- 2 -

Enlarge image

|

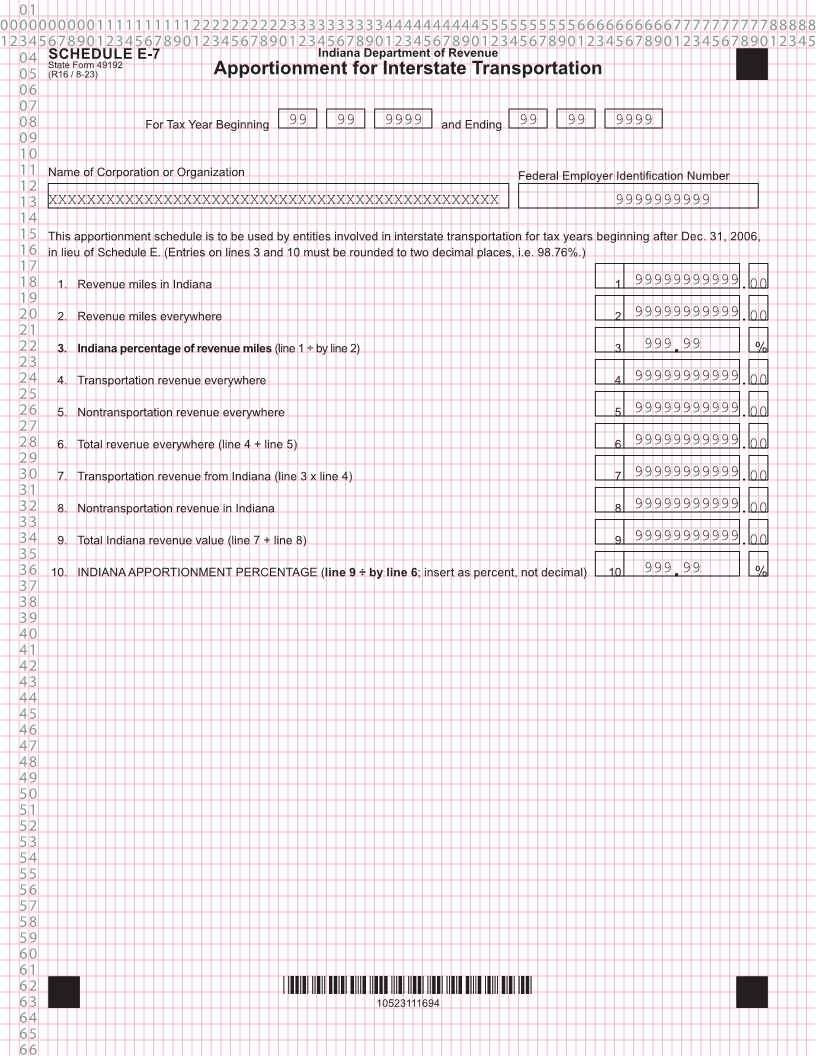

Indiana Department of Revenue

Schedule E-7 - Apportionment Schedule for Interstate Transportation

Income Tax Liability of Entities Involved in Interstate For railroads, truck lines, bus lines, and interurban lines,

Transportation if the service both originates and terminates in Indiana,

Schedule E-7 is to be used by entities who are engaged in all the receipts from that service shall be considered from

the transportation of persons and property for hire. All Indiana.

entities involved in public transportation who operate

or whose property is operated in or through Indiana are Line 2. Enter the total revenue miles traveled everywhere.

subject to Indiana income tax. This schedule is to be used For purposes of apportionment, the term everywhere does

by airlines, railroads, truck lines, bus lines, interurban not include sales of a foreign corporation located outside

lines, pipeline systems, and inland water carriers for the United States and its territories.

purposes of apportioning Indiana adjusted gross income.

Line 3. Divide the revenue miles in Indiana (line 1) by

Adjusted Gross Income the revenue miles everywhere (line 2) to determine the

The Indiana adjusted gross income tax applies to all percentage of transportation activity within Indiana.

entities who derive income from the provision of public

transportation services operated in or whose property Line 4. Enter the total amount of income derived from

is operated through Indiana. A transportation company transportation activity everywhere.

carrying persons or goods in or through Indiana is subject

to Indiana adjusted gross income tax. Line 5. Enter the total income from nontransportation

sources, such as income from interest, dividends, sale of

All multistate taxpayers are required under Indiana Code capital assets, etc. Service fees (boxing and tagging items

6-3-2-2(b) to use an apportionment formula to determine and so on), sales income (packing boxes, insurance, and

the amount of business income taxable in Indiana. so on), and all other nonmobile-type income must be

included.

Instructions for Completing Schedule E-7

Line 1. Enter the total revenue miles traveled in Indiana. Line 6. Enter the total of line 4 and line 5.

The total revenue dollars from transportation, both

intrastate and interstate, are to be assigned to the states Line 7. Multiply line 4 by line 3 to determine the amount of

through which the property, freight, or passengers move transportation revenue from Indiana.

based on mileage. Pipeline companies may substitute barrel

miles, cubic foot miles, or other appropriate measures for Line 8. Enter the amount of income derived from

revenue miles. In practice, revenue miles usually equal road nontransportation activity in Indiana.

miles.

Line 9. Enter the total of line 7 and line 8.

For airlines, use the ratio of departures of aircraft in

Indiana by cost & value to the total value of departures Line 10. Divide line 9 by line 6 to determine the Indiana

of aircraft by cost & value from all jurisdictions. (MTC apportionment percentage.

approach).

Carry the resulting average Indiana apportionment

If you have receipts from the transportation of passengers percentage to the appropriate line on the annual Indiana

(including mail and express handled in passenger income tax return.

service) and from the transportation of freight, mail, and

express, determine the miles attributable to Indiana from

passengers and freight, mail, and express separately.

*24100000000*

24100000000

|