Enlarge image

Income Tax Letter of Intent

Tax Year 2024

st

This form must be completed and submitted to efile@dor.ms.gov by September 1 , 2024

Enlarge image |

Income Tax Letter of Intent

Tax Year 2024

st

This form must be completed and submitted to efile@dor.ms.gov by September 1 , 2024

|

Enlarge image |

2024 Tax Software Provider Mississippi Department of Revenue

Letter of Intent

Welcome to the Income Tax Letter of Intent (LOI). If your software company intends to submit electronic and/or paper

returns to the Mississippi Department of Revenue (MDOR), you will need to complete this form and submit it to

efile@dor.ms.gov.

By submitting this Letter of Intent (LOI) to the MDOR, you agree to meet our standards for software provider

registration, tax preparation software, and substitute forms. If you do not meet the standards and requirements

explained in this LOI or provide an incomplete form, we may deny your application or revoke your approved software

provider status and reject all electronic and/or paper returns submitted using your products.

You must complete a separate LOI for each unique product your company offers.

Note: If you are a new Software Provider who has not filed city/state income tax returns with any city or state agencies,

you must have passed assurance testing with the IRS. Attach documentation from the IRS demonstrating you have

successfully tested with the IRS.

Important dates

The MDOR has important key dates to ensure we are ready for the filing season and taxpayers can file an accurate and

timely tax return. Please note the following key dates:

st

• Complete and submit this LOI by September 1 , 2024.

th

• Substitute forms approval must be completed by December 15 , 2024.

• Assurance testing (ATS) begins in November 2024.

st

• Last day we will accept initial e-file tests is December 31 , 2024.

st

• E-file tests must be completed and approved by January 31 , 2025.

Amended Letter of Intent

Check this box if this is an amended Letter of Intent.

Reason for amendment:

Company information

List your company information.

Name of company Product name State Software ID (if applicable)

DBA name NACTP vendor ID State Tax Account Number

Address Product address/URL Company FEIN

City State Zip code

List your other product names using the same calculation engines here: Note: The same calculation engine is defined as

products that use the same calculation engine and support all the same forms and schedules.

2

|

Enlarge image |

IRS issued electronic identification numbers

List your IRS electronic identification numbers.

EFIN(s) ETIN(s)

Individual Tax Test EFIN(s) Test ETIN(s)

Production EFIN(s) Production ETIN(s)

Business Tax Test EFIN(s) Test ETIN(s)

Production EFIN(s) Production ETIN(s)

Contact information

List the contact information for each area identified.

Regulatory/compliance contact Phone Email address

Primary individual MeF contact Phone Email address

Secondary individual MeF contact Phone Email address

Primary business MeF contact Phone Email address

Secondary business MeF contact Phone Email address

Primary fiduciary (Estate/Trust) MeF contact Phone Email address

Secondary fiduciary (Estate/Trust) MeF contact Phone Email address

Primary leads reporting contact Phone Email address

Secondary leads reporting contact Phone Email address

3

|

Enlarge image |

Substitute forms registration

Complete this section only if your product will provide substitute forms.

State Substitute Form Vendor Number

Primary individual forms contact Phone Email address

Secondary individual forms contact Phone Email address

Primary business forms contact Phone Email address

Secondary business forms contact Phone Email address

Primary Withholding Forms Contact Phone Email Address

Secondary Withholding Forms Contact Phone Email Address

Note: If you have separate contacts for each business tax type, please list them by tax type on a separate sheet and

attach it to this submission.

Software products and tax types supported

Check all that apply.

Type of software product supported

DIY/consumer (Web-Based)

DIY/consumer (Desktop)

Professional/paid preparer (Web-Based)

Professional/paid preparer (Desktop)

