Enlarge image

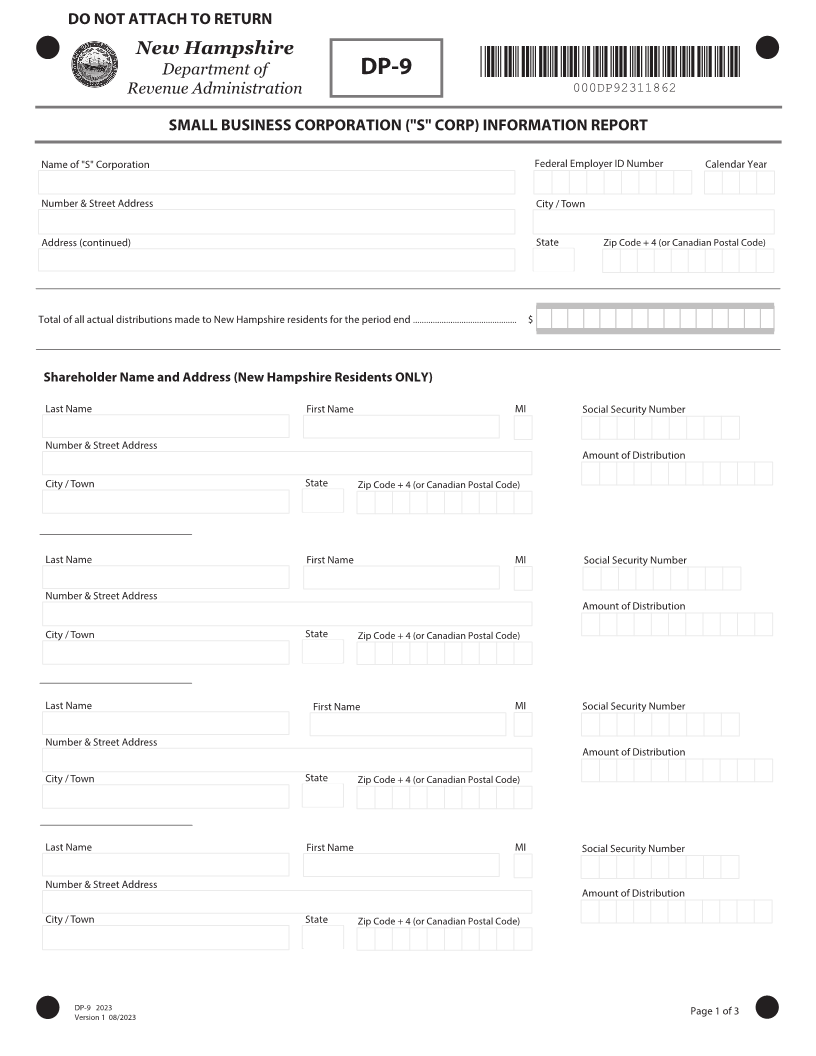

DO NOT ATTACH TO RETURN

New Hampshire

Department of DP-9 *000DP92311862*

Revenue Administration 000DP92311862

SMALL BUSINESS CORPORATION ("S" CORP) INFORMATION REPORT

Name of "S" Corporation Federal Employer ID Number Calendar Year

Number & Street Address City / Town

Address (continued) State Zip Code + 4 (or Canadian Postal Code)

Total of all actual distributions made to New Hampshire residents for the period end ............................................... $

Shareholder Name and Address (New Hampshire Residents ONLY)

Last Name First Name MI Social Security Number

Number & Street Address

Amount of Distribution

City / Town State Zip Code + 4 (or Canadian Postal Code)

Last Name First Name MI Social Security Number

Number & Street Address

Amount of Distribution

City / Town State Zip Code + 4 (or Canadian Postal Code)

Last Name First Name MI Social Security Number

Number & Street Address

Amount of Distribution

City / Town State Zip Code + 4 (or Canadian Postal Code)

Last Name First Name MI Social Security Number

Number & Street Address

Amount of Distribution

City / Town State Zip Code + 4 (or Canadian Postal Code)

DP 9 202 Page 1 of 3

7FSTJPO 0 /202