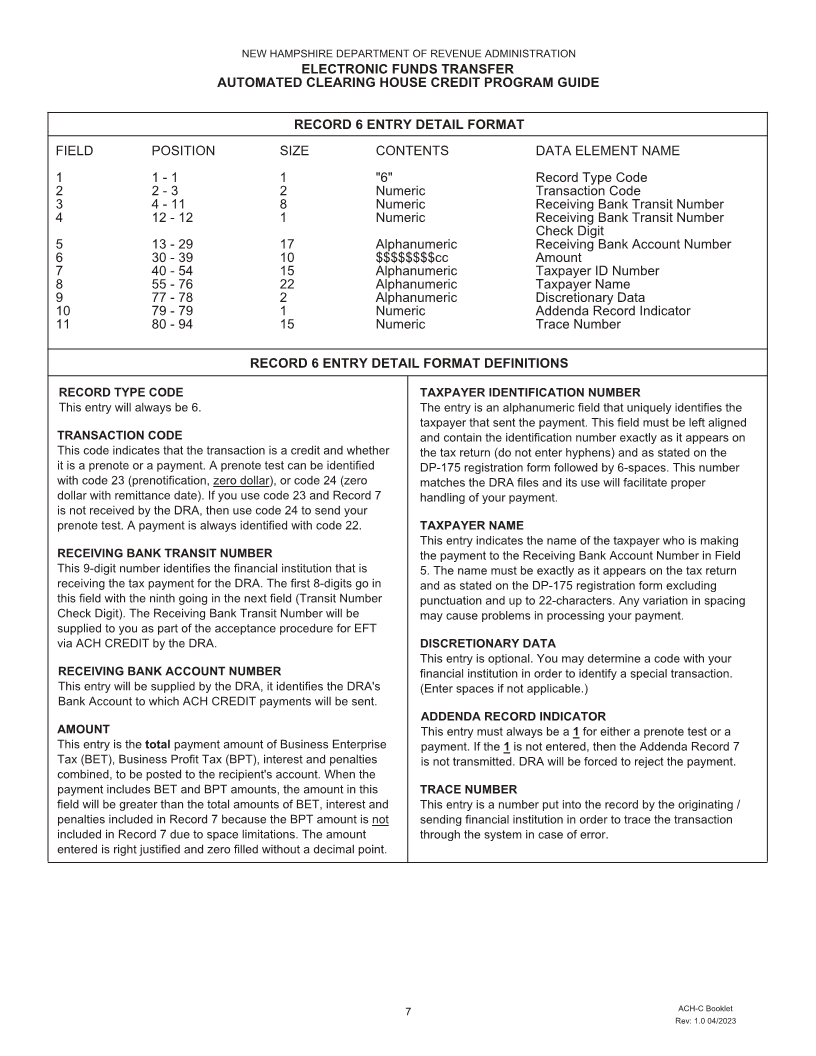

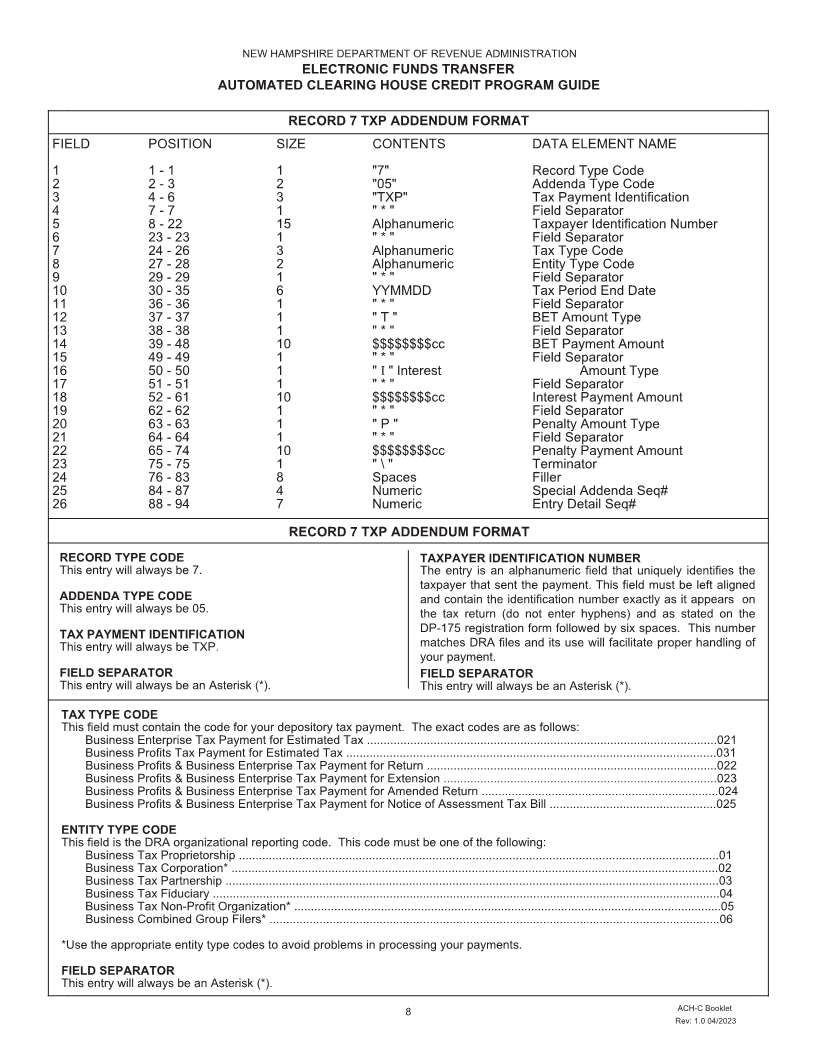

