Enlarge image

New Hampshire 202

Department of *0DP1602311862*

DP-160

Revenue Administration 0DP1602311862

SCHEDULE OF CREDITS

DO NOT COMPLETE FORM DP-160 IF THE ONLY CREDIT AVAILABLE IS THE BET CREDIT

Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

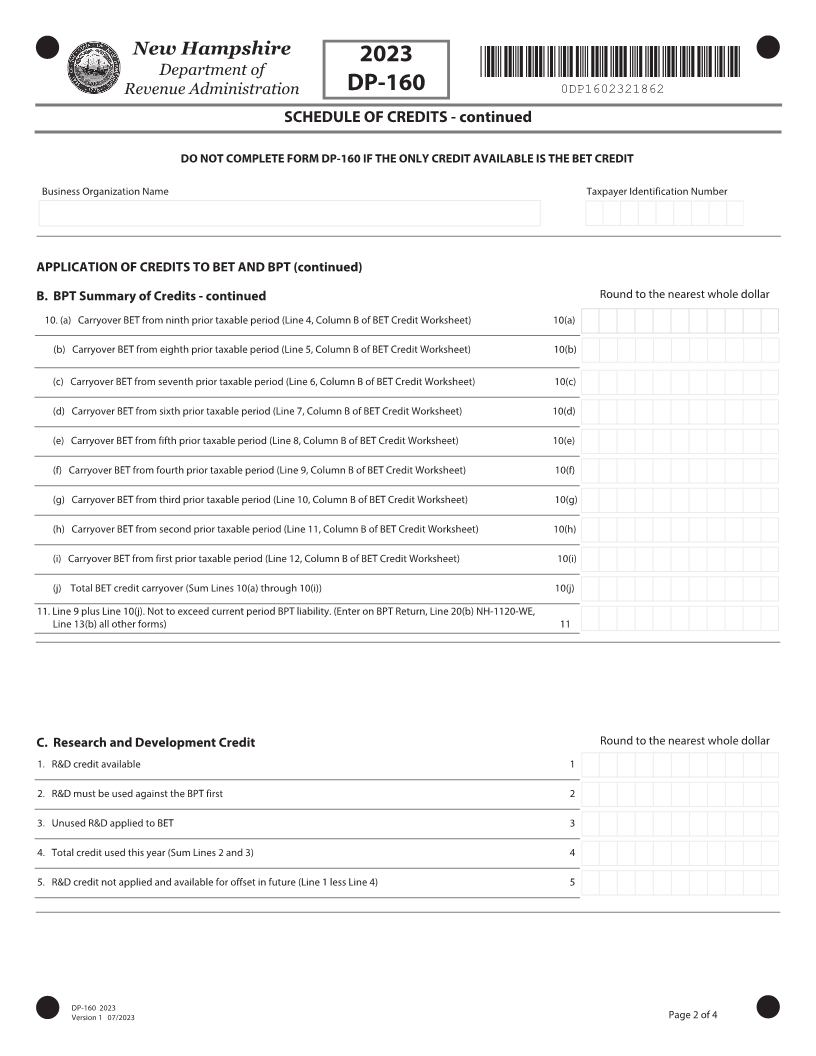

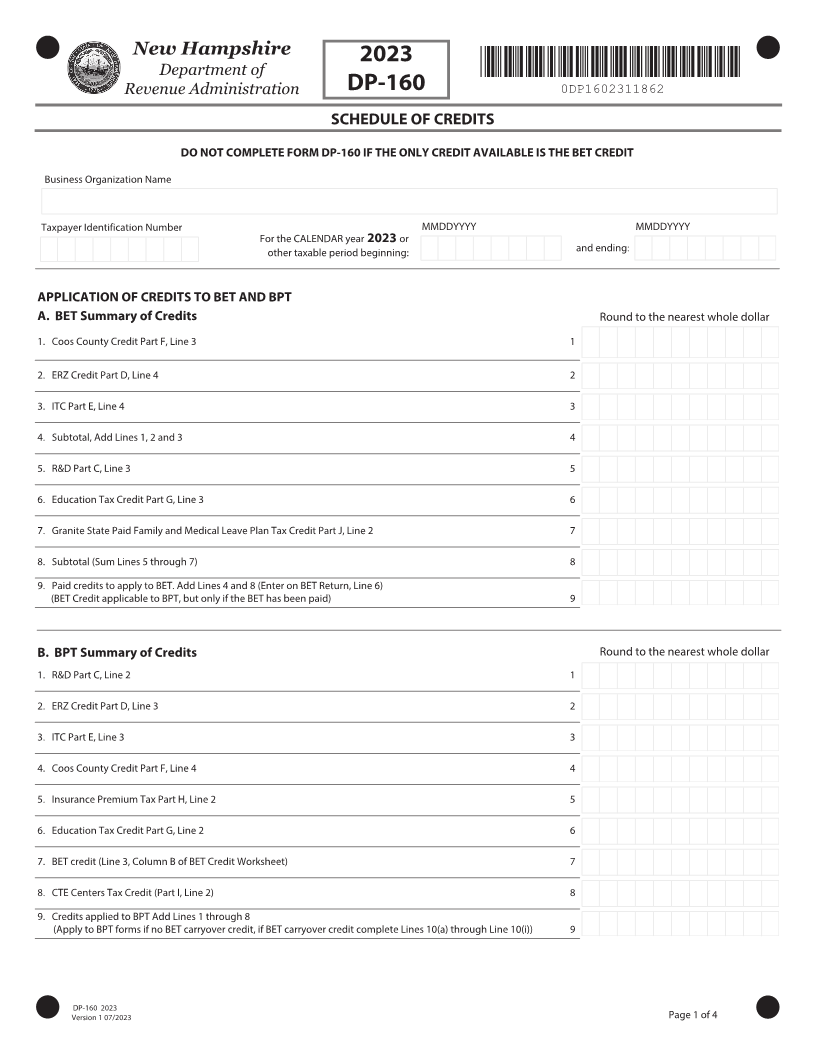

APPLICATION OF CREDITS TO BET AND BPT

A. BET Summary of Credits Round to the nearest whole dollar

1. Coos County Credit Part F, Line 3 1

2. ERZ Credit Part D, Line 4 2

3. ITC Part E, Line 4 3

4. Subtotal, Add Lines 1, 2 and 3 4

5. R&D Part C, Line 3 5

6. Education Tax Credit Part G, Line 3 6

7. Granite State Paid Family and Medical Leave Plan Tax Credit Part J, Line 2 7

8. Subtotal (Sum Lines 5 through 7) 8

9. Paid credits to apply to BET. Add Lines 4 and 8 (Enter on BET Return, Line 6)

(BET Credit applicable to BPT, but only if the BET has been paid) 9

B. BPT Summary of Credits Round to the nearest whole dollar

1. R&D Part C, Line 2 1

2. ERZ Credit Part D, Line 3 2

3. ITC Part E, Line 3 3

4. Coos County Credit Part F, Line 4 4

5. Insurance Premium Tax Part H, Line 2 5

6. Education Tax Credit Part G, Line 2 6

7. BET credit (Line 3, Column B of BET Credit Worksheet) 7

8. CTE Centers Tax Credit (Part I, Line 2) 8

9. Credits applied to BPT Add Lines 1 through 8

(Apply to BPT forms if no BET carryover credit, if BET carryover credit complete Lines 10(a) through Line 10(J )) 9

DP-160 202

Version 1 0 /202 Page 1 of 4