Enlarge image

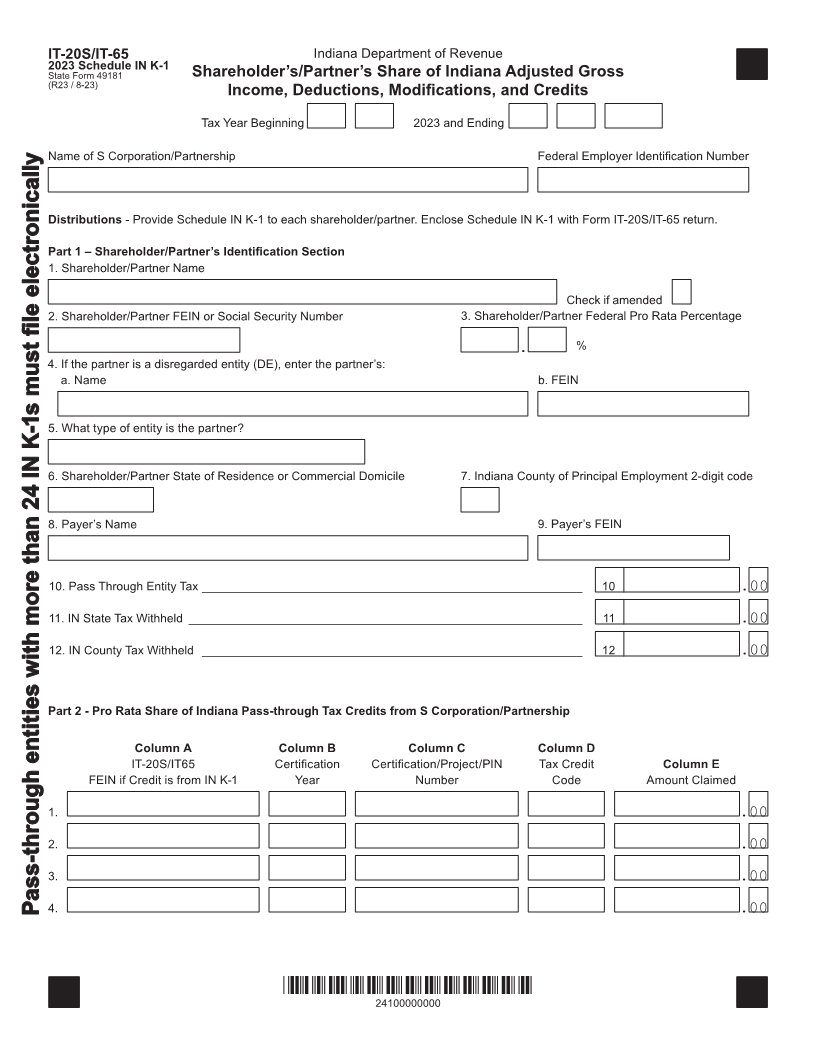

IT-20S/IT-65 Indiana Department of Revenue 2023 Schedule IN K-1 State Form 49181 Shareholder’s/Partner’s Share of Indiana Adjusted Gross (R23 / 8-23) Income, Deductions, Modifications, and Credits Tax Year Beginning 2023 and Ending Name of S Corporation/Partnership Federal Employer Identification Number Distributions - Provide Schedule IN K-1 to each shareholder/partner. Enclose Schedule IN K-1 with Form IT-20S/IT-65 return. Part 1 – Shareholder/Partner’s Identification Section 1. Shareholder/Partner Name Check if amended le electronically le electronically2. Shareholder/Partner FEIN or Social Security Number 3. Shareholder/Partner Federal Pro Rata Percentage fifi % . 4. If the partner is a disregarded entity (DE), enter the partner’s: a. Name b. FEIN 5. What type of entity is the partner? 6. Shareholder/Partner State of Residence or Commercial Domicile 7. Indiana County of Principal Employment 2-digit code 8. Payer’s Name 9. Payer’s FEIN 10. Pass Through Entity Tax _________________________________________________________ 10 .00 11. IN State Tax Withheld ___________________________________________________________ 11 .00 12. IN County Tax Withheld _________________________________________________________ 12 .00 Part 2 - Pro Rata Share of Indiana Pass-through Tax Credits from S Corporation/Partnership Column A Column B Column C Column D IT-20S/IT65 Certification Certification/Project/PIN Tax Credit Column E FEIN if Credit is from IN K-1 Year Number Code Amount Claimed 1. .00 2. .00 3. .00 Pass-through entities with more than 24 IN K-1s must Pass-through entities with more than 24 IN K-1s must 4. .00 *24100000000* 24100000000