Enlarge image

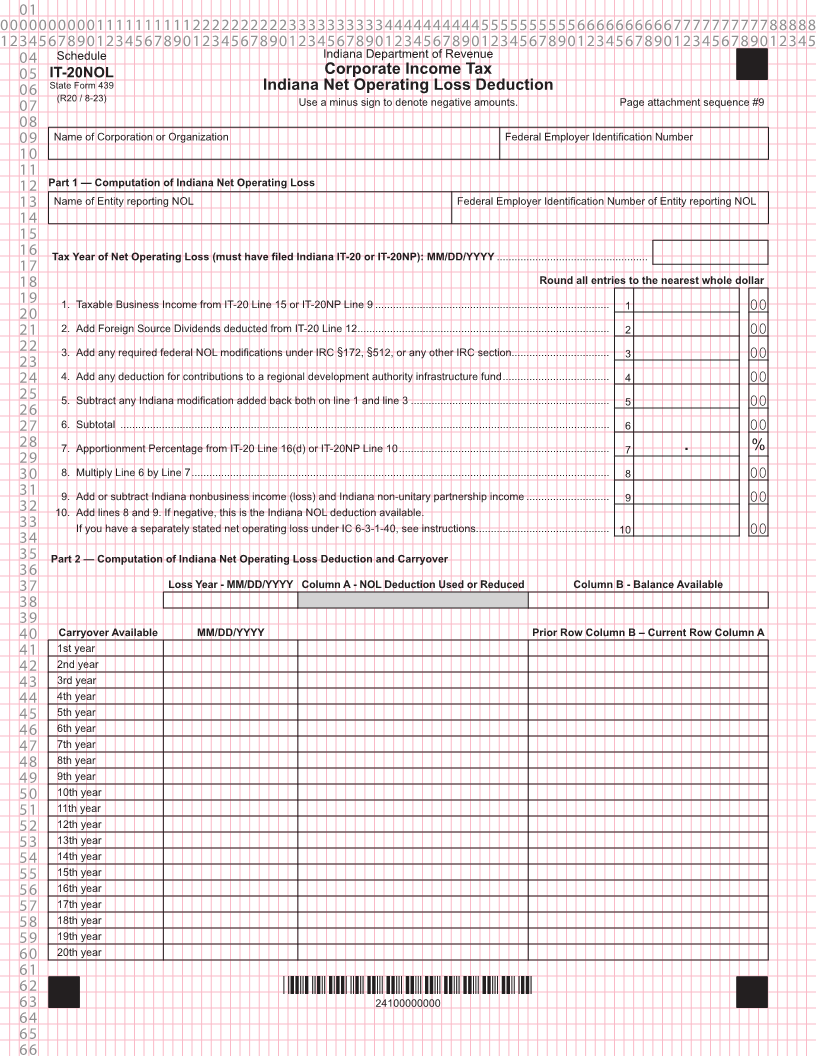

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Schedule Indiana Department of Revenue 05 IT-20NOL Corporate Income Tax 06 State Form 439 Indiana Net Operating Loss Deduction 07 (R20 / 8-23) Use a minus sign to denote negative amounts. Page attachment sequence #9 08 09 Name of Corporation or Organization Federal Employer Identification Number 10 11 12 Part 1 — Computation of Indiana Net Operating Loss 13 Name of Entity reporting NOL Federal Employer Identification Number of Entity reporting NOL 14 15 16 Tax Year of Net Operating Loss (must have filed Indiana IT-20 or IT-20NP): MM/DD/YYYY ................................................... 17 18 Round all entries to the nearest whole dollar 19 1. Taxable Business Income from IT-20 Line 15 or IT-20NP Line 9 ............................................................................... 1 00 20 21 2. Add Foreign Source Dividends deducted from IT-20 Line 12 ..................................................................................... 2 00 22 3. Add any required federal NOL modifications under IRC §172, §512, or any other IRC section................................. 3 00 23 24 4. Add any deduction for contributions to a regional development authority infrastructure fund .................................... 4 00 25 5. Subtract any Indiana modification added back both on line 1 and line 3 ................................................................... 5 00 26 27 6. Subtotal ..................................................................................................................................................................... 6 00 28 7. Apportionment Percentage from IT-20 Line 16(d) or IT-20NP Line 10 ....................................................................... 7 . % 29 30 8. Multiply Line 6 by Line 7 ............................................................................................................................................. 8 00 31 9. Add or subtract Indiana nonbusiness income (loss) and Indiana non-unitary partnership income ............................ 9 00 32 10. Add lines 8 and 9. If negative, this is the Indiana NOL deduction available. 33 If you have a separately stated net operating loss under IC 6-3-1-40, see instructions. ............................................ 10 00 34 35 Part 2 — Computation of Indiana Net Operating Loss Deduction and Carryover 36 37 Loss Year - MM/DD/YYYY Column A - NOL Deduction Used or Reduced Column B - Balance Available 38 39 40 Carryover Available MM/DD/YYYY Prior Row Column B – Current Row Column A 41 1st year 42 2nd year 43 3rd year 44 4th year 45 5th year 46 6th year 47 7th year 48 8th year 49 9th year 50 10th year 51 11th year 52 12th year 53 13th year 54 14th year 55 15th year 56 16th year 57 17th year 58 18th year 59 19th year 60 20th year 61 62 *24100000000* 63 24100000000 64 65 66