Tax types supported

Individual Income Tax e-File Substitute forms

Estate/Trust/Fiduciary Tax e-File Substitute forms

Corporate Income/Franchise tax e-File Substitute forms

Pass-Through Partnerships/S-Corp e-File Substitute forms

Insurance premium tax Substitute forms

4

|

Enlarge image |

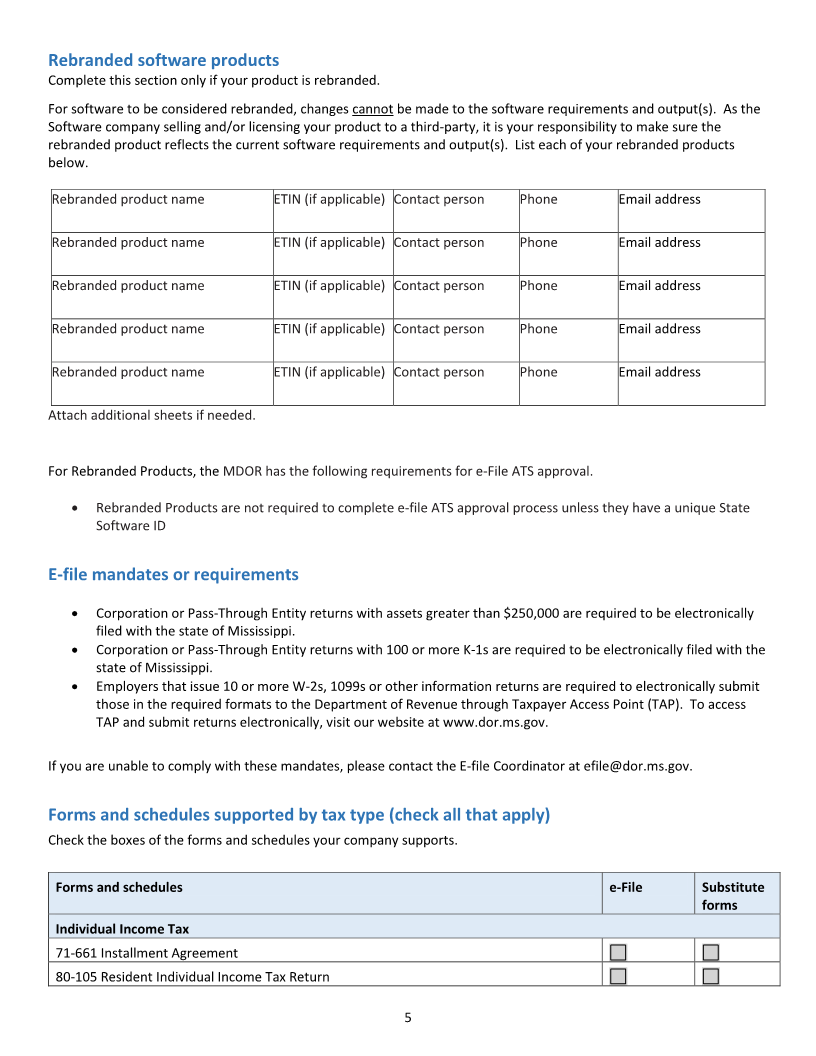

Rebranded software products

Complete this section only if your product is rebranded.

For software to be considered rebranded, changes cannot be made to the software requirements and output(s). As the

Software company selling and/or licensing your product to a third-party, it is your responsibility to make sure the

rebranded product reflects the current software requirements and output(s). List each of your rebranded products

below.

Rebranded product name ETIN (if applicable) Contact person Phone Email address

Rebranded product name ETIN (if applicable) Contact person Phone Email address

Rebranded product name ETIN (if applicable) Contact person Phone Email address

Rebranded product name ETIN (if applicable) Contact person Phone Email address

Rebranded product name ETIN (if applicable) Contact person Phone Email address

Attach additional sheets if needed.

For Rebranded Products, the MDOR has the following requirements for e-File ATS approval.

• Rebranded Products are not required to complete e-file ATS approval process unless they have a unique State

Software ID

E-file mandates or requirements

• Corporation or Pass-Through Entity returns with assets greater than $250,000 are required to be electronically

filed with the state of Mississippi.

• Corporation or Pass-Through Entity returns with 100 or more K-1s are required to be electronically filed with the

state of Mississippi.

• Employers that issue 10 or more W-2s, 1099s or other information returns are required to electronically submit

those in the required formats to the Department of Revenue through Taxpayer Access Point (TAP). To access

TAP and submit returns electronically, visit our website at www.dor.ms.gov.

If you are unable to comply with these mandates, please contact the E-file Coordinator at efile@dor.ms.gov.

Forms and schedules supported by tax type (check all that apply)

Check the boxes of the forms and schedules your company supports.

