Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

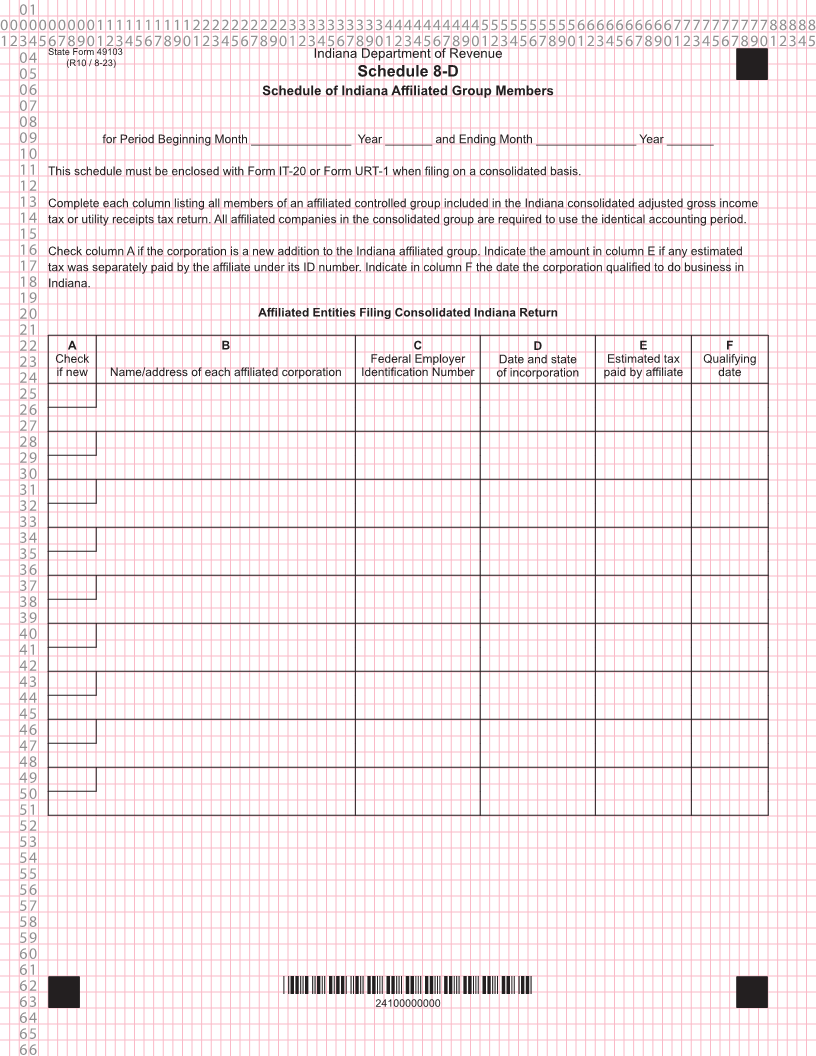

04 State Form 49103 Indiana Department of Revenue

(R10 / 8-23)

05 Schedule 8-D

06 Schedule of Indiana Affiliated Group Members

07

08

09 for Period Beginning Month _______________ Year _______ and Ending Month _______________ Year _______

10

11 This schedule must be enclosed with Form IT-20 or Form URT-1 when filing on a consolidated basis.

12

13 Complete each column listing all members of an affiliated controlled group included in the Indiana consolidated adjusted gross income

14 tax or utility receipts tax return. All affiliated companies in the consolidated group are required to use the identical accounting period.

15

16 Check column A if the corporation is a new addition to the Indiana affiliated group. Indicate the amount in column E if any estimated

17 tax was separately paid by the affiliate under its ID number. Indicate in column F the date the corporation qualified to do business in

18 Indiana.

19

20 Affiliated Entities Filing Consolidated Indiana Return

21

22 A B C D E F

23 Check Federal Employer Date and state Estimated tax Qualifying

if new Name/address of each affiliated corporation Identification Number

24 of incorporation paid by affiliate date

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62 *24100000000*

63 24100000000

64

65

66