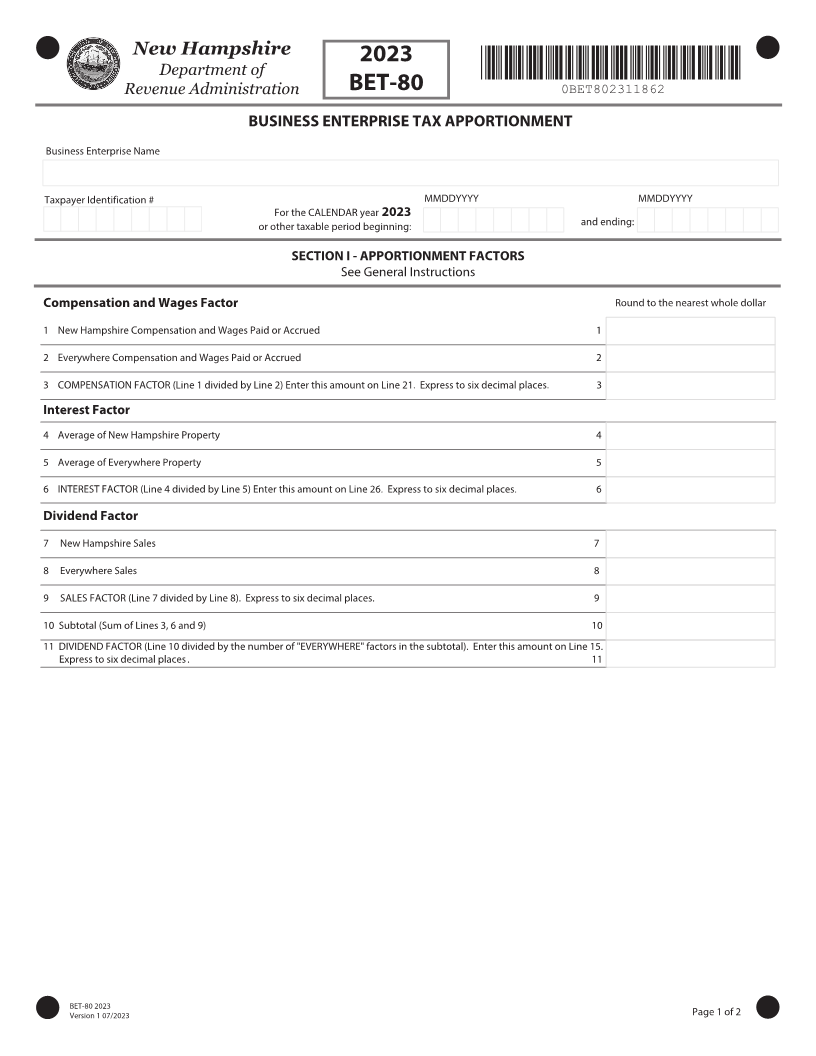

Enlarge image

New Hampshire

202

Department of *0BET802311862*

Revenue Administration BET-80 0BET802311862

BUSINESS ENTERPRISE TAX APPORTIONMENT

Business Enterprise Name

Taxpayer Identification # MMDDYYYY MMDDYYYY

For the CALENDAR year

or other taxable period beginning: and ending:

SECTION I - APPORTIONMENT FACTORS

See General Instructions

Compensation and Wages Factor Round to the nearest whole dollar

1 New Hampshire Compensation and Wages Paid or Accrued 1

2 Everywhere Compensation and Wages Paid or Accrued 2

3 COMPENSATION FACTOR (Line 1 divided by Line 2) Enter this amount on Line 21. Express to six decimal places. 3

Interest Factor

4 Average of New Hampshire Property 4

5 Average of Everywhere Property 5

6 INTEREST FACTOR (Line 4 divided by Line 5) Enter this amount on Line 26. Express to six decimal places. 6

Dividend Factor

7 New Hampshire Sales 7

8 Everywhere Sales 8

9 S"-&4 '"$503 (Line 7 divided by Line 8). Express to six decimal places. 9

10 Subtotal (Sum of Lines 3, 6 and 9) 10

11 DIVIDEND FACTOR (Line 10 divided by the number of "EVERYWHERE" factors in the subtotal). Enter this amount on Line 15.

Express to six decimal places . 11

BET-80 202 Page 1 of 2

Version 1 0 /202