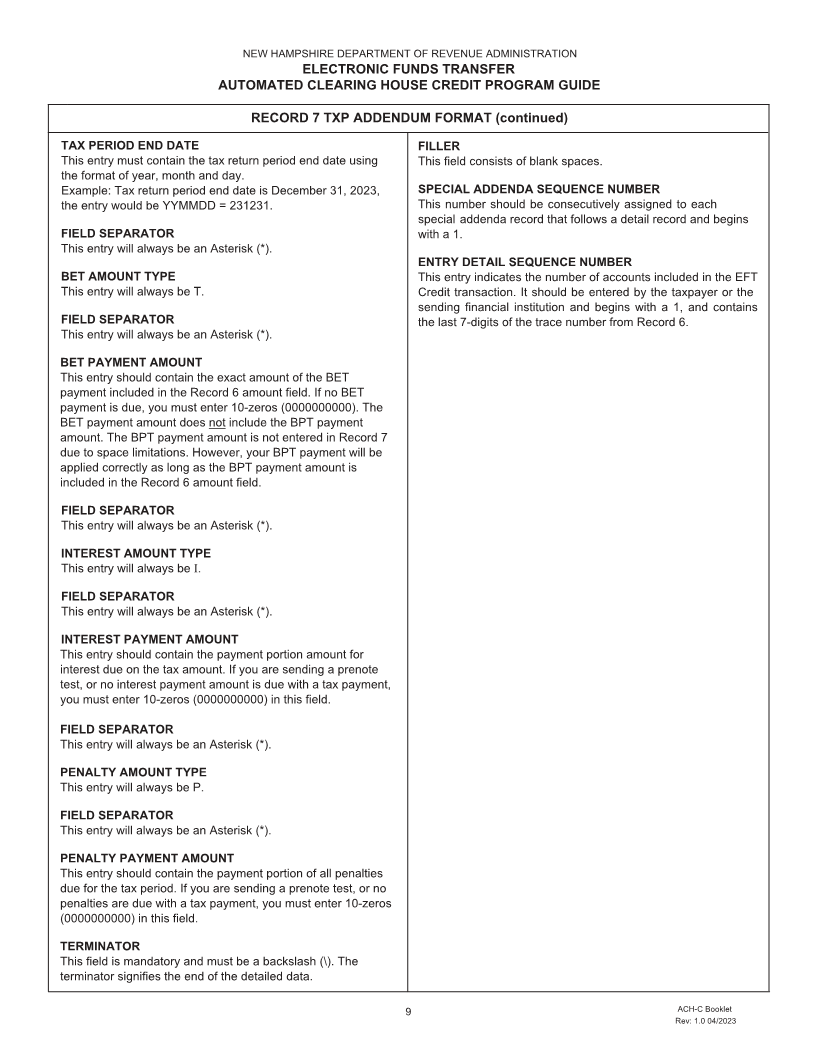

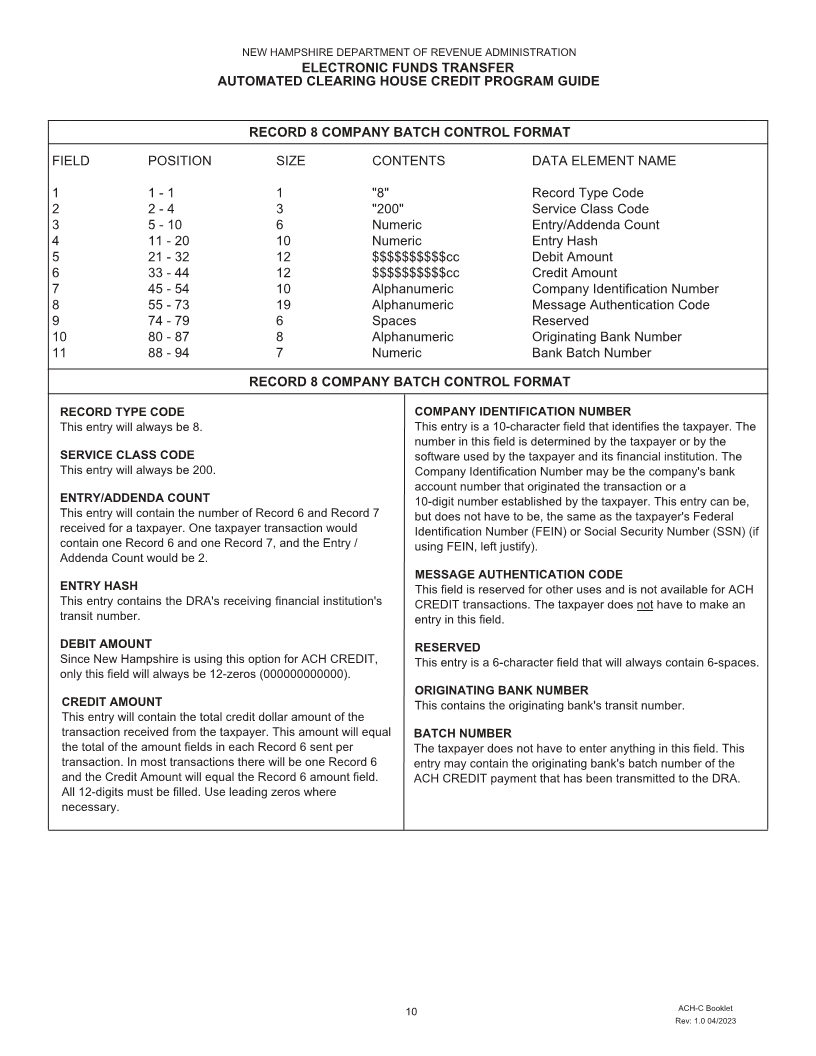

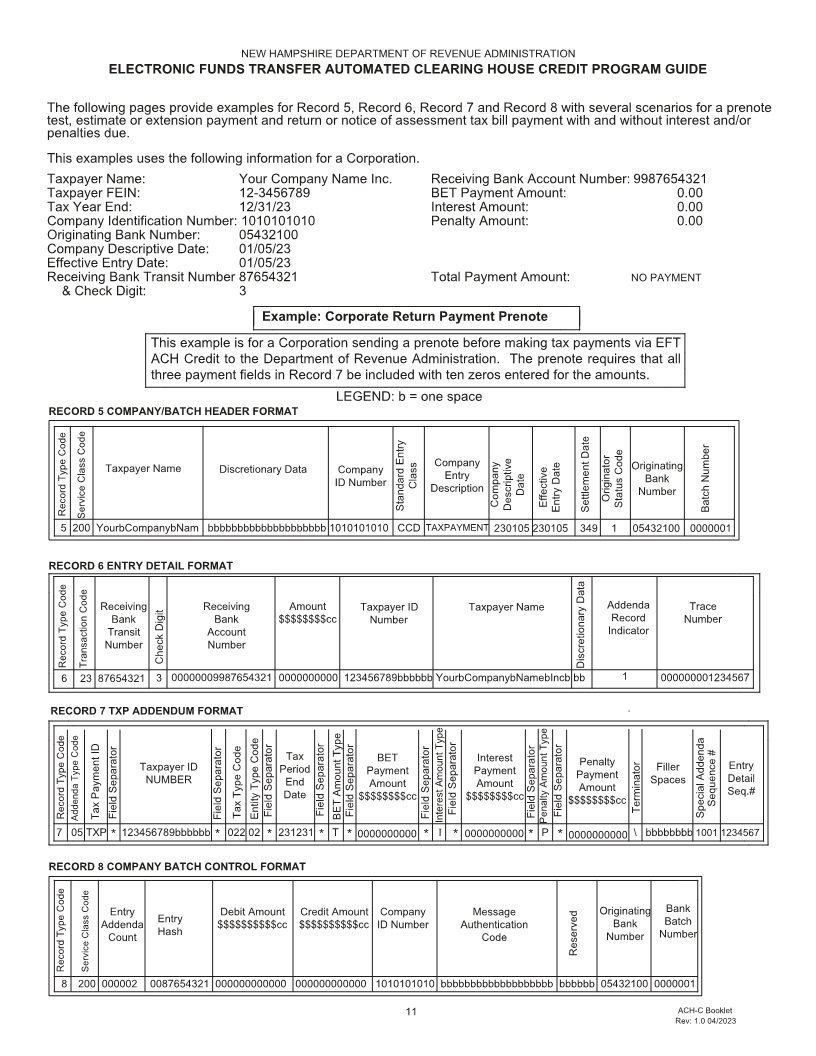

