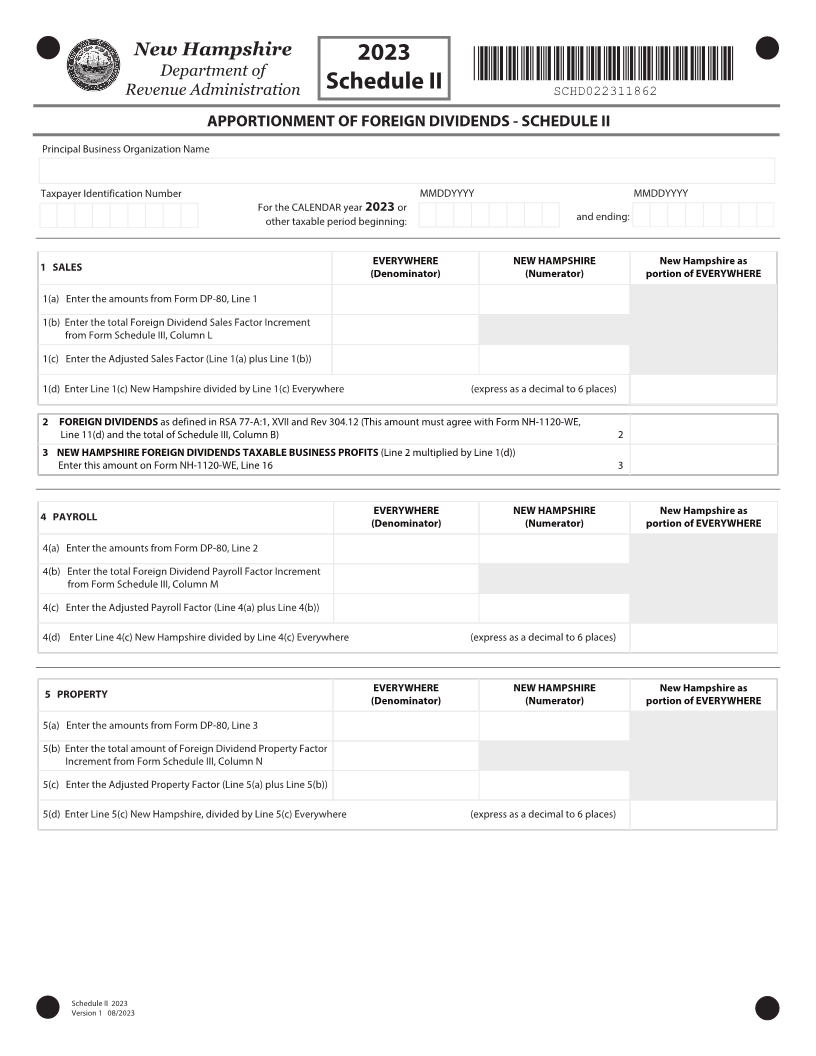

Enlarge image

New Hampshire 202

Department of *SCHD022311862*

Schedule II

Revenue Administration SCHD022311862

APPORTIONMENT OF FOREIGN DIVIDENDS - SCHEDULE II

Principal Business Organization Name

Taxpayer Identification Number MMDDYYYY MMDDYYYY

For the CALENDAR year 202 or

other taxable period beginning: and ending:

1 SALES EVERYWHERE NEW HAMPSHIRE New Hampshire as

(Denominator) (Numerator) portion of EVERYWHERE

1(a) Enter the amounts from Form DP-80, Line 1

1(b) Enter the total Foreign Dividend Sales Factor Increment

from Form Schedule III, Column L

1(c) Enter the Adjusted Sales Factor (Line 1(a) plus Line 1(b))

1(d) Enter Line 1(c) New Hampshire divided by Line 1(c) Everywhere (express as a decimal to 6 places)

2 FOREIGN DIVIDENDS as defined in RSA 77-A:1, XVII and Rev 304.12 (This amount must agree with Form NH-1120-WE,

Line 11(d) and the total of Schedule III, Column B) 2

3 NEW HAMPSHIRE FOREIGN DIVIDENDS TAXABLE BUSINESS PROFITS (Line 2 multiplied by Line 1(d))

Enter this amount on Form NH-1120-WE, Line 16 3

4 PAYROLL EVERYWHERE NEW HAMPSHIRE New Hampshire as

(Denominator) (Numerator) portion of EVERYWHERE

4(a) Enter the amounts from Form DP-80, Line 2

4(b) Enter the total Foreign Dividend Payroll Factor Increment

from Form Schedule III, Column M

4(c) Enter the Adjusted Payroll Factor (Line 4(a) plus Line 4(b))

4(d) Enter Line 4(c) New Hampshire divided by Line 4(c) Everywhere (express as a decimal to 6 places)

5 PROPERTY EVERYWHERE NEW HAMPSHIRE New Hampshire as

(Denominator) (Numerator) portion of EVERYWHERE

5(a) Enter the amounts from Form DP-80, Line 3

5(b) Enter the total amount of Foreign Dividend Property Factor

Increment from Form Schedule III, Column N

5(c) Enter the Adjusted Property Factor (Line 5(a) plus Line 5(b))

5(d) Enter Line 5(c) New Hampshire, divided by Line 5(c) Everywhere (express as a decimal to 6 places)

Schedule II 202

Version 1 08/202