Enlarge image

New Hampshire

202

Department of *0132WE2211862*

Revenue Administration DP-132-WE 0132WE2311862

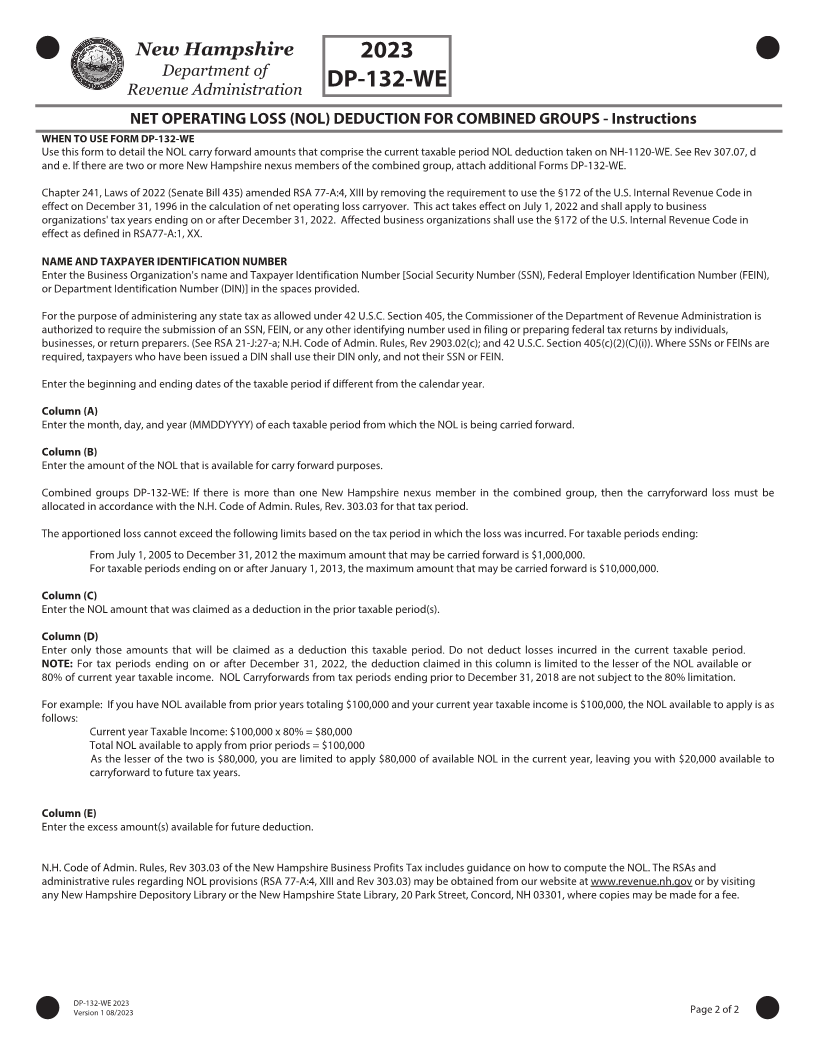

NET OPERATING LOSS (NOL) DEDUCTION FOR COMBINED GROUPS

Principal New Hampshire Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or and ending:

other taxable period beginning:

Federal Employer ID Number, Social Security

Nexus Member Name Number or Department ID Number

Column A Column B Column C Column D Column E

Ending date of tax NOL amount available Amount of NOL carry forward Amount of NOL to be Amount of NOL to

year in which NOL for carryforward. See which has been used in used as a deduction carry forward to

occurred instructions for limitations taxable periods prior to in this taxable period future taxable periods

from DP-131-A this taxable period (See Instructions)

1

2

3

4

5

6

7

8

9

10

11

Line 11 - Total Columns B, C, D, & E (Sum Lines 1 - 10 in each respective column).

The amount of NOL carryforward deducted this taxable period is Column D, Line 11. If you have more than one Form DP-132-WE total all Line 11 D amounts to

calculate your NOL carryforward deduction (see instructions).

This is the amount to be reported on the applicable Business Profits Tax return. Use additional Forms DP-132-WE if you have NOL carryforward deduction(s) for more

than one entity.

NOTE: Column B less Column C should equal the sum of Column D plus Column E.

DP-132-WE 202 Page of 2

Version 1 /202