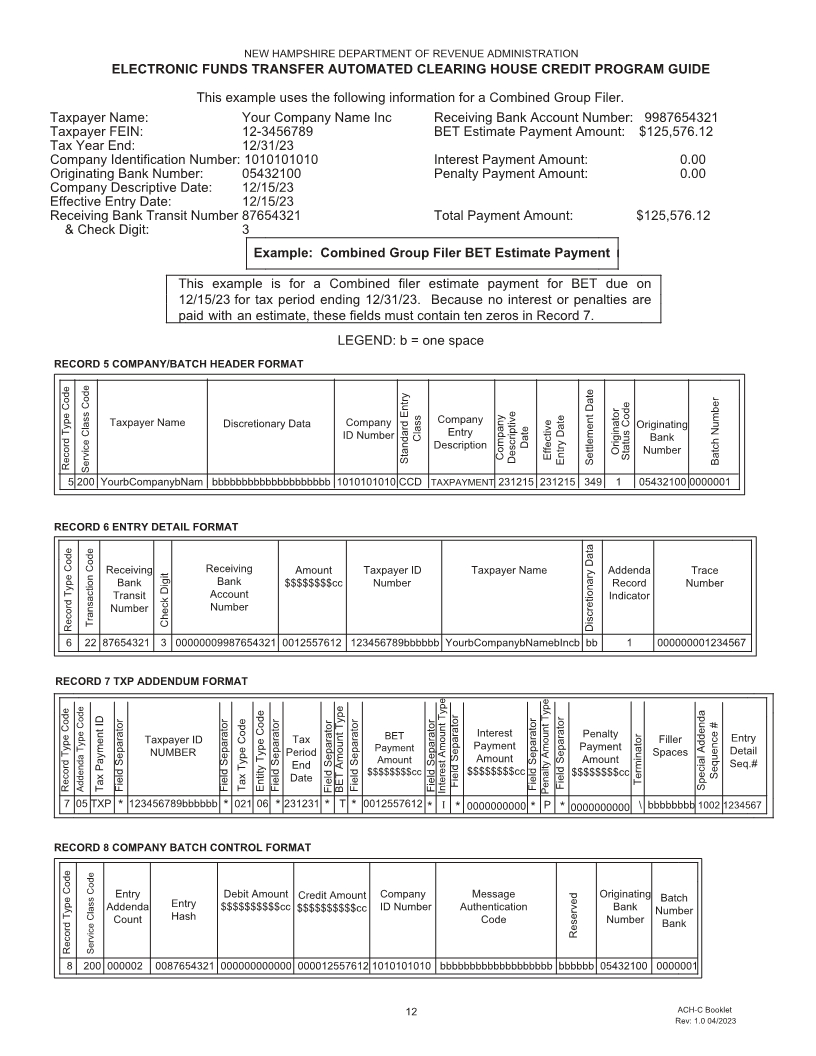

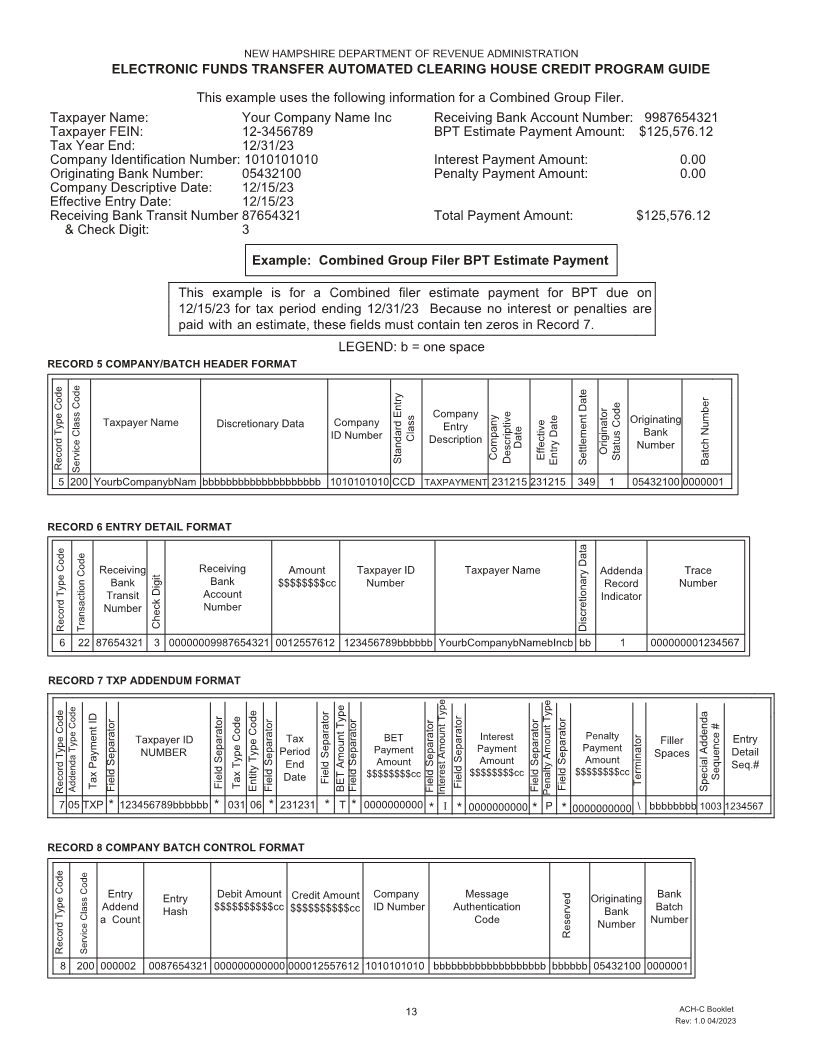

Standard File & Record Formats Rentals Tax, and more. These entities may file payments accessing the

Department's Granite Tax Connect (GTC) web portal at

Corporate Return Prenote www.revenue.nh.gov/gtc.

