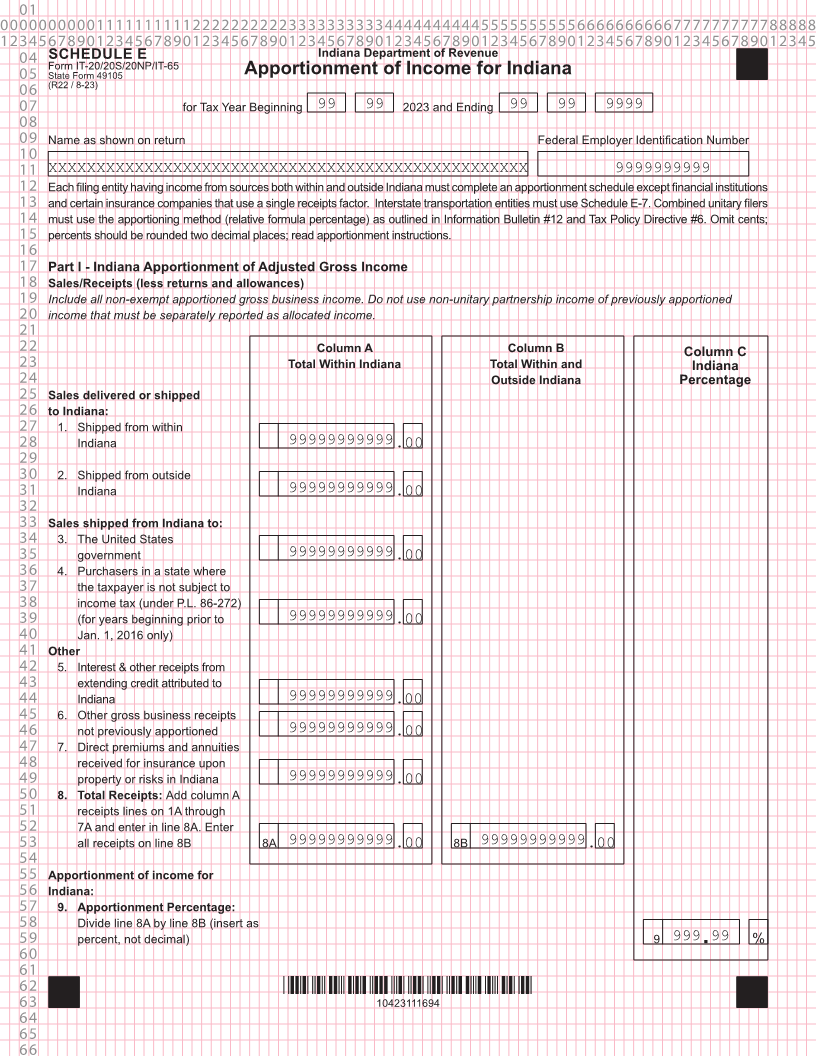

Enlarge image

01 0000000000111111111122222222223333333333444444444455555555556666666666777777777788888 1234567890123456789012345678901234567890123456789012345678901234567890123456789012345 04 SCHEDULE E Indiana Department of Revenue Form IT-20/20S/20NP/IT-65 05 State Form 49105 Apportionment of Income for Indiana (R22 / 8-23) 06 07 for Tax Year Beginning 99 99 2023 and Ending 99 99 9999 08 09 Name as shown on return Federal Employer Identification Number 10 11 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 9999999999 12 Each filing entity having income from sources both within and outside Indiana must complete an apportionment schedule except financial institutions 13 and certain insurance companies that use a single receipts factor. Interstate transportation entities must use Schedule E-7. Combined unitary filers 14 must use the apportioning method (relative formula percentage) as outlined in Information Bulletin #12 and Tax Policy Directive #6. Omit cents; 15 percents should be rounded two decimal places; read apportionment instructions. 16 17 Part I - Indiana Apportionment of Adjusted Gross Income 18 Sales/Receipts (less returns and allowances) 19 Include all non-exempt apportioned gross business income. Do not use non-unitary partnership income of previously apportioned 20 income that must be separately reported as allocated income. 21 22 Column A Column B Column C 23 Total Within Indiana Total Within and Indiana 24 Outside Indiana Percentage 25 Sales delivered or shipped 26 to Indiana: 27 1. Shipped from within 28 Indiana 99999999999 .00 29 30 2. Shipped from outside 31 Indiana 99999999999.00 32 33 Sales shipped from Indiana to: 34 3. The United States 35 government 99999999999.00 36 4. Purchasers in a state where 37 the taxpayer is not subject to 38 income tax (under P.L. 86-272) 39 (for years beginning prior to 99999999999.00 40 Jan. 1, 2016 only) 41 Other 42 5. Interest & other receipts from 43 extending credit attributed to 44 Indiana 99999999999.00 45 6. Other gross business receipts 46 not previously apportioned 99999999999.00 47 7. Direct premiums and annuities 48 received for insurance upon 49 property or risks in Indiana 99999999999.00 50 8. Total Receipts: Add column A 51 receipts lines on 1A through 52 7A and enter in line 8A. Enter 53 all receipts on line 8B 8A 99999999999.00 8B 99999999999 .00 54 55 Apportionment of income for 56 Indiana: 57 9. Apportionment Percentage: 58 Divide line 8A by line 8B (insert as 59 percent, not decimal) 9 999. 99 % 60 61 62 *10423111694* 63 10423111694 64 65 66