Enlarge image

1HZ +DPSVKLUH

'HSDUWPHQW RI

WͲϮϬϬ *0DP2002311862*

5HYHQXH $GPLQLVWUDWLRQ

0DP2002311862

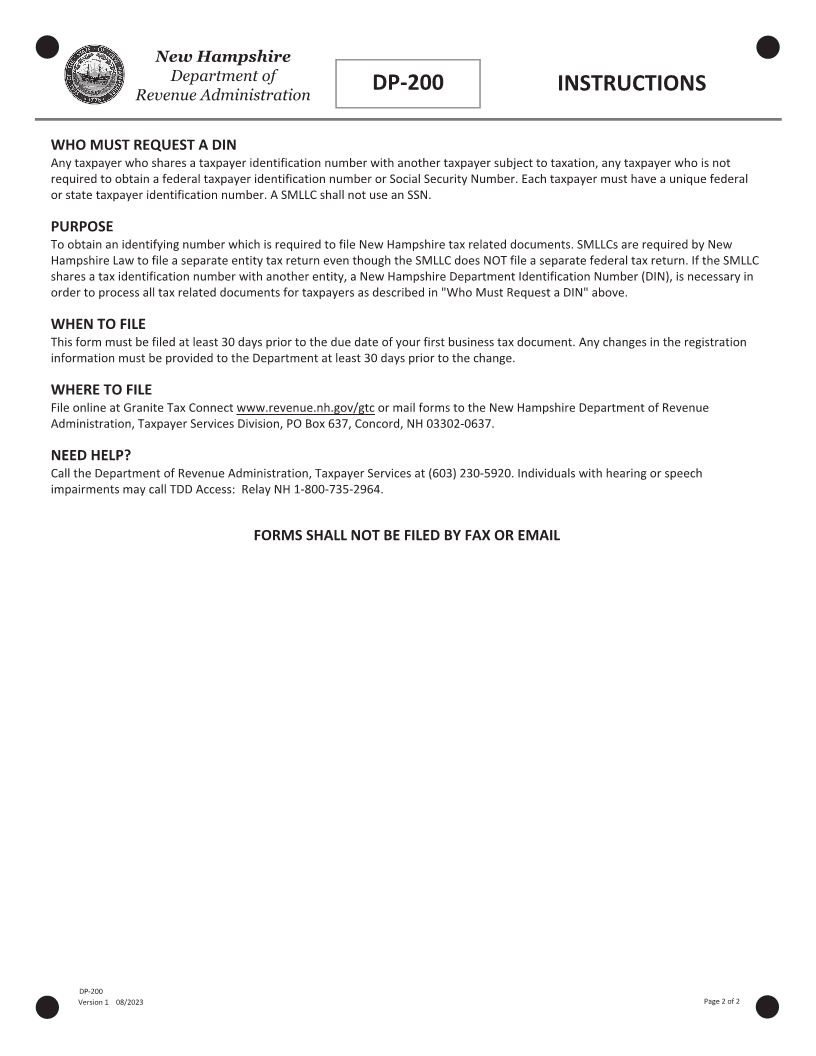

Z Yh ^d &KZ W ZdD Ed / Ed/&/ d/KE EhD Z ; /EͿ

h^/E ^^ Ed/dz /E&KZD d/KE

ƵƐŝŶĞƐƐ EĂŵĞ

EƵŵďĞƌ Θ ^ƚƌĞĞƚ ĚĚƌĞƐƐ K EKd &/> d,/^ &KZD &KZ E ^D>>

d, d >Z z , ^ /d^ KtE & /E

ŝƚLJ ͬ dŽǁŶ ^ƚĂƚĞ * ŝƉ ŽĚĞ н ϰ ;Žƌ ĂŶĂĚŝĂŶ WŽƐƚĂů ŽĚĞͿ

zŽƵ ŵƵƐƚ ƵƐĞ LJŽƵƌ ĞƉĂƌƚŵĞŶƚ /ĚĞŶƚŝĨŝĐĂƚŝŽŶ EƵŵďĞƌ ; /EͿ ŽŶ Ăůů ŽĨ ƚŚĞ ĚŽĐƵŵĞŶƚƐ ĨŝůĞĚ ǁŝƚŚ ƚŚĞ Z ŝŶƐƚĞĂĚ ŽĨ ƚŚĞ &ĞĚĞƌĂů ŵƉůŽLJĞƌ /ĚĞŶƚŝĨŝĐĂƚŝŽŶ EƵŵďĞƌ ;& /EͿ Žƌ

