Enlarge image

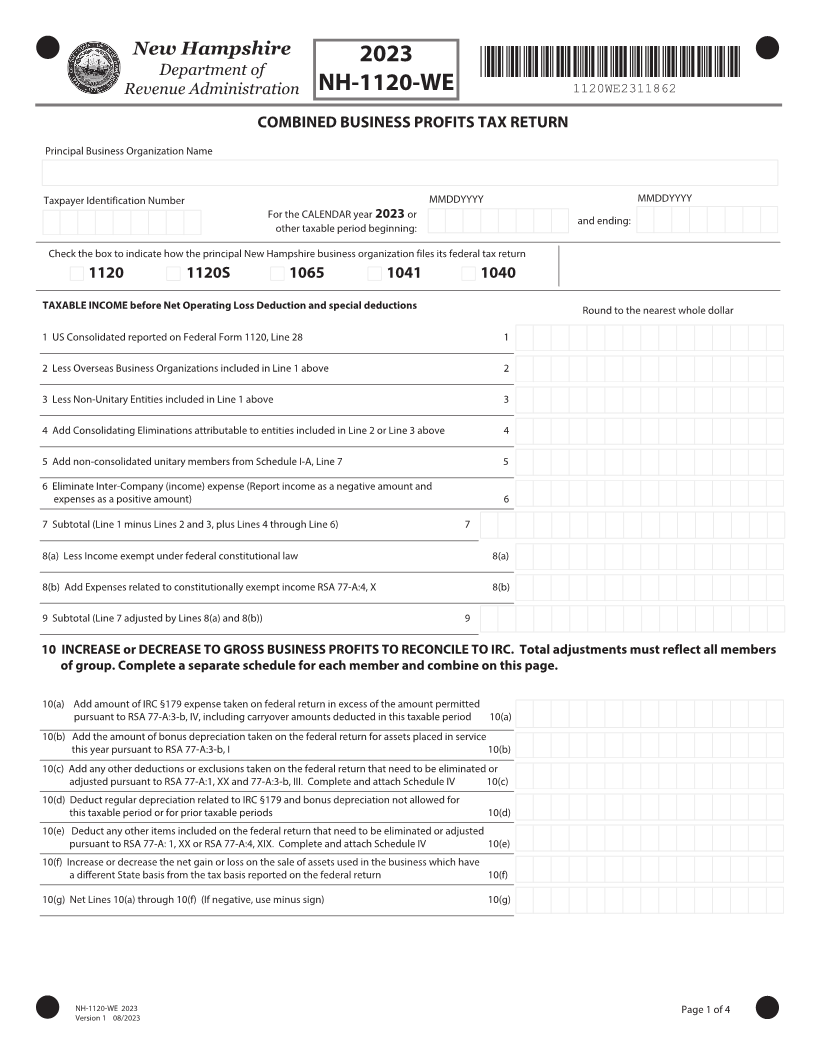

New Hampshire

202

Department of *1120WE2311862*

Revenue Administration NH-1120-WE 1120WE2311862

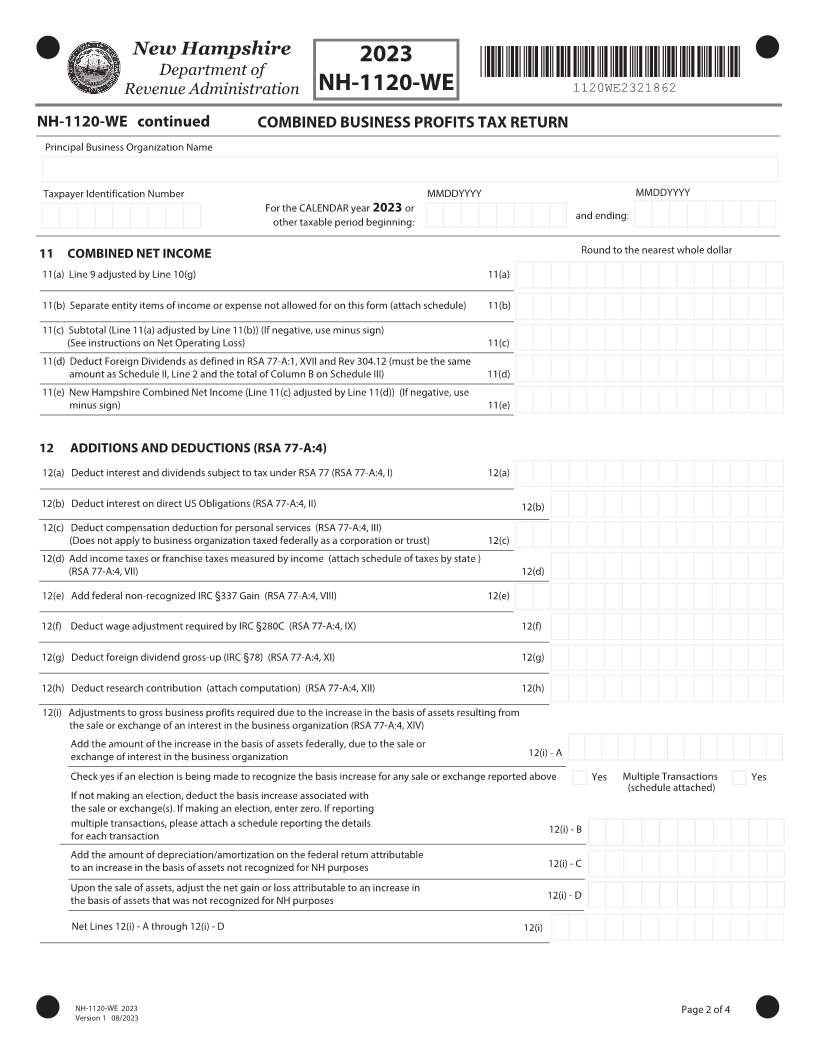

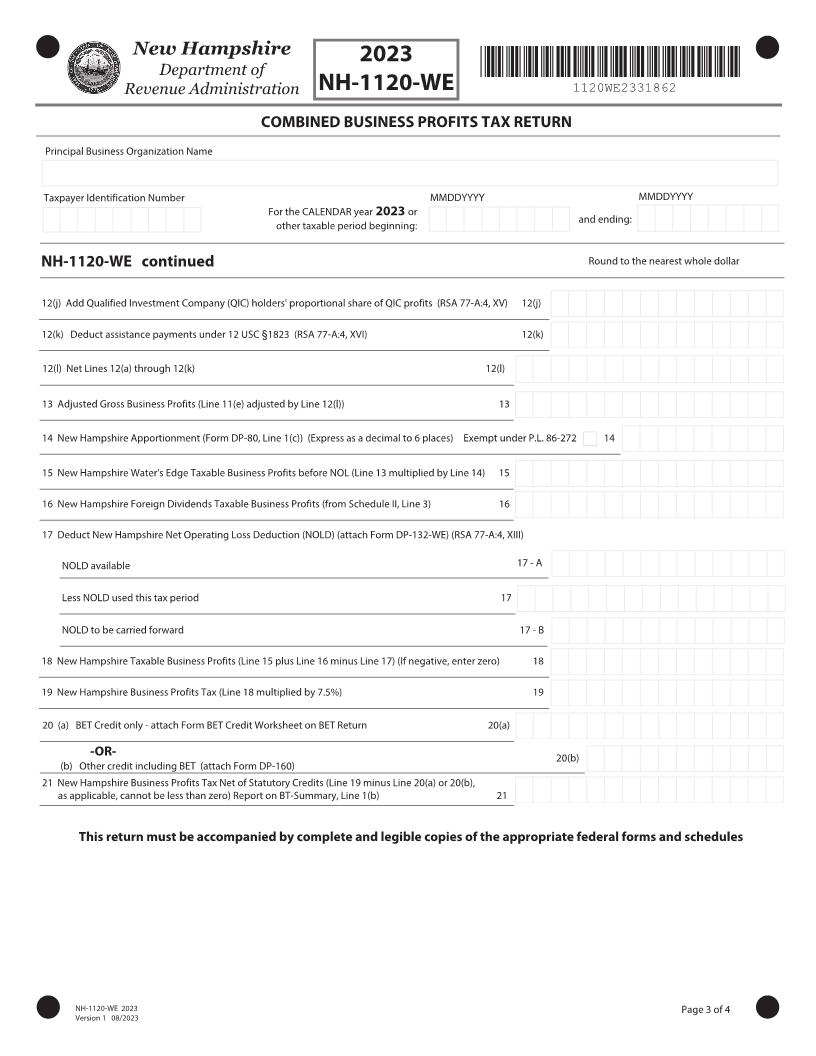

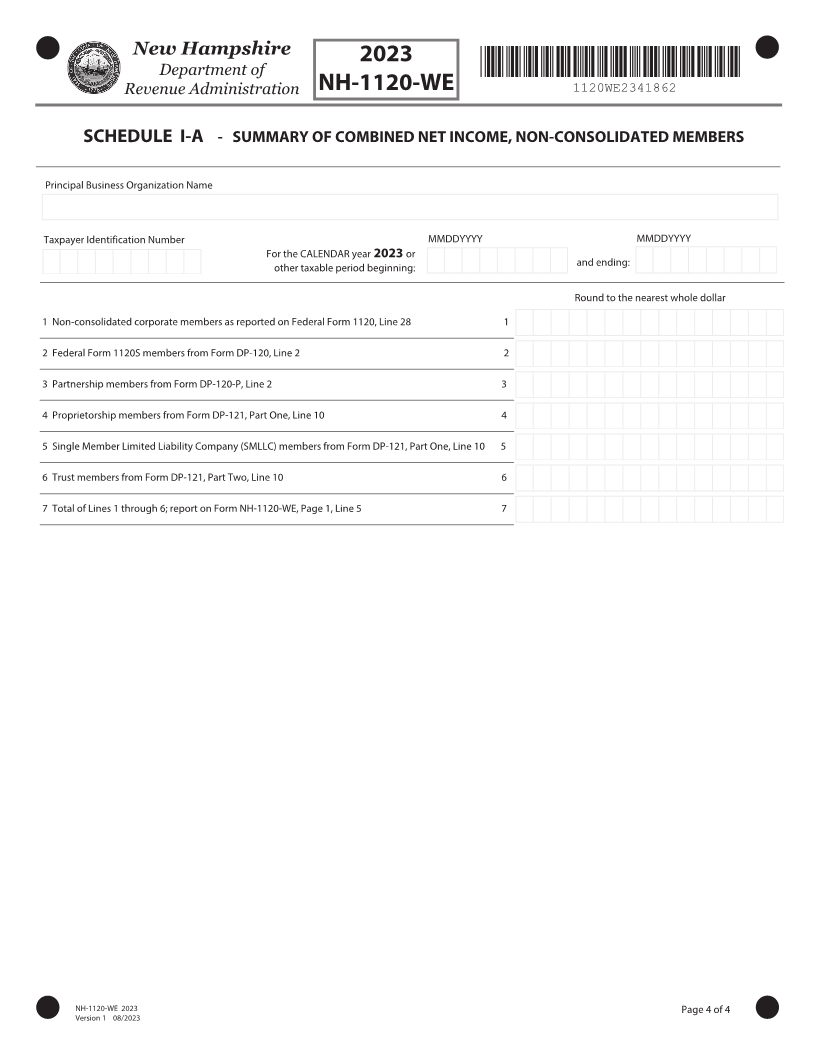

COMBINED BUSINESS PROFITS TAX RETURN

Principal Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or and ending:

other taxable period beginning:

Check the box to indicate how the principal New Hampshire business organization files its federal tax return

1120 1120S 1065 1041 1040

TAXABLE INCOME before Net Operating Loss Deduction and special deductions Round to the nearest whole dollar

1 US Consolidated reported on Federal Form 1120, Line 28 1

2 Less Overseas Business Organizations included in Line 1 above 2

3 Less Non-Unitary Entities included in Line 1 above 3

4 Add Consolidating Eliminations attributable to entities included in Line 2 or Line 3 above 4

