- 3 -

Enlarge image

|

Instructions for Indiana Withholding and

Composite Filing Opt-Out Affidavit

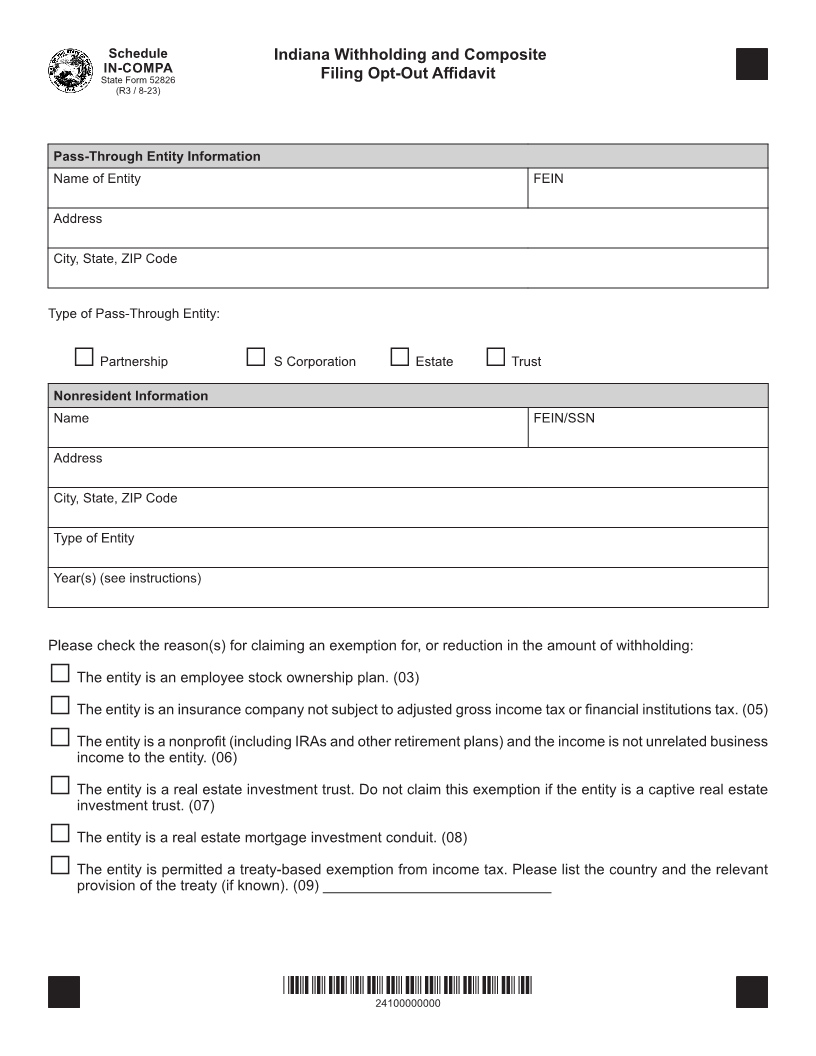

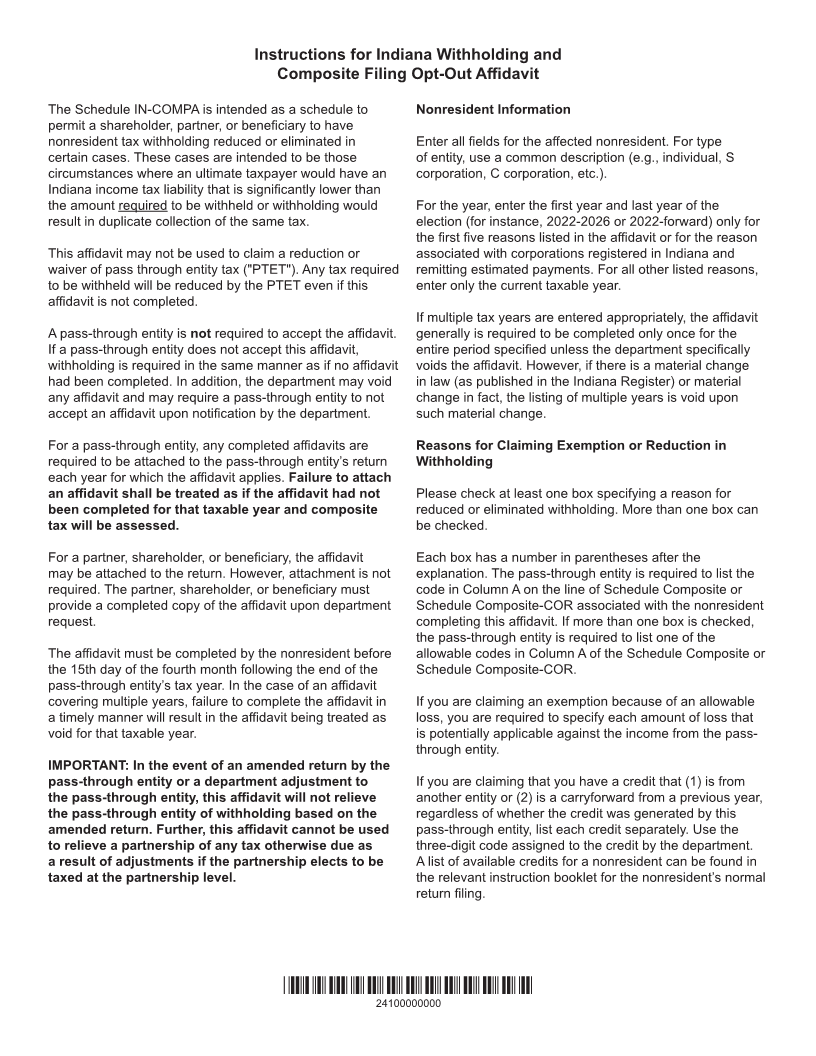

The Schedule IN-COMPA is intended as a schedule to Nonresident Information

permit a shareholder, partner, or beneficiary to have

nonresident tax withholding reduced or eliminated in Enter all fields for the affected nonresident. For type

certain cases. These cases are intended to be those of entity, use a common description (e.g., individual, S

circumstances where an ultimate taxpayer would have an corporation, C corporation, etc.).

Indiana income tax liability that is significantly lower than

the amount required to be withheld or withholding would For the year, enter the first year and last year of the

result in duplicate collection of the same tax. election (for instance, 2022-2026 or 2022-forward) only for

the first five reasons listed in the affidavit or for the reason

This affidavit may not be used to claim a reduction or associated with corporations registered in Indiana and

waiver of pass through entity tax ("PTET"). Any tax required remitting estimated payments. For all other listed reasons,

to be withheld will be reduced by the PTET even if this enter only the current taxable year.

affidavit is not completed.

If multiple tax years are entered appropriately, the affidavit

A pass-through entity is not required to accept the affidavit. generally is required to be completed only once for the

If a pass-through entity does not accept this affidavit, entire period specified unless the department specifically

withholding is required in the same manner as if no affidavit voids the affidavit. However, if there is a material change

had been completed. In addition, the department may void in law (as published in the Indiana Register) or material

any affidavit and may require a pass-through entity to not change in fact, the listing of multiple years is void upon

accept an affidavit upon notification by the department. such material change.

For a pass-through entity, any completed affidavits are Reasons for Claiming Exemption or Reduction in

required to be attached to the pass-through entity’s return Withholding

each year for which the affidavit applies. Failure to attach

an affidavit shall be treated as if the affidavit had not Please check at least one box specifying a reason for

been completed for that taxable year and composite reduced or eliminated withholding. More than one box can

tax will be assessed. be checked.

For a partner, shareholder, or beneficiary, the affidavit Each box has a number in parentheses after the

may be attached to the return. However, attachment is not explanation. The pass-through entity is required to list the

required. The partner, shareholder, or beneficiary must code in Column A on the line of Schedule Composite or

provide a completed copy of the affidavit upon department Schedule Composite-COR associated with the nonresident

request. completing this affidavit. If more than one box is checked,

the pass-through entity is required to list one of the

The affidavit must be completed by the nonresident before allowable codes in Column A of the Schedule Composite or

the 15th day of the fourth month following the end of the Schedule Composite-COR.

pass-through entity’s tax year. In the case of an affidavit

