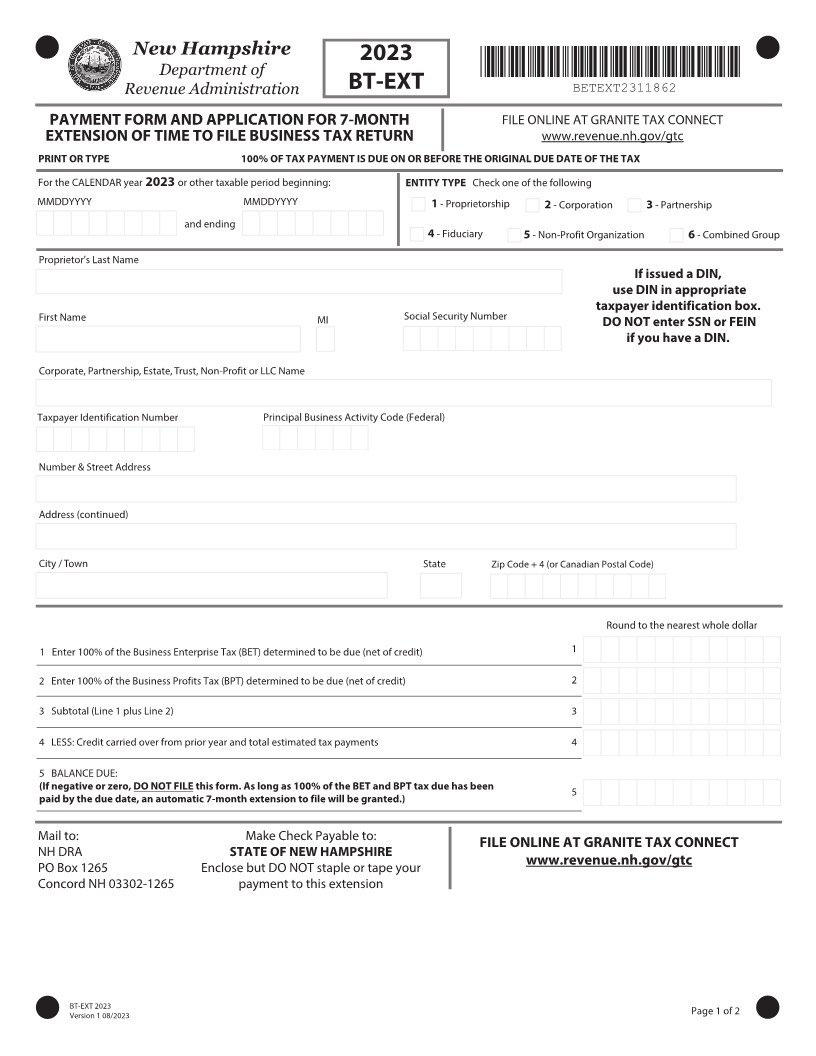

Enlarge image

New Hampshire 202

Department of *BETEXT2311862*

Revenue Administration BT-EXT BETEXT2311862

PAYMENT FORM AND APPLICATION FOR 7-MONTH FILE ONLINE AT GRANITE TAX CONNECT

EXTENSION OF TIME TO FILE BUSINESS TAX RETURN www.revenue.nh.gov/gtc

PRINT OR TYPE 100% OF TAX PAYMENT IS DUE ON OR BEFORE THE ORIGINAL DUE DATE OF THE TAX

For the CALENDAR year 202 or other taxable period beginning: ENTITY TYPE Check one of the following

MMDDYYYY MMDDYYYY 1 - Proprietorship 2 - Corporation 3 - Partnership

and ending

4 - Fiduciary 5 - Non-Profit Organization 6 - Combined Group

Proprietor's Last Name

If issued a DIN,

use DIN in appropriate

taxpayer identification box.

First Name MI Social Security Number

DO NOT enter SSN or FEIN

if you have a DIN.

Corporate, Partnership, Estate, Trust, Non-Profit or LLC Name

Taxpayer Identification Number Principal Business Activity Code (Federal)

Number & Street Address

Address (continued)

City / Town State Zip Code + 4 (or Canadian Postal Code)

Round to the nearest whole dollar

1 Enter 100% of the Business Enterprise Tax #&5 determined to be due (net of credit) 1

2 Enter 100% of the Business Profits Tax #15 determined to be due (net of credit) 2

3 Subtotal (Line 1 plus Line 2) 3

4 LESS: Credit carried over from prior year and total estimated tax payments 4

5 BALANCE DUE:

(If negative or zero, %0 /05 '*-& this GPSN "T MPOH BT PG UIF #&5 BOE #15 UBY EVF IBT CFFO 5

QBJE CZ UIF EVF EBUF BO BVUPNBUJD NPOUI FYUFOTJPO UP GJMF XJMM CF HSBOUFE )

Mail to: Make Check Payable to:

FILE ONLINE AT GRANITE TAX CONNECT

NH DRA STATE OF NEW HAMPSHIRE

www.revenue.nh.gov/gtc

PO Box 1265 Enclose but DO NOT staple or tape your

Concord NH 03302-1265 payment to this extension

BT-EXT 202 Page 1 of 2

Version 1 0 /202