5 Add non-consolidated unitary members from Schedule I-A, Line 7 5

6 Eliminate Inter-Company (income) expense (Report income as a negative amount and

expenses as a positive amount) 6

7 Subtotal (Line 1 minus Lines 2 and 3, plus Lines 4 through Line 6) 7

8(a) Less Income exempt under federal constitutional law 8(a)

8(b) Add Expenses related to constitutionally exempt income RSA 77-A:4, X 8(b)

9 Subtotal (Line 7 adjusted by Lines 8(a) and 8(b)) 9

10 INCREASE or DECREASE TO GROSS BUSINESS PROFITS TO RECONCILE TO IRC. Total adjustments must reflect all members

of group. Complete a separate schedule for each member and combine on this page.

10(a) Add amount of IRC §179 expense taken on federal return in excess of the amount permitted

pursuant to RSA 77-A:3-b, IV, including carryover amounts deducted in this taxable period 10(a)

10(b) Add the amount of bonus depreciation taken on the federal return for assets placed in service

this year pursuant to RSA 77-A:3-b, I 10(b)

10(c) Add any other deductions or exclusions taken on the federal return that need to be eliminated or

adjusted pursuant to RSA 77-A:1, XX and 77-A:3-b, III. Complete and attach Schedule IV 10(c)

10(d) Deduct regular depreciation related to IRC §179 and bonus depreciation not allowed for

this taxable period or for prior taxable periods 10(d)

10(e) Deduct any other items included on the federal return that need to be eliminated or adjusted

pursuant to RSA 77-A: 1, XX or RSA 77-A:4, XIX. Complete and attach Schedule IV 10(e)

10(f) Increase or decrease the net gain or loss on the sale of assets used in the business which have

a different State basis from the tax basis reported on the federal return 10(f)

10(g) Net Lines 10(a) through 10(f) (If negative, use minus sign) 10(g)

NH-1120-WE 202 Page 1 of 4

Version 1 08 202