Forms and schedules e-File Substitute

forms

Individual Income Tax

71-661 Installment Agreement

80-105 Resident Individual Income Tax Return

5

|

Enlarge image |

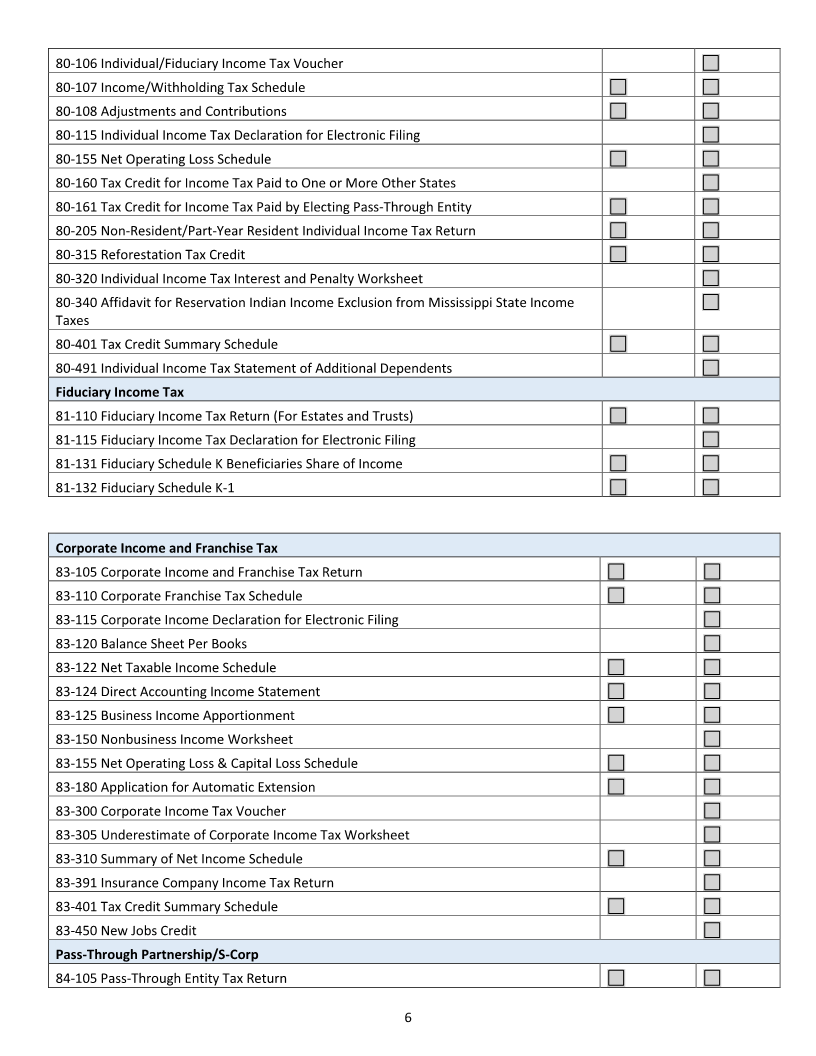

80-106 Individual/Fiduciary Income Tax Voucher

80-107 Income/Withholding Tax Schedule

80-108 Adjustments and Contributions

80-115 Individual Income Tax Declaration for Electronic Filing

80-155 Net Operating Loss Schedule

80-160 Tax Credit for Income Tax Paid to One or More Other States

80-161 Tax Credit for Income Tax Paid by Electing Pass-Through Entity

80-205 Non-Resident/Part-Year Resident Individual Income Tax Return

80-315 Reforestation Tax Credit

80-320 Individual Income Tax Interest and Penalty Worksheet

80-340 Affidavit for Reservation Indian Income Exclusion from Mississippi State Income

Taxes

80-401 Tax Credit Summary Schedule

80-491 Individual Income Tax Statement of Additional Dependents

Fiduciary Income Tax

81-110 Fiduciary Income Tax Return (For Estates and Trusts)

