Enlarge image

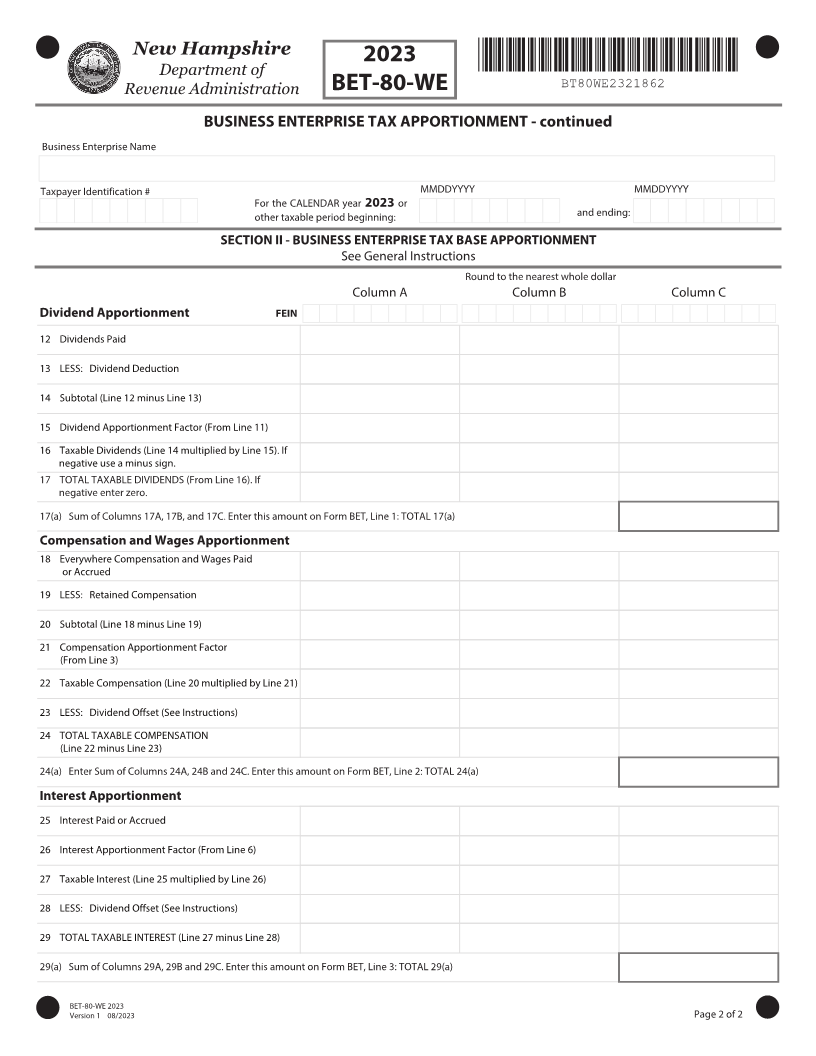

New Hampshire

202

Department of *BT80WE2311862*

Revenue Administration BET-80-WE BT80WE2311862

BUSINESS ENTERPRISE TAX APPORTIONMENT FOR

INDIVIDUAL NEXUS MEMBERS OF A COMBINED GROUP

Business Enterprise Name

Taxpayer Identification # MMDDYYYY MMDDYYYY

For the CALENDAR year or

other taxable period beginning: and ending:

SECTION I - APPORTIONMENT FACTORS

See General Instructions

Round to the nearest whole dollar

Column A Column B Column C

Name Name Name

FEIN FEIN FEIN

Compensation and Wages Factor

1 New Hampshire Compensation and Wages Paid

or Accrued

2 Everywhere Compensation and Wages Paid or Accrued

3 COMPENSATION FACTOR (Line 1 divided by Line 2).

Enter on Line 21 (express to six decimal places).

Interest Factor

4 Average of New Hampshire Property

5 Average of Everywhere Property

6 INTEREST FACTOR (Line 4 divided by Line 5).

Enter on Line 26 (express to 6 decimal places).

Dividend Factor

7 New Hampshire Sales

8 Everywhere Sales

9 Sales Factor (Line 7 divided by Line 8). Express to six

decimal places.

10 Subtotal (Sum of Lines 3, 6 and 9)

11 DIVIDEND FACTOR (Line 10 divided by number

of "Everywhere" factors in subtotal). Enter on Line 15

(express to six decimal places).

BET-80-WE 202 Page 1 of 2

Version 1 /202