Enlarge image

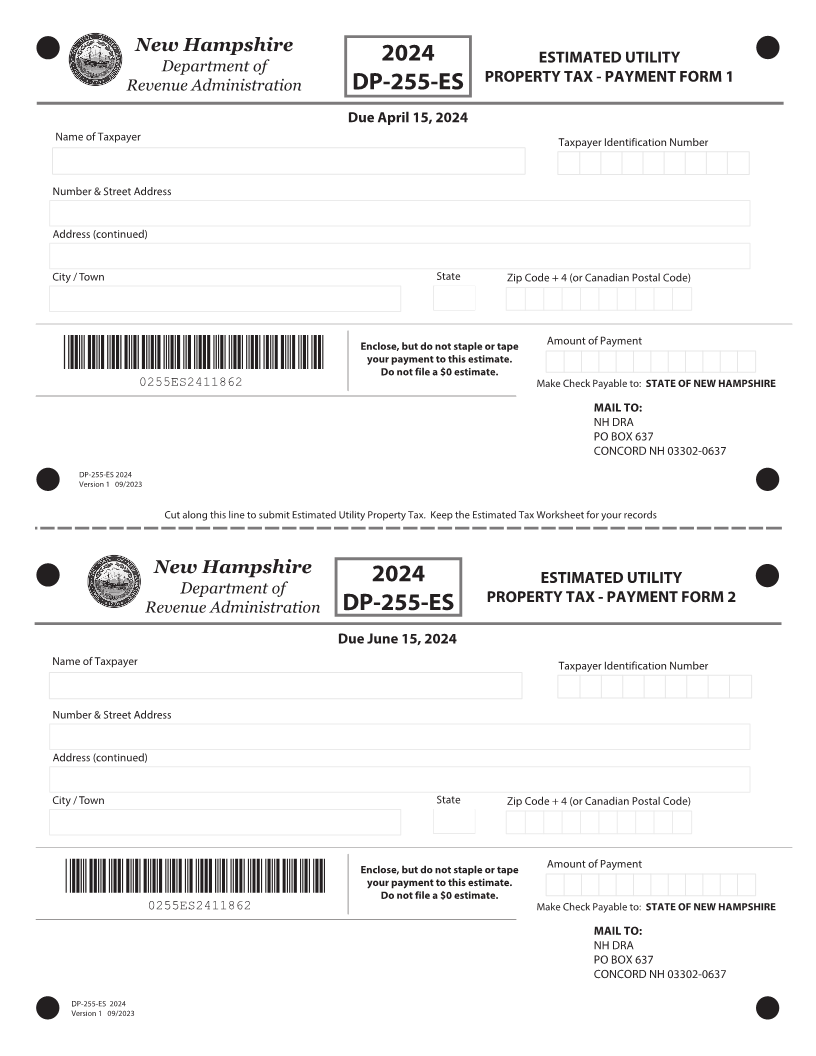

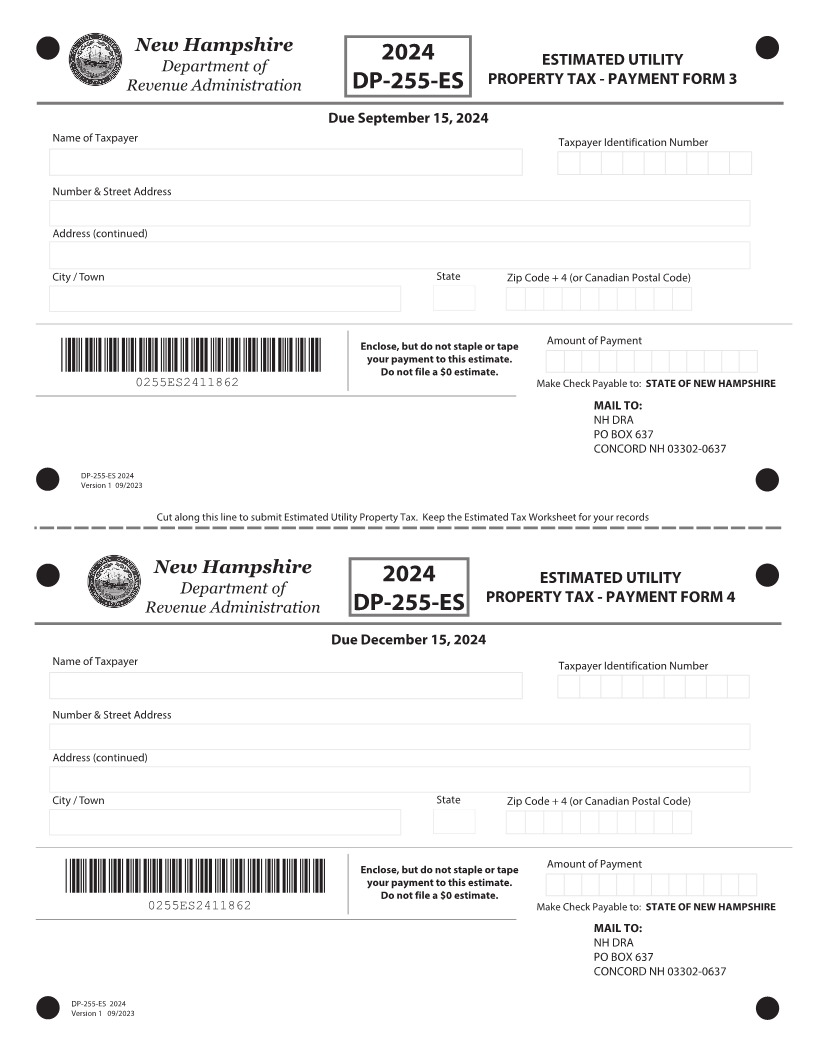

New Hampshire 202

Department of

Revenue Administration DP-255-ES

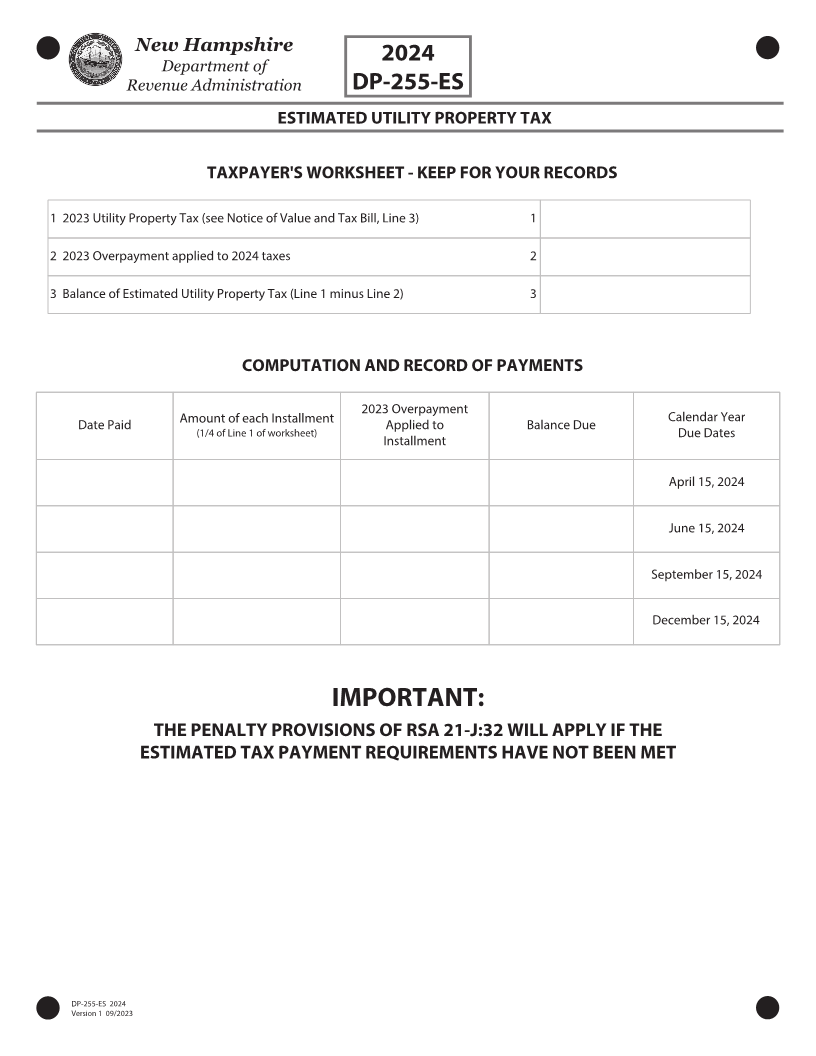

ESTIMATED UTILITY PROPERTY TAX

5"91":&3h4 803,4)&&5 ,&&1 '03 :063 3&$03%4

1 202 Utility Property Tax (see Notice of Value and Tax Bill, Line 3) 1

2 202 Overpayment applied to 202 taxes 2

3 Balance of Estimated Utility Property Tax (Line 1 minus Line 2) 3

COMPUTATION AND RECORD OF PAYMENTS

202 Overpayment

Amount of each Installment Calendar Year

Date Paid Applied to Balance Due

(1/4 of Line 1 of worksheet) Due Dates

Installment

April 15, 202

June 15, 202

SeptFNCFS 15, 202

DecFNCFS 15, 202

IMPORTANT:

THE PENALTY PROVISIONS OF RSA 21-J:32 WILL APPLY IF THE

ESTIMATED TAX PAYMENT REQUIREMENTS HAVE NOT BEEN MET

DP-255-ES 202

7FSTJPO 0 /202