81-115 Fiduciary Income Tax Declaration for Electronic Filing

81-131 Fiduciary Schedule K Beneficiaries Share of Income

81-132 Fiduciary Schedule K-1

Corporate Income and Franchise Tax

83-105 Corporate Income and Franchise Tax Return

83-110 Corporate Franchise Tax Schedule

83-115 Corporate Income Declaration for Electronic Filing

83-120 Balance Sheet Per Books

83-122 Net Taxable Income Schedule

83-124 Direct Accounting Income Statement

83-125 Business Income Apportionment

83-150 Nonbusiness Income Worksheet

83-155 Net Operating Loss & Capital Loss Schedule

83-180 Application for Automatic Extension

83-300 Corporate Income Tax Voucher

83-305 Underestimate of Corporate Income Tax Worksheet

83-310 Summary of Net Income Schedule

83-391 Insurance Company Income Tax Return

83-401 Tax Credit Summary Schedule

83-450 New Jobs Credit

Pass-Through Partnership/S-Corp

84-105 Pass-Through Entity Tax Return

6

|

Enlarge image |

84-110 S-Corporation Franchise Tax Schedule

84-115 Pass-Through Entity Declaration for Electronic Filing

84-122 Net Taxable Income Schedule

84-124 Direct Accounting Income Statement

84-125 Business Income Apportionment Schedule

84-131 Schedule K

84-132 Schedule K-1

84-150 Nonbusiness Income Worksheet

84-155 Net Operating Loss Schedule

84-161 Tax Credit for Income Tax Paid by Electing Pass-Through Entity

84-300 Pass-Through Entity Income Tax Voucher

84-380 Non-Resident Income Tax Agreement

84-381 Pass-Through Entity Election Form

84-387 Partnership Income Tax Withholding Voucher

84-401 Tax Credit Summary Schedule

Electronic amended returns

MDOR requests you support electronic amended returns for those available through MeF.

Agency requirements

This section identifies agency requirements and expectations of new and existing Software Providers and the software

product.

Issue notification and resolution requirements

This section represents the MDOR issue notification and issue resolution standards. If something is discovered with

your software that causes issues for tax returns sent to Mississippi, we expect an email sent to efile@dor.ms.gov with

the following information:

• Date the issue was discovered

• Description of the issue

• Actual or estimated number of taxpayer records involved

• Specific data elements involved

• Information that has been passed on to the taxpayer about the issue

• Plan for correcting the issue/Estimated date the issue will be corrected

Data breaches, security incidents, or other improper disclosures of taxpayer data that by law require reporting to the

Mississippi Attorney General must also be reported to the MDOR.

System security requirements

The MDOR does not prescribe the security requirements for your system. You are responsible for implementing

appropriate security measures to protect taxpayers and their information in your system. You must apply security

measures to protect taxpayer information in your system when it is on-line, off-line, at rest, and in transit.

Production return submission requirements

All returns generated from this software must be e-filed or printed from the approved software or a subsequent product

update.

7

|

Enlarge image |

Product updates

Desktop product users who attempt to file 10 or more business days after a production release must be required to

download and apply the product update.

Schemas

Your software must follow the schema requirements. Find MDOR schema requirements on the FTA State Exchange

System.

Testing and submissions

All e-file ATS and substitute forms tests submitted during the approval process must be created in, and originate from,

the actual software.

Software limitations

List any software limitations to forms or schedules you support.

Software exceptions

Provide any exceptions to forms or schedules you support based on the type of software during ATS. Example, a DIY

product does not support the same schedules as a professional product. Failure to provide this information could delay

the review of your test returns.

