Enlarge image

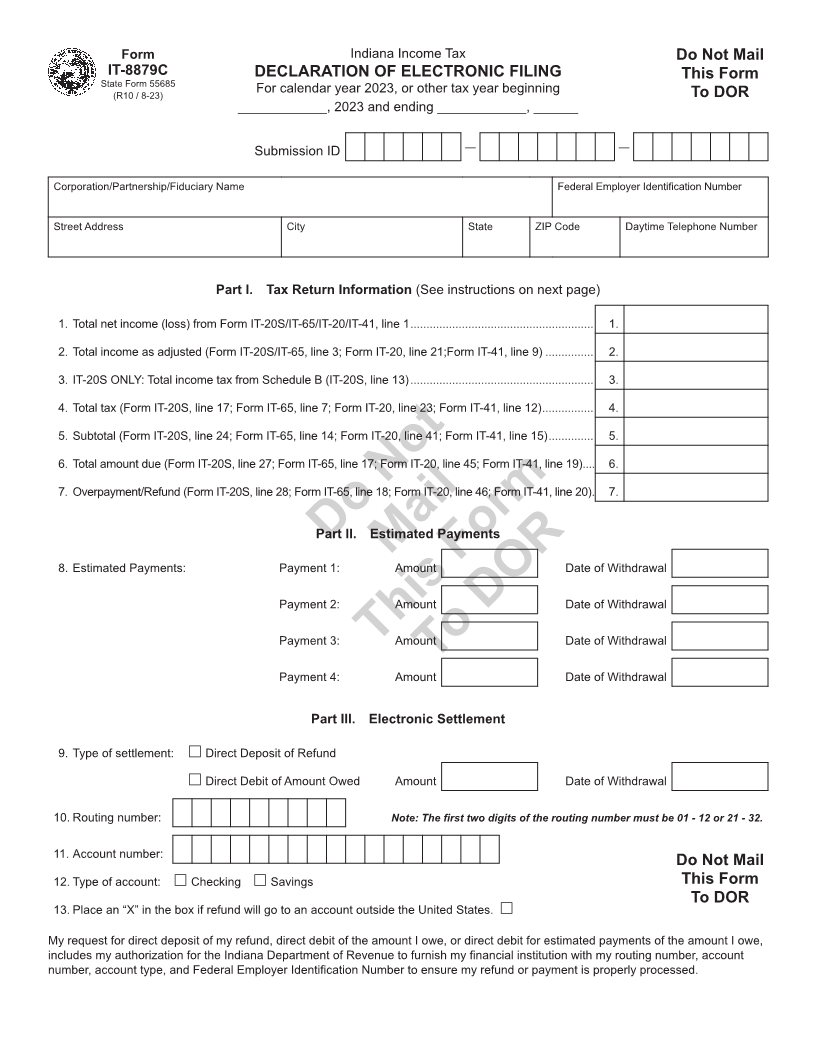

Form Indiana Income Tax Do Not Mail

IT-8879C DECLARATION OF ELECTRONIC FILING This Form

State Form 55685

(R10 / 8-23) For calendar year 2023, or other tax year beginning To DOR

____________, 2023 and ending ____________, ______

Submission ID — —

Corporation/Partnership/Fiduciary Name Federal Employer Identification Number

Street Address City State ZIP Code Daytime Telephone Number

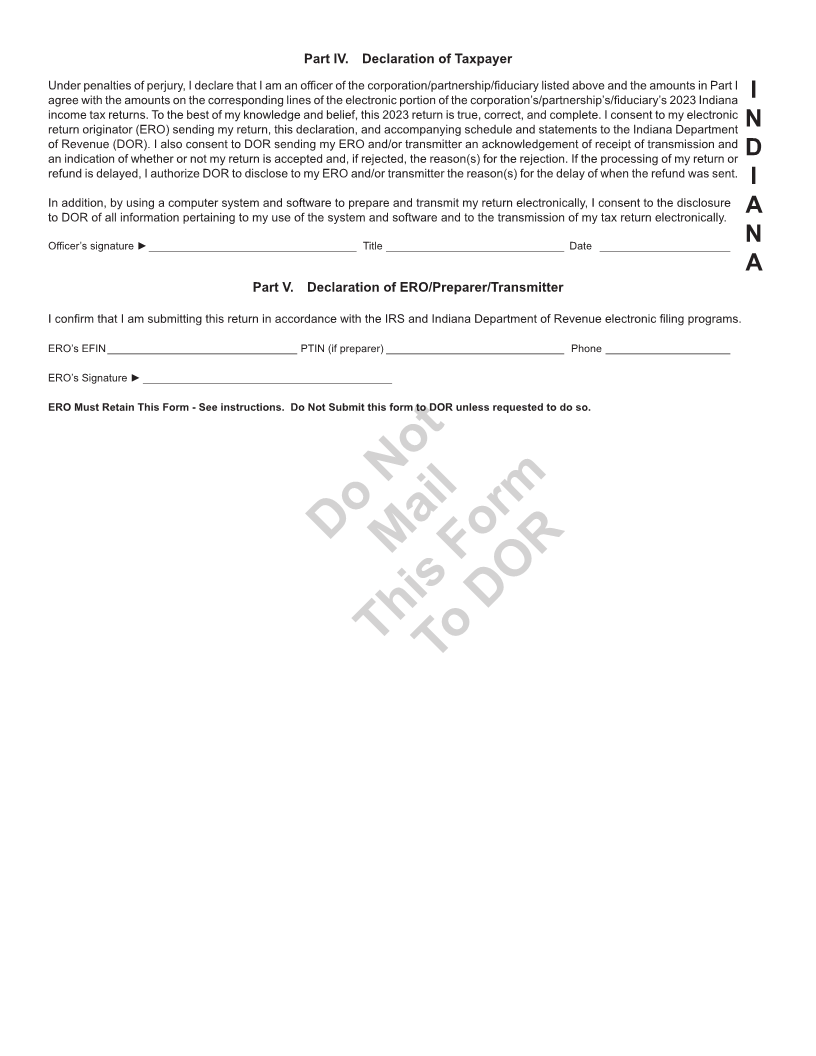

Part I. Tax Return Information (See instructions on next page)

1. Total net income (loss) from Form IT-20S/IT-65/IT-20/IT-41, line 1 ......................................................... 1.

2. Total income as adjusted (Form IT-20S/IT-65, line 3; Form IT-20, line 21;Form IT-41, line 9) ............... 2.

3. IT-20S ONLY: Total income tax from Schedule B (IT-20S, line 13) ......................................................... 3.

4. Total tax (Form IT-20S, line 17; Form IT-65, line 7; Form IT-20, line 23; Form IT-41, line 12) ................ 4.

5. Subtotal (Form IT-20S, line 24; Form IT-65, line 14; Form IT-20, line 41; Form IT-41, line 15) .............. 5.