Combined Group Estimate Payment

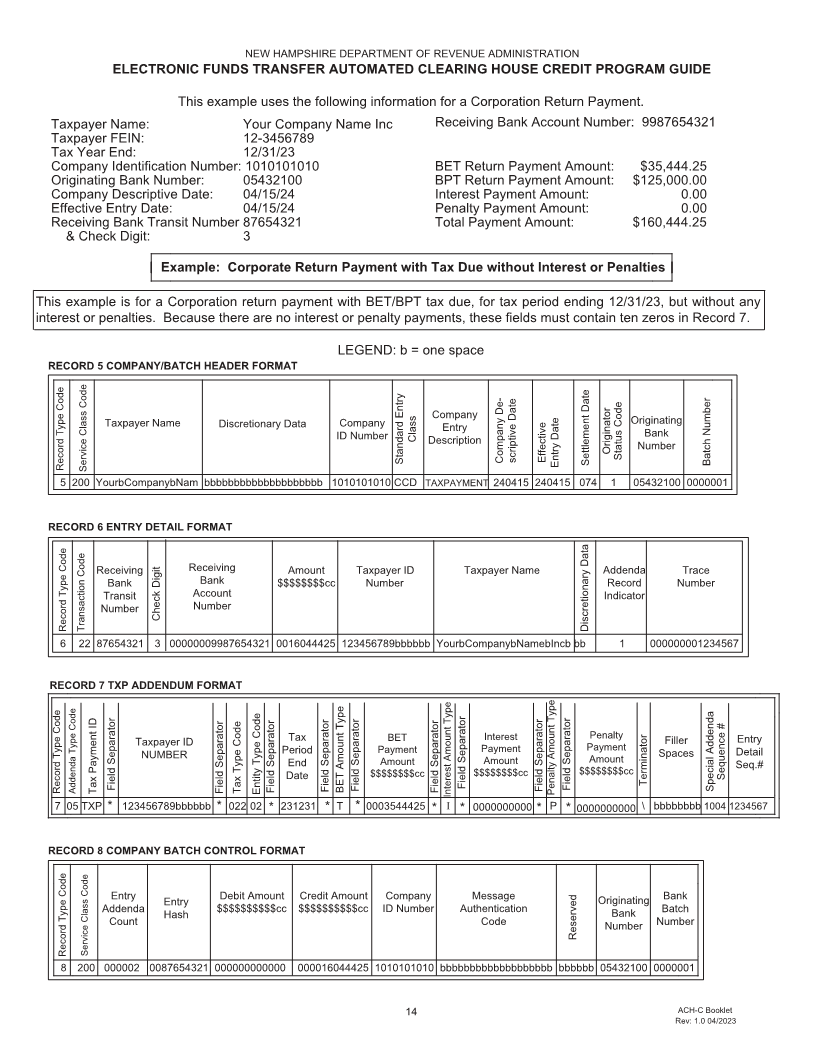

Corporate Return w/Tax Due IMPORTANT NOTICE REGARDING ELECTRONIC

BANKING TRANSACTIONS

Partnership Return w/Tax Due

Please read carefully: The Federal Office of Foreign Assets Control is

imposing additional reporting requirements on electronic banking

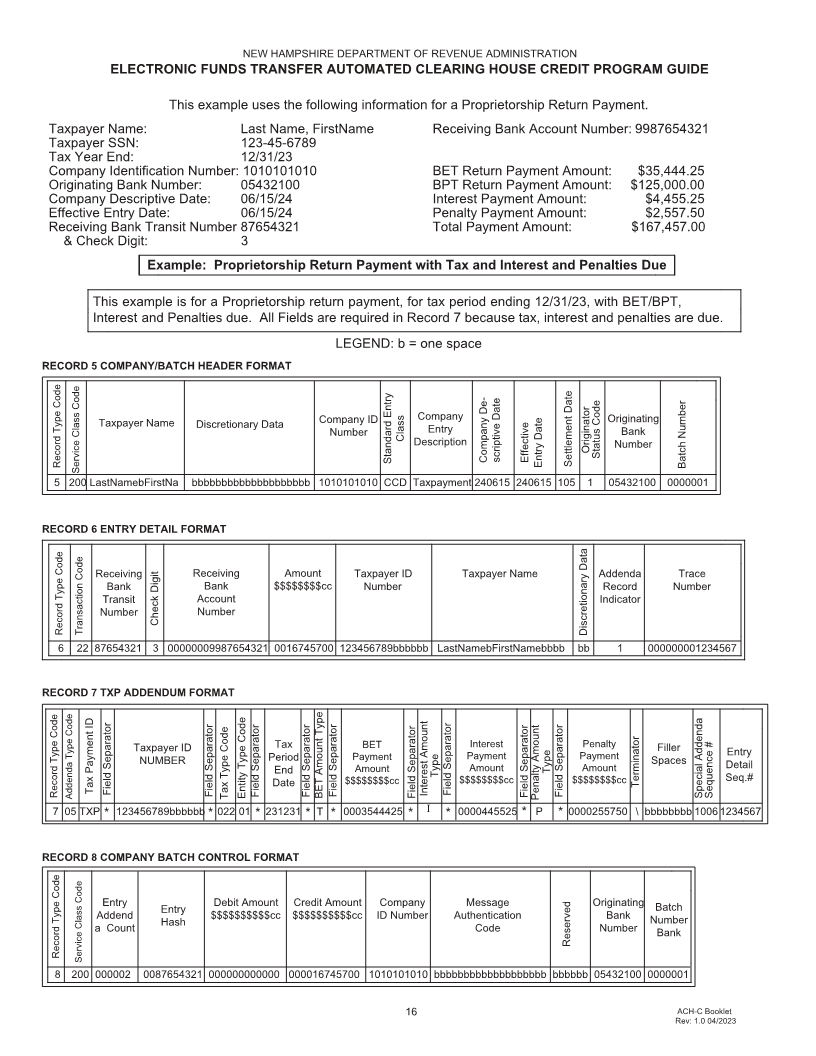

Proprietorship Return w/Tax Due transactions directly involving a financial institution outside of the territorial

