Enlarge image

New Hampshire 202

Department of

NH-1040-ES

Revenue Administration

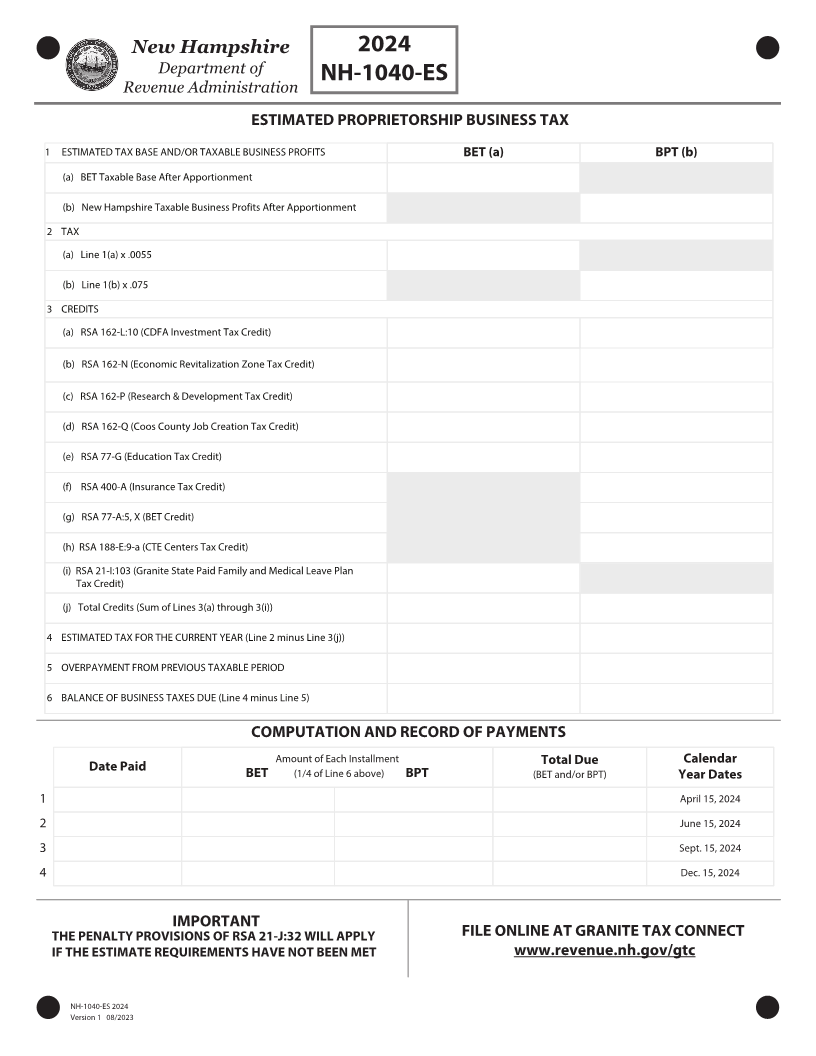

ESTIMATED PROPRIETORSHIP BUSINESS TAX

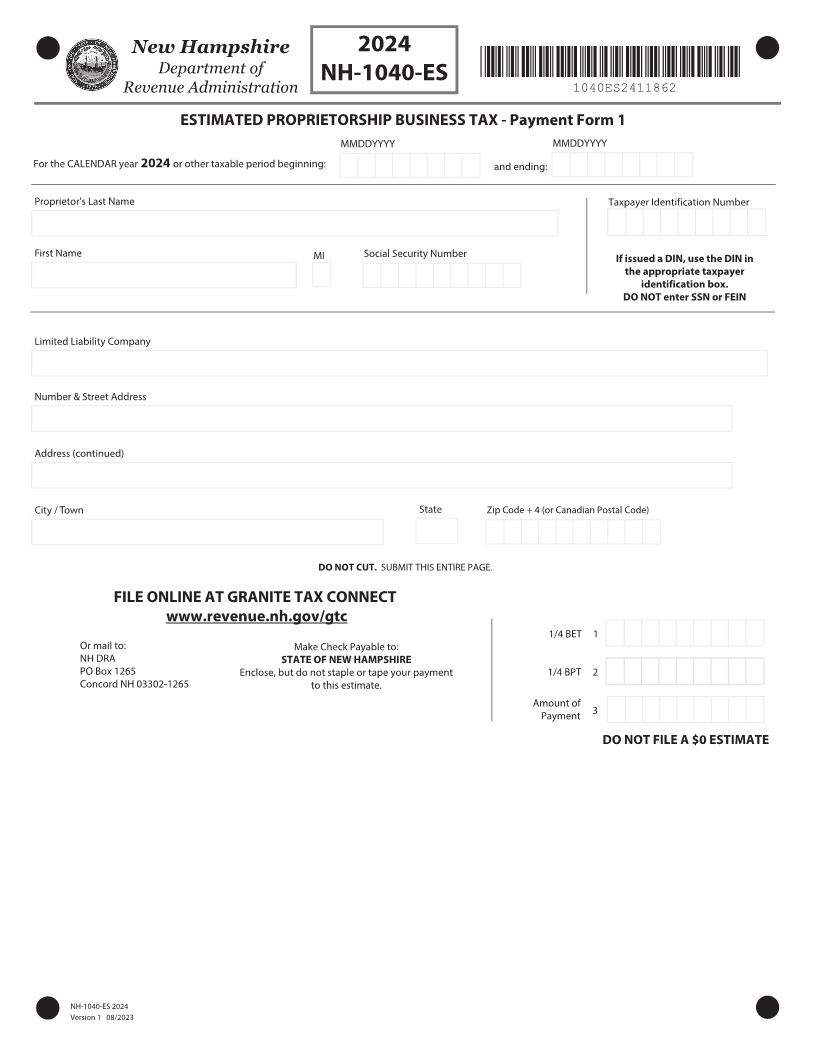

1 ESTIMATED TAX BASE AND/OR TAXABLE BUSINESS PROFITS BET (a) BPT (b)

(a) BET Taxable Base After Apportionment

(b) New Hampshire Taxable Business Profits After Apportionment

2 TAX

(a) Line 1(a) x .0055

(b) Line 1(b) x .075

3 CREDITS

(a) RSA 162-L:10 (CDFA Investment Tax Credit)

(b) RSA 162-N (Economic Revitalization Zone Tax Credit)

(c) RSA 162-P (Research & Development Tax Credit)

(d) RSA 162-Q (Coos County Job Creation Tax Credit)

(e) RSA 77-G (Education Tax Credit)

(f) RSA 400-A (Insurance Tax Credit)

(g) RSA 77-A:5, X (BET Credit)

(h) RSA 188-E:9-a (CTE Centers Tax Credit)

(i) RSA 21-I:103 (Granite State Paid Family and Medical Leave Plan

Tax Credit)

(j) Total Credits (Sum of Lines 3(a) through 3(i))

4 ESTIMATED TAX FOR THE CURRENT YEAR (Line 2 minus Line 3(j))

5 OVERPAYMENT FROM PREVIOUS TAXABLE PERIOD

6 BALANCE OF BUSINESS TAXES DUE (Line 4 minus Line 5)

COMPUTATION AND RECORD OF PAYMENTS

Amount of Each Installment Total Due Calendar

Date Paid BET (1/4 of Line 6 above) BPT (BET and/or BPT) Year Dates

1 April 15, 202

2 June 15, 202

3 Sept. 15, 202

4 Dec. 15, 202

IMPORTANT

THE PENALTY PROVISIONS OF RSA 21-J:32 WILL APPLY FILE ONLINE AT GRANITE TAX CONNECT

IF THE ESTIMATE REQUIREMENTS HAVE NOT BEEN MET www.revenue.nh.gov/gtc

NH-1040-ES 202

Version 1 0 /202