Enlarge image

202

New Hampshire

Department of BET CREDIT *0BETCW2311862*

Revenue Administration WORKSHEET 0BETCW2311862

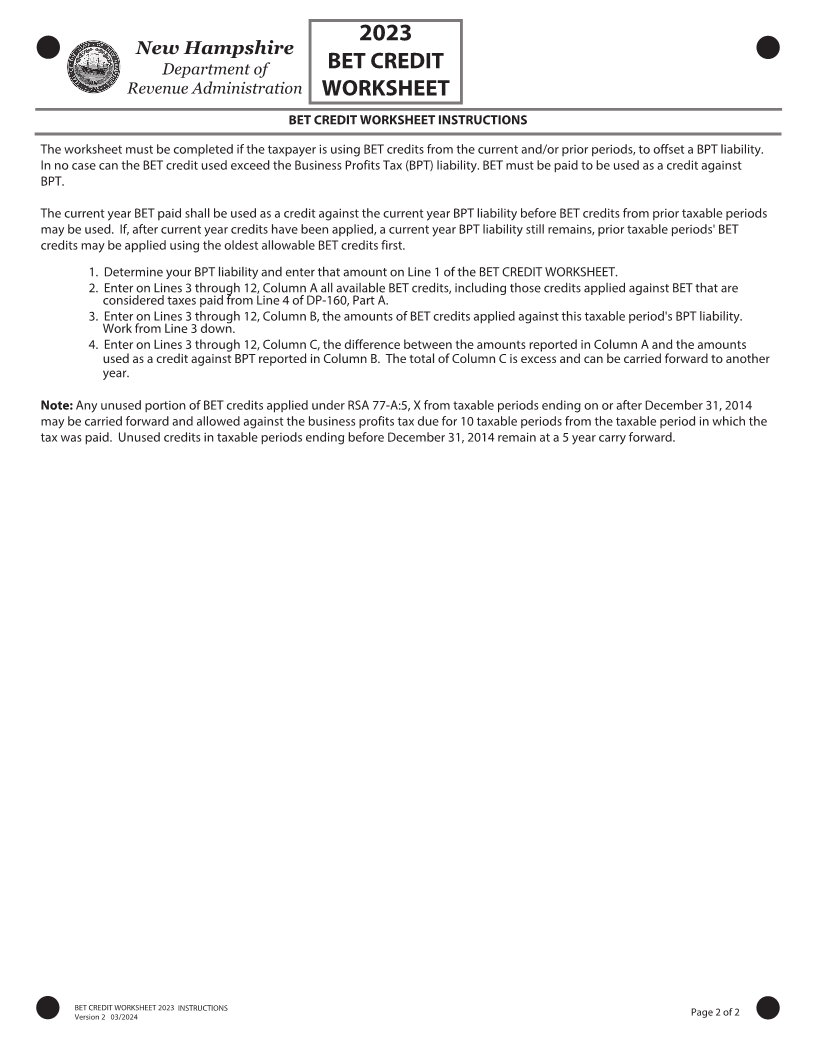

BUSINESS ENTERPRISE TAX CREDIT WORKSHEET

Taxpayer Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

1. Business Profits Tax (BPT) from BPT Return, Line 19 NH-1120-WE, Line 12 all other forms. 1

2. Sum the amounts from Lines 3 through 1 , Column B plus other credits applied from Form

DP-160 part B, not to exceed the amount on Line 1. Include the result on the BPT return,

Line 20(a) NH-1120-WE or Line 13(a) all other forms. If other credits are applied, include

result on BPT return, Line 20(b) NH-1120-WE, Line 13(b) all other forms.

Use carry forward amounts in the following order for this A B C

taxable period Available Credits Credit Applied to BPT Excess Credits

3. BET tax paid amount from Line 7 BET Return plus

Line 4 of DP-160, Part A.

4. Carry over BET from OJOth prior taxable period

. Carry over BET from eighth prior taxable period

. Carry over BET from seventh prior taxable period

. Carry over BET from sixth prior taxable period

. Carry over BET from fifth prior taxable period

. Carry over BET from fourth prior taxable period

. Carry over BET from third prior taxable period

1 . Carry over BET from second prior taxable period

1 . Carry over BET from first prior taxable period

BET CREDIT WORKSHEET 202 Page 1 of 2

Version /202