Enlarge image

New Hampshire 202

Department of *0DP1202311862*

Revenue Administration DP-120 0DP1202311862

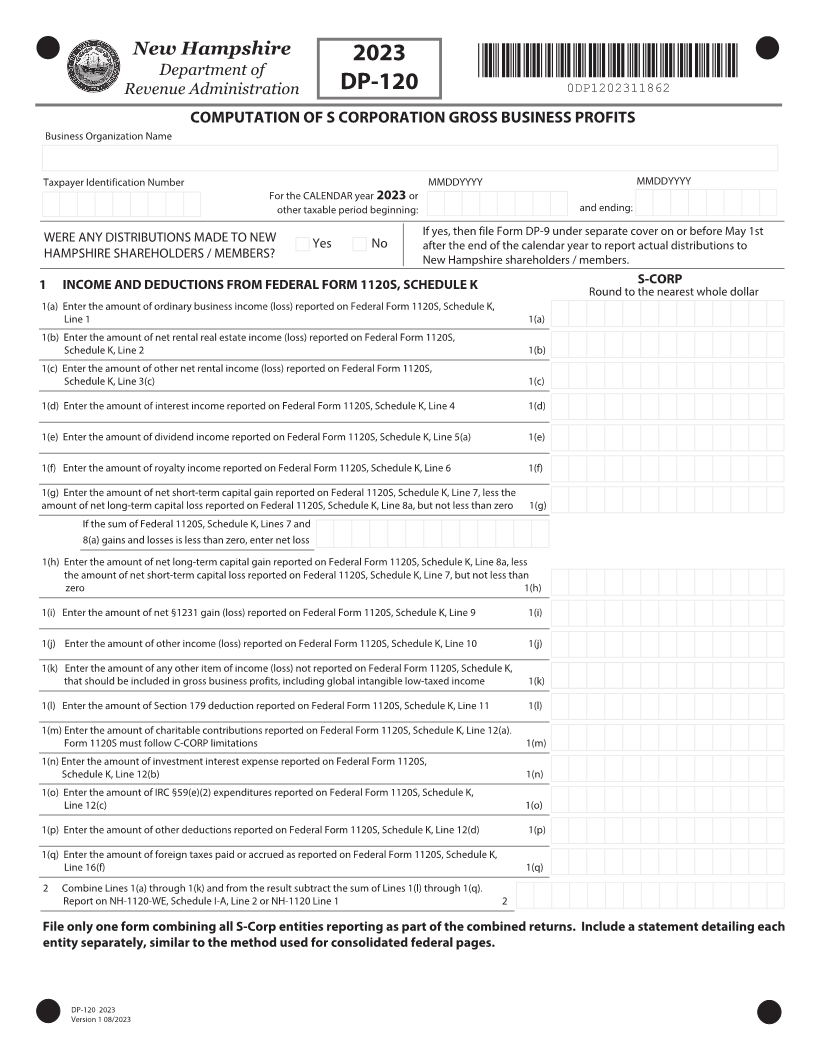

COMPUTATION OF S CORPORATION GROSS BUSINESS PROFITS

Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

If yes, then file Form DP-9 under separate cover on or before May 1st

WERE ANY DISTRIBUTIONS MADE TO NEW Yes No after the end of the calendar year to report actual distributions to

HAMPSHIRE SHAREHOLDERS / MEMBERS? New Hampshire shareholders / members.

1 INCOME AND DEDUCTIONS FROM FEDERAL FORM 1120S, SCHEDULE K S-CORP

Round to the nearest whole dollar

1(a) Enter the amount of ordinary business income (loss) reported on Federal Form 1120S, Schedule K,

Line 1 1(a)

1(b) Enter the amount of net rental real estate income (loss) reported on Federal Form 1120S,

Schedule K, Line 2 1(b)

1(c) Enter the amount of other net rental income (loss) reported on Federal Form 1120S,

Schedule K, Line 3(c) 1(c)

1(d) Enter the amount of interest income reported on Federal Form 1120S, Schedule K, Line 4 1(d)

1(e) Enter the amount of dividend income reported on Federal Form 1120S, Schedule K, Line 5(a) 1(e)

1(f) Enter the amount of royalty income reported on Federal Form 1120S, Schedule K, Line 6 1(f)

1(g) Enter the amount of net short-term capital gain reported on Federal 1120S, Schedule K, Line 7, less the

amount of net long-term capital loss reported on Federal 1120S, Schedule K, Line 8a, but not less than zero 1(g)

If the sum of Federal 1120S, Schedule K, Lines 7 and

8(a) gains and losses is less than zero, enter net loss

1(h) Enter the amount of net long-term capital gain reported on Federal Form 1120S, Schedule K, Line 8a, less

the amount of net short-term capital loss reported on Federal 1120S, Schedule K, Line 7, but not less than

zero 1(h)

1(i) Enter the amount of net §1231 gain (loss) reported on Federal Form 1120S, Schedule K, Line 9 1(i)

1(j) Enter the amount of other income (loss) reported on Federal Form 1120S, Schedule K, Line 10 1(j)

1(k) Enter the amount of any other item of income (loss) not reported on Federal Form 1120S, Schedule K,

that should be included in gross business profits, including global intangible low-taxed income 1(k)

1(l) Enter the amount of Section 179 deduction reported on Federal Form 1120S, Schedule K, Line 11 1(l)

1(m) Enter the amount of charitable contributions reported on Federal Form 1120S, Schedule K, Line 12(a).

Form 1120S must follow C-CORP limitations 1(m)

1(n) Enter the amount of investment interest expense reported on Federal Form 1120S,

Schedule K, Line 12(b) 1(n)

1(o) Enter the amount of IRC §59(e)(2) expenditures reported on Federal Form 1120S, Schedule K,

Line 12(c) 1(o)

1(p) Enter the amount of other deductions reported on Federal Form 1120S, Schedule K, Line 12(d) 1(p)

1(q) Enter the amount of foreign taxes paid or accrued as reported on Federal Form 1120S, Schedule K,

Line 16(f) 1(q)

2 Combine Lines 1(a) through 1(k) and from the result subtract the sum of Lines 1(l) through 1(q).

Report on NH-1120-WE, Schedule I-A, Line 2 or NH-1120 Line 1 2

File only one form combining all S-Corp entities reporting as part of the combined returns. Include a statement detailing each

entity separately, similar to the method used for consolidated federal pages.

DP-120 202

Version 1 08/202