jurisdiction of the United States. These transactions are called "International

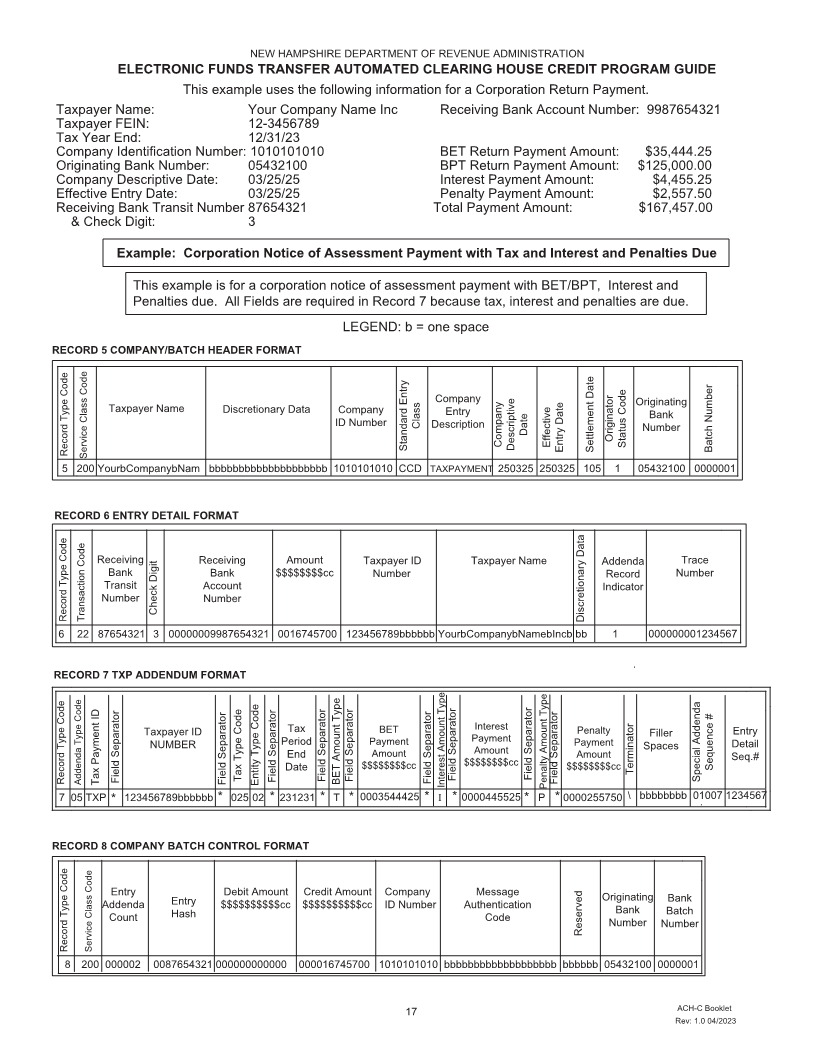

Corporate Notice Assessment Payment ACI Transactions" (IAT). Presently, the New Hampshire Department of

Revenue Administration does not support IAT ACH CREDIT or DEBIT

transactions.

Individuals who need auxiliary aids for effective

communications in programs and services of the New If you have any questions regarding either the ACH CREDIT or DEBIT

Hampshire Department of Revenue Administration programs, please call Taxpayer Services at (603) 230-5920, Monday through

(DRA) are invited to make their needs and Friday, 8:00am-4:30pm. Additional forms can be found on our website at

preferences known. Individuals with hearing or speech www.revenue.nh.gov, by calling the forms line at (603) 230-5001, or by

impairments may call TDD Access: Relay NH emailing us at forms@dra.nh.gov.

1-800-735-2964.

Copies of laws, administrative rules, and forms may

be obtained from our website at www.revenue.nh.gov.

ACH-C Booklet

Rev: 1. 0 04/2023