^ŽĐŝĂů ^ĞĐƵƌŝƚLJ EƵŵďĞƌ ;^^EͿ͘

D D Z KZ d yW z Z /E&KZD d/KE

DĞŵďĞƌ Žƌ dĂdžƉĂLJĞƌ EĂŵĞ dĂdžƉĂLJĞƌ /ĚĞŶƚŝĨŝĐĂƚŝŽŶ EƵŵďĞƌ

EƵŵďĞƌ Θ ^ƚƌĞĞƚ ĚĚƌĞƐƐ & /E ^^E

ŝƚLJ ͬ dŽǁŶ ^ƚĂƚĞ * ŝƉ ŽĚĞ н ϰ ;Žƌ ĂŶĂĚŝĂŶ WŽƐƚĂů ŽĚĞͿ

Ed/dz dzW ͗ KZWKZ d/KE KD /E 'ZKhW &/ h / Zz W ZdE Z^,/W WZKWZ/ dKZ^,/W

&Žƌ ĨĞĚĞƌĂů ŝŶĐŽŵĞ ƚĂdž ƉƵƌƉŽƐĞƐ͕ ƚŚĞ ŝŶĐŽŵĞ ŽĨ ƚŚĞ ^D>> ǁŝůů ďĞ ƌĞƉŽƌƚĞĚ ŽŶ ƚŚĞ ƚĂdž ƌĞƚƵƌŶ ŽĨ ƚŚĞ ŵĞŵďĞƌ ĂƐ ůŝƐƚĞĚ ĂďŽǀĞ͘

&Žƌ ĨĞĚĞƌĂů ŝŶĐŽŵĞ ƚĂdž ƉƵƌƉŽƐĞƐ͕ ƚŚĞ ŝŶĐŽŵĞ ŽĨ ƚŚĞ ^D>> ǁŝůů EKd ďĞ ƌĞƉŽƌƚĞĚ ŽŶ ƚŚĞ ƚĂdž ƌĞƚƵƌŶ ŽĨ ƚŚĞ ŵĞŵďĞƌ ĂƐ ůŝƐƚĞĚ ĂďŽǀĞ͘

d, /E KD t/>> Z WKZd KE d, d y Z dhZE &KZ͗

DĞŵďĞƌ Žƌ dĂdžƉĂLJĞƌ EĂŵĞ dĂdžƉĂLJĞƌ /ĚĞŶƚŝĨŝĐĂƚŝŽŶ EƵŵďĞƌ

EƵŵďĞƌ Θ ^ƚƌĞĞƚ ĚĚƌĞƐƐ

& /E ^^E

ŝƚLJ ͬ dŽǁŶ ^ƚĂƚĞ * ŝƉ ŽĚĞ н ϰ ;Žƌ ĂŶĂĚŝĂŶ WŽƐƚĂů ŽĚĞͿ

^/'E dhZ Θ /E&KZD d/KE

hŶĚĞƌ ƉĞŶĂůƚŝĞƐ ŽĨ ƉĞƌũƵƌLJ͕ / ĚĞĐůĂƌĞ ƚŚĂƚ / ŚĂǀĞ ĞdžĂŵŝŶĞĚ ƚŚŝƐ ĚŽĐƵŵĞŶƚ ĂŶĚ ƚŽ ƚŚĞ ďĞƐƚ ŽĨ ŵLJ ďĞůŝĞĨ ŝƚ ŝƐ ƚƌƵĞ͕ ĐŽƌƌĞĐƚ ĂŶĚ ĐŽŵƉůĞƚĞ͘

^ŝŐŶĂƚƵƌĞ ;ŝŶ ŝŶŬͿ ŽĨ ƉƉůŝĐĂŶƚ DD zzzz

WƌŝŶƚ ^ŝŐŶĂƚŽƌLJ EĂŵĞ Θ dŝƚůĞ

&/> KE>/E d 'Z E d d y KEE d ttt͘Z s Eh ͘E,͘'Ksͬ'd / KZ

D /> dK͗ E, Z ͕ WK Ky ϲϯϳ͕ KE KZ E, ϬϯϯϬϮͲϬϲϯϳ

WͲϮϬϬ

sĞƌƐŝŽŶ ϭ ϬϴͬϮϬϮϯ WĂŐĞ ϭ ŽĨ Ϯ