Enlarge image

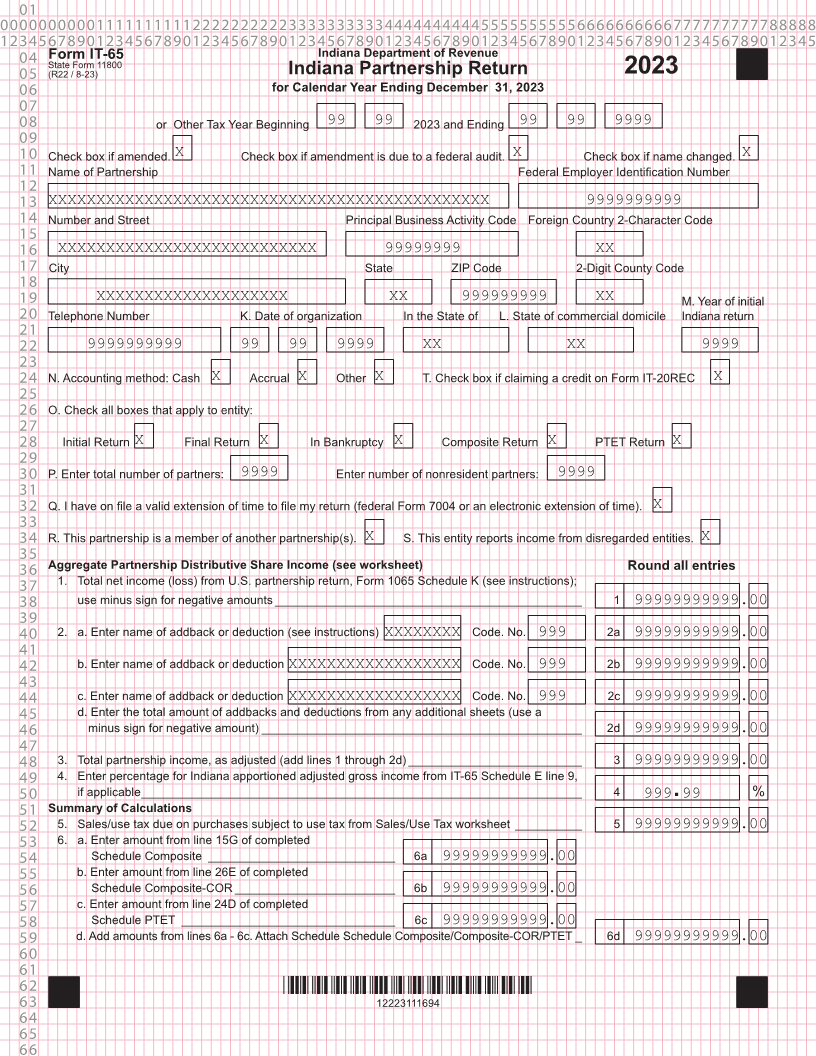

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 Form IT-65 Indiana Department of Revenue State Form 11800 05 (R22 / 8-23) Indiana Partnership Return 2023 06 for Calendar Year Ending December 31, 2023 07 08 or Other Tax Year Beginning 99 99 2023 and Ending 99 99 9999 09 10 Check box if amended. X Check box if amendment is due to a federal audit. X Check box if name changed. X 11 Name of Partnership Federal Employer Identification Number 12 13 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999 14 Number and Street Principal Business Activity Code Foreign Country 2-Character Code 15 16 XXXXXXXXXXXXXXXXXXXXXXXXXXX 99999999 XX 17 City State ZIP Code 2-Digit County Code 18 19 XXXXXXXXXXXXXXXXXXXX XX 999999999 XX M. Year of initial 20 Telephone Number K. Date of organization In the State of L. State of commercial domicile Indiana return 21 22 9999999999 99 99 9999 XX XX 9999 23 24 N. Accounting method: Cash X Accrual X Other X T. Check box if claiming a credit on Form IT-20REC X 25 26 O. Check all boxes that apply to entity: 27 28 Initial Return X Final Return X In Bankruptcy X Composite Return X PTET Return X 29 30 P. Enter total number of partners: 9999 Enter number of nonresident partners: 9999 31 32 Q. I have on file a valid extension of time to file my return (federal Form 7004 or an electronic extension of time). X 33 34 R. This partnership is a member of another partnership(s). X S. This entity reports income from disregarded entities. X 35 36 Aggregate Partnership Distributive Share Income (see worksheet) Round all entries 37 1. Total net income (loss) from U.S. partnership return, Form 1065 Schedule K (see instructions); 38 use minus sign for negative amounts ______________________________________________ 1 99999999999.00 39 40 2. a. Enter name of addback or deduction (see instructions) XXXXXXXX Code. No. 999 2a 99999999999.00 41 42 b. Enter name of addback or deduction XXXXXXXXXXXXXXXXXX Code. No. 999 2b 99999999999.00 43 44 c. Enter name of addback or deduction XXXXXXXXXXXXXXXXXX Code. No. 999 2c 99999999999.00 45 d. Enter the total amount of addbacks and deductions from any additional sheets (use a 46 minus sign for negative amount) ________________________________________________ 2d 99999999999.00 47 48 3. Total partnership income, as adjusted (add lines 1 through 2d) __________________________ 3 99999999999.00 49 4. Enter percentage for Indiana apportioned adjusted gross income from IT-65 Schedule E line 9, 50 if applicable __________________________________________________________________ 4 999. 99 % 51 Summary of Calculations 52 5. Sales/use tax due on purchases subject to use tax from Sales/Use Tax worksheet __________ 5 99999999999.00 53 6. a. Enter amount from line 15G of completed 54 Schedule Composite ____________________________ 6a 99999999999.00 55 b. Enter amount from line 26E of completed 56 Schedule Composite-COR ________________________ 6b 99999999999.00 57 c. Enter amount from line 24D of completed 58 Schedule PTET ________________________________ 6c 99999999999.00 59 d. Add amounts from lines 6a - 6c. Attach Schedule Schedule Composite/Composite-COR/PTET _ 6d 99999999999.00 60 61 62 *12223111694* 63 12223111694 64 65 66