8

|

Enlarge image |

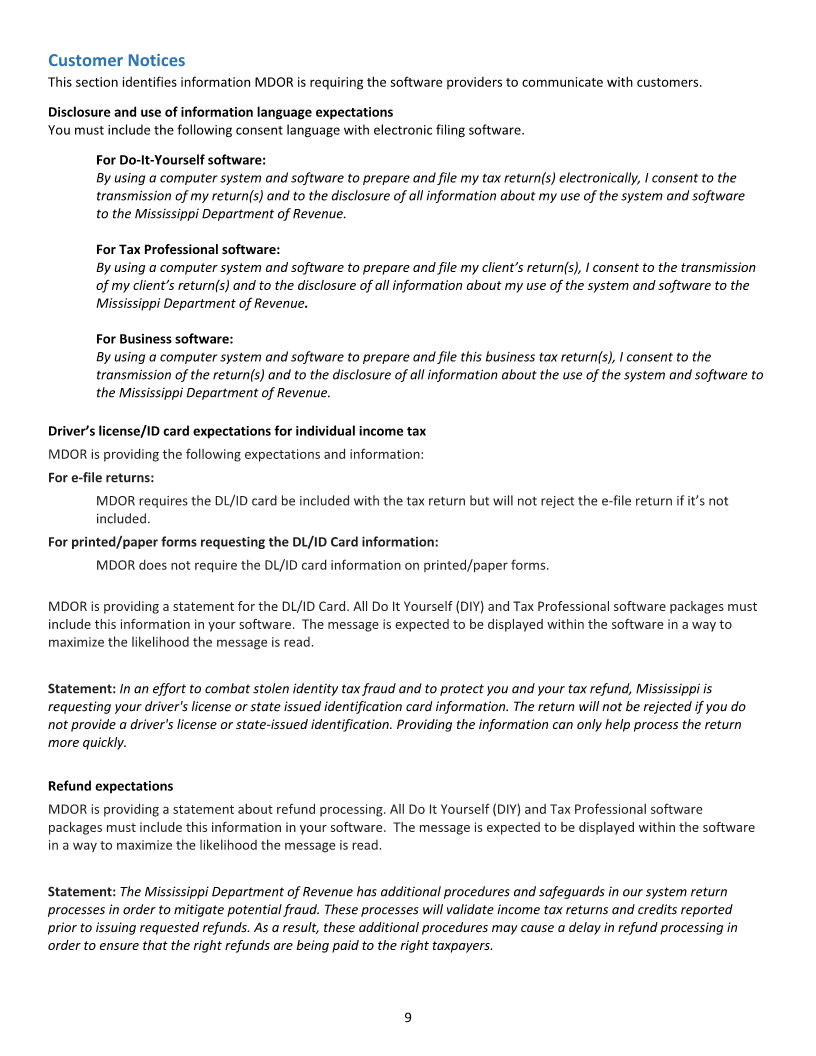

Customer Notices

This section identifies information MDOR is requiring the software providers to communicate with customers.

Disclosure and use of information language expectations

You must include the following consent language with electronic filing software.

For Do-It-Yourself software:

By using a computer system and software to prepare and file my tax return(s) electronically, I consent to the

transmission of my return(s) and to the disclosure of all information about my use of the system and software

to the Mississippi Department of Revenue.

For Tax Professional software:

By using a computer system and software to prepare and file my client’s return(s), I consent to the transmission

of my client’s return(s) and to the disclosure of all information about my use of the system and software to the

Mississippi Department of Revenue.

For Business software:

By using a computer system and software to prepare and file this business tax return(s), I consent to the

transmission of the return(s) and to the disclosure of all information about the use of the system and software to

the Mississippi Department of Revenue.

Driver’s license/ID card expectations for individual income tax

MDOR is providing the following expectations and information:

For e-file returns:

MDOR requires the DL/ID card be included with the tax return but will not reject the e-file return if it’s not

included.

For printed/paper forms requesting the DL/ID Card information:

MDOR does not require the DL/ID card information on printed/paper forms.

MDOR is providing a statement for the DL/ID Card. All Do It Yourself (DIY) and Tax Professional software packages must

include this information in your software. The message is expected to be displayed within the software in a way to

maximize the likelihood the message is read.

Statement: In an effort to combat stolen identity tax fraud and to protect you and your tax refund, Mississippi is

requesting your driver's license or state issued identification card information. The return will not be rejected if you do

not provide a driver's license or state-issued identification. Providing the information can only help process the return

more quickly.

Refund expectations

MDOR is providing a statement about refund processing. All Do It Yourself (DIY) and Tax Professional software

packages must include this information in your software. The message is expected to be displayed within the software

in a way to maximize the likelihood the message is read.

Statement: The Mississippi Department of Revenue has additional procedures and safeguards in our system return

processes in order to mitigate potential fraud. These processes will validate income tax returns and credits reported

prior to issuing requested refunds. As a result, these additional procedures may cause a delay in refund processing in

order to ensure that the right refunds are being paid to the right taxpayers.

