Enlarge image

New Hampshire

Department of

NH-1310 *NH13102311862*

Revenue Administration

NH13102311862

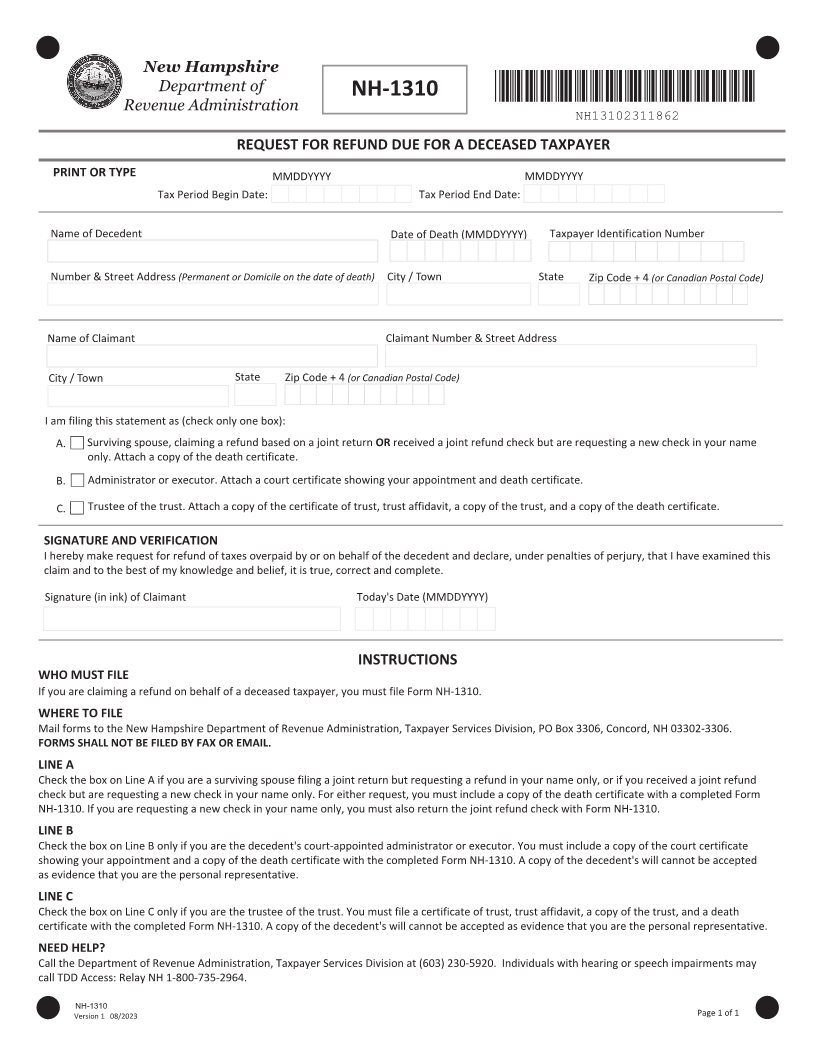

REQUEST FOR REFUND DUE FOR A DECEASED TAXPAYER

PRINT OR TYPE MMDDYYYY MMDDYYYY

Tax Period Begin Date: Tax Period End Date:

Name of Decedent Date of Death (MMDDYYYY) Taxpayer Identification Number

Number & Street Address ;WĞƌŵĂŶĞŶƚ Žƌ ŽŵŝĐŝůĞ ŽŶ ƚŚĞ ĚĂƚĞ ŽĨ ĚĞĂƚŚͿ City / Town State Zip Code + 4 ;Žƌ ĂŶĂĚŝĂŶ WŽƐƚĂů ŽĚĞͿ

Name of Claimant Claimant Number & Street Address

City / Town State Zip Code + 4 ;Žƌ ĂŶĂĚŝĂŶ WŽƐƚĂů ŽĚĞͿ

I am filing this statement as (check only one box):

A. Surviving spouse, claiming a refund based on a joint return KZ ƌĞĐĞŝǀĞĚ Ă ũŽŝŶƚ ƌĞĨƵŶĚ ĐŚĞĐŬ ďƵƚ ĂƌĞ ƌĞƋƵĞƐƚŝŶŐ Ă ŶĞǁ ĐŚĞĐŬ ŝŶ LJŽƵƌ ŶĂŵĞ

ŽŶůLJ. Attach a copy of the death certificate.

B. dministrator or executor. Attach a court certificate showing your appointment and death certificate.

C. Trustee of the trust. Attach a copy of the certificate of trust, trust affidavit, a copy of the trust, and a copy of the death certificate.

^/'E dhZ E s Z/&/ d/KE

I hereby make request for refund of taxes overpaid by or on behalf of the decedent and declare, under penalties of perjury, that I have examined this

claim and to the best of my knowledge and belief, it is true, correct and complete.

Signature (in ink) of Claimant dŽĚĂLJΖƐ ĂƚĞ ;DD zzzzͿ

INSTRUCTIONS

t,K Dh^d &/>

/Ĩ LJŽƵ ĂƌĞ ĐůĂŝŵŝŶŐ Ă ƌĞĨƵŶĚ ŽŶ ďĞŚĂůĨ ŽĨ Ă ĚĞĐĞĂƐĞĚ ƚĂdžƉĂLJĞƌ͕ LJŽƵ ŵƵƐƚ ĨŝůĞ &Žƌŵ E,ͲϭϯϭϬ͘

WHERE TO FILE

Mail forms to the New Hampshire Department of Revenue Administration, Taxpayer Services Division, PO Box 3306, Concord, NH 03302-3306.

FORMS SHALL NOT BE FILED BY FAX OR EMAIL͘

>/E A

Check the box on Line A if you are a surviving spouse filing a joint return but requesting a refund in your name only, or if you received a joint refund

check but are requesting a new check in your name only. For either request, you must include a copy of the death certificate with a completed Form

NH-1310. If you are requesting a new check in your name only, you must also return the joint refund check with Form NH-1310.

>/E B

Check the box on Line B only if you are the decedent's court-appointed administrator or executor. You must include a copy of the court certificate

showing your appointment and a copy of the death certificate with the completed Form NH-1310. A copy of the decedent's will cannot be accepted

as evidence that you are the personal representative.

>/E C

Check the box on Line C only if you are the trustee of the trust. You must file a certificate of trust, trust affidavit, a copy of the trust, and a death

certificate with the completed Form NH-1310. A copy of the decedent's will cannot be accepted as evidence that you are the personal representative.

NEED HELP?

Call the Department of Revenue Administration, Taxpayer Services Division at (603) 230-5920. Individuals with hearing or speech impairments may

call TDD Access: Relay NH 1-800-735-2964.

NH-1310

sĞƌƐŝŽŶ ϭ ϴ 0 /202ϯ Page 1 of 1