Enlarge image

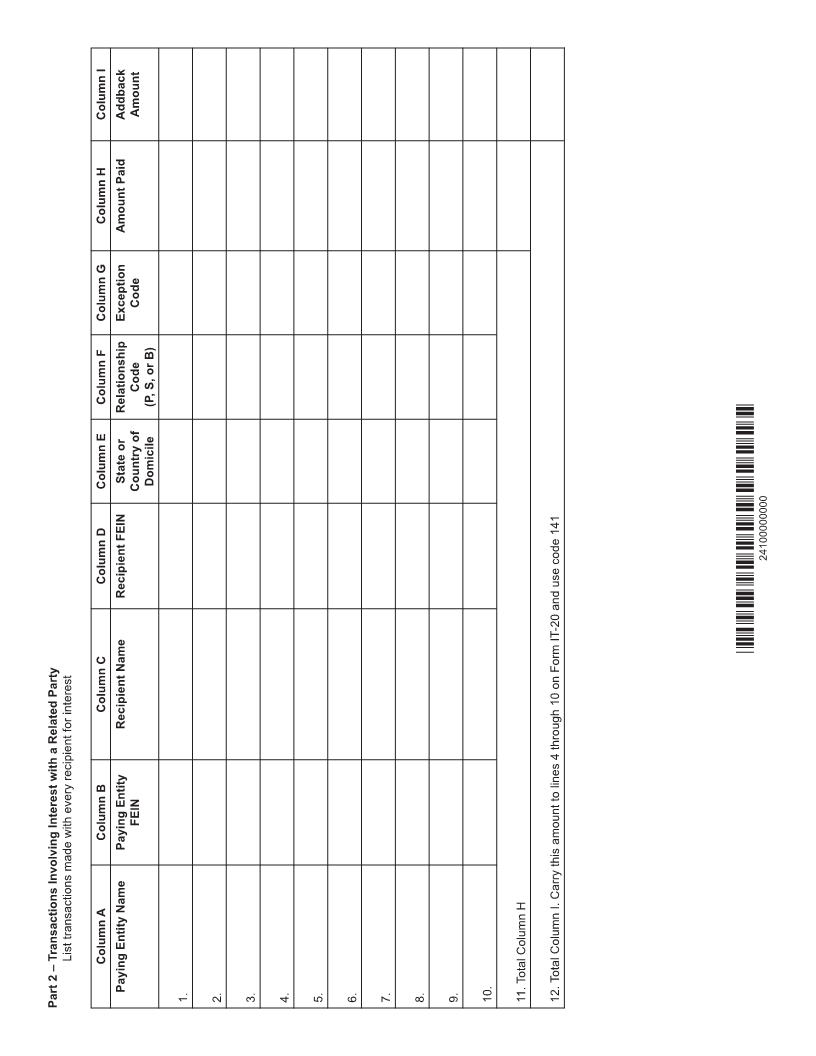

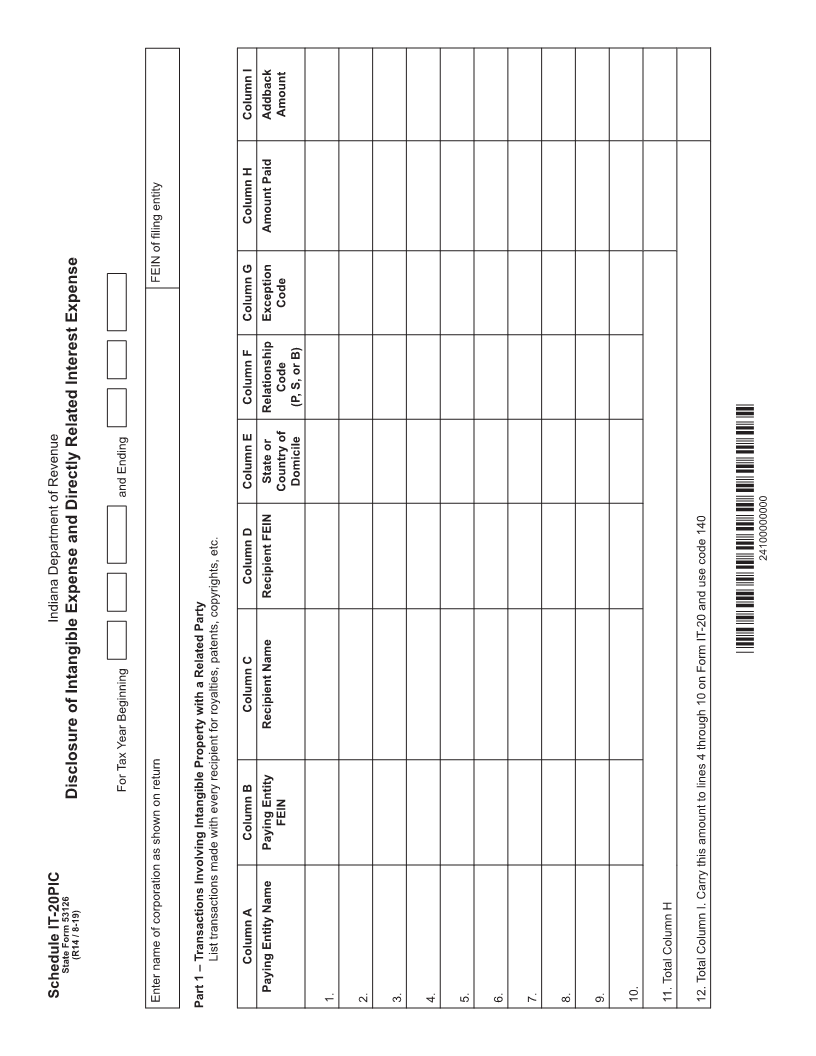

Column I Addback Amount Column H Amount Paid )(,1 RI ¿OLQJ HQWLW\ Code Column G Exception Code Column F (P, S, or B) Relationship Column E State or and Ending Country of Domicile 24100000000 Column D Recipient FEIN Indiana Department of Revenue Column C Recipient Name For Tax Year Beginning Disclosure of Intangible Expense and Directly Related Interest Expense FEIN Column B Paying Entity (R14 / 8-19) /LVW WUDQVDFWLRQV PDGH ZLWK HYHU\ UHFLSLHQW IRU UR\DOWLHV SDWHQWV FRS\ULJKWV HWF Column A State Form 53126 Paying Entity Name Schedule IT-20PIC Enter name of corporation as shown on return Part 1 – Transactions Involving Intangible Property with a Related Party 7RWDO &ROXPQ + 7RWDO &ROXPQ , &DUU\ WKLV DPRXQW WR OLQHV WKURXJK RQ )RUP ,7 DQG XVH FRGH