9

|

Enlarge image |

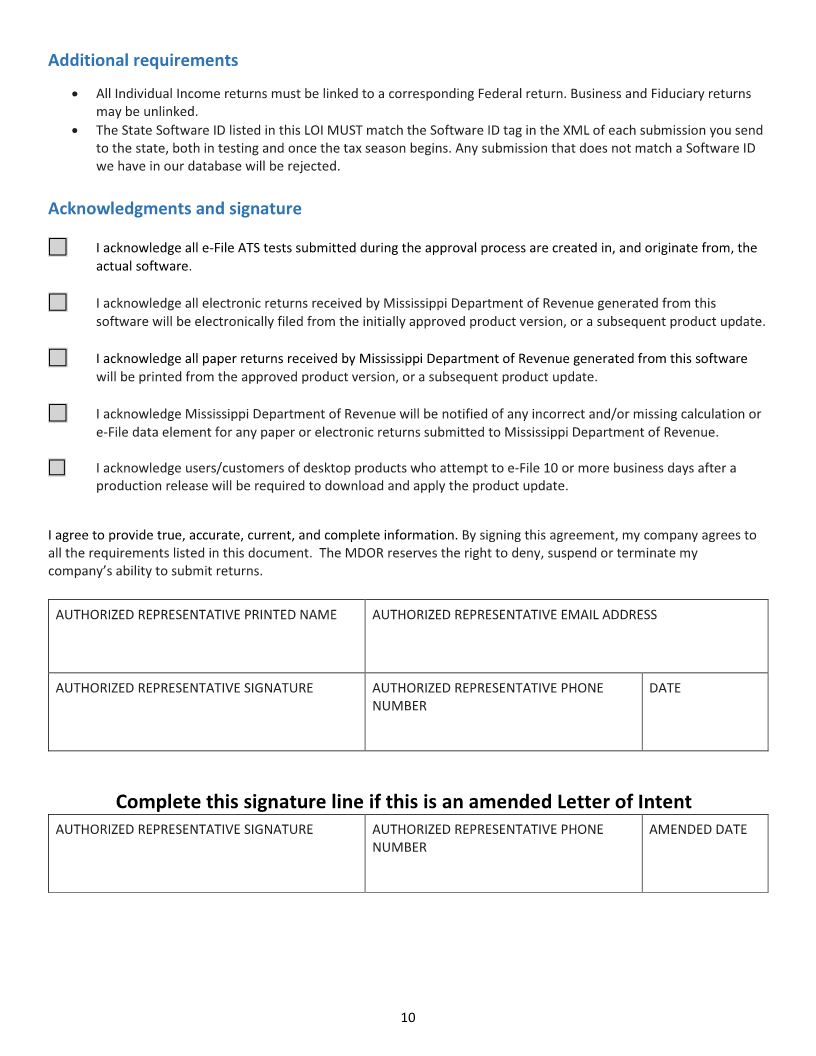

Additional requirements

• All Individual Income returns must be linked to a corresponding Federal return. Business and Fiduciary returns

may be unlinked.

• The State Software ID listed in this LOI MUST match the Software ID tag in the XML of each submission you send

to the state, both in testing and once the tax season begins. Any submission that does not match a Software ID

we have in our database will be rejected.

Acknowledgments and signature

I acknowledge all e-File ATS tests submitted during the approval process are created in, and originate from, the

actual software.

I acknowledge all electronic returns received by Mississippi Department of Revenue generated from this

software will be electronically filed from the initially approved product version, or a subsequent product update.

I acknowledge all paper returns received by Mississippi Department of Revenue generated from this software

will be printed from the approved product version, or a subsequent product update.

I acknowledge Mississippi Department of Revenue will be notified of any incorrect and/or missing calculation or

e-File data element for any paper or electronic returns submitted to Mississippi Department of Revenue.

I acknowledge users/customers of desktop products who attempt to e-File 10 or more business days after a

production release will be required to download and apply the product update.

I agree to provide true, accurate, current, and complete information. By signing this agreement, my company agrees to

all the requirements listed in this document. The MDOR reserves the right to deny, suspend or terminate my

company’s ability to submit returns.