6. Total amount due (Form IT-20S, line 27; Form IT-65, line 17; Form IT-20, line 45; Form IT-41, line 19) .... 6.

7. Overpayment/Refund (Form IT-20S, line 28; Form IT-65, line 18; Form IT-20, line 46; Form IT-41, line 20) . 7.

Part II. Estimated Payments

Do Not

Mail

8. Estimated Payments: Payment 1: Amount Date of Withdrawal

Payment 2: Amount Date of Withdrawal

Payment 3: Amount Date of Withdrawal

This Form

To DOR

Payment 4: Amount Date of Withdrawal

Part III. Electronic Settlement

9. Type of settlement: Direct Deposit of Refund

Direct Debit of Amount Owed Amount Date of Withdrawal

10. Routing number: Note: The first two digits of the routing number must be 01 - 12 or 21 - 32.

11. Account number:

Do Not Mail

12. Type of account: Checking Savings This Form

To DOR

13. Place an “X” in the box if refund will go to an account outside the United States.

My request for direct deposit of my refund, direct debit of the amount I owe, or direct debit for estimated payments of the amount I owe,

includes my authorization for the Indiana Department of Revenue to furnish my financial institution with my routing number, account

number, account type, and Federal Employer Identification Number to ensure my refund or payment is properly processed.