AUTHORIZED REPRESENTATIVE PRINTED NAME AUTHORIZED REPRESENTATIVE EMAIL ADDRESS

AUTHORIZED REPRESENTATIVE SIGNATURE AUTHORIZED REPRESENTATIVE PHONE DATE

NUMBER

Complete this signature line if this is an amended Letter of Intent

AUTHORIZED REPRESENTATIVE SIGNATURE AUTHORIZED REPRESENTATIVE PHONE AMENDED DATE

NUMBER

10

|

Enlarge image |

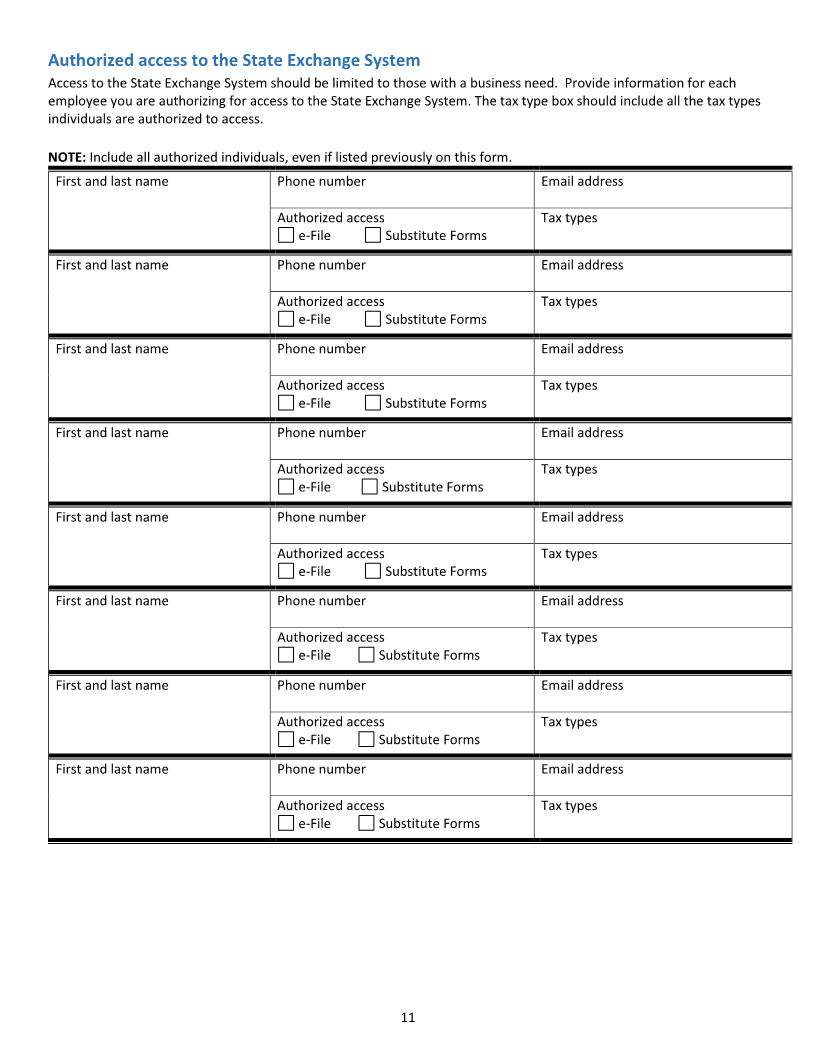

Authorized access to the State Exchange System

Access to the State Exchange System should be limited to those with a business need. Provide information for each

employee you are authorizing for access to the State Exchange System. The tax type box should include all the tax types

individuals are authorized to access.

NOTE: Include all authorized individuals, even if listed previously on this form.

First and last name Phone number Email address

Authorized access Tax types

e-File Substitute Forms

First and last name Phone number Email address

Authorized access Tax types

e-File Substitute Forms

First and last name Phone number Email address

Authorized access Tax types

e-File Substitute Forms

First and last name Phone number Email address

Authorized access Tax types

e-File Substitute Forms

First and last name Phone number Email address

Authorized access Tax types

e-File Substitute Forms

First and last name Phone number Email address

Authorized access Tax types

e-File Substitute Forms

First and last name Phone number Email address

Authorized access Tax types

e-File Substitute Forms

First and last name Phone number Email address

Authorized access Tax types

e-File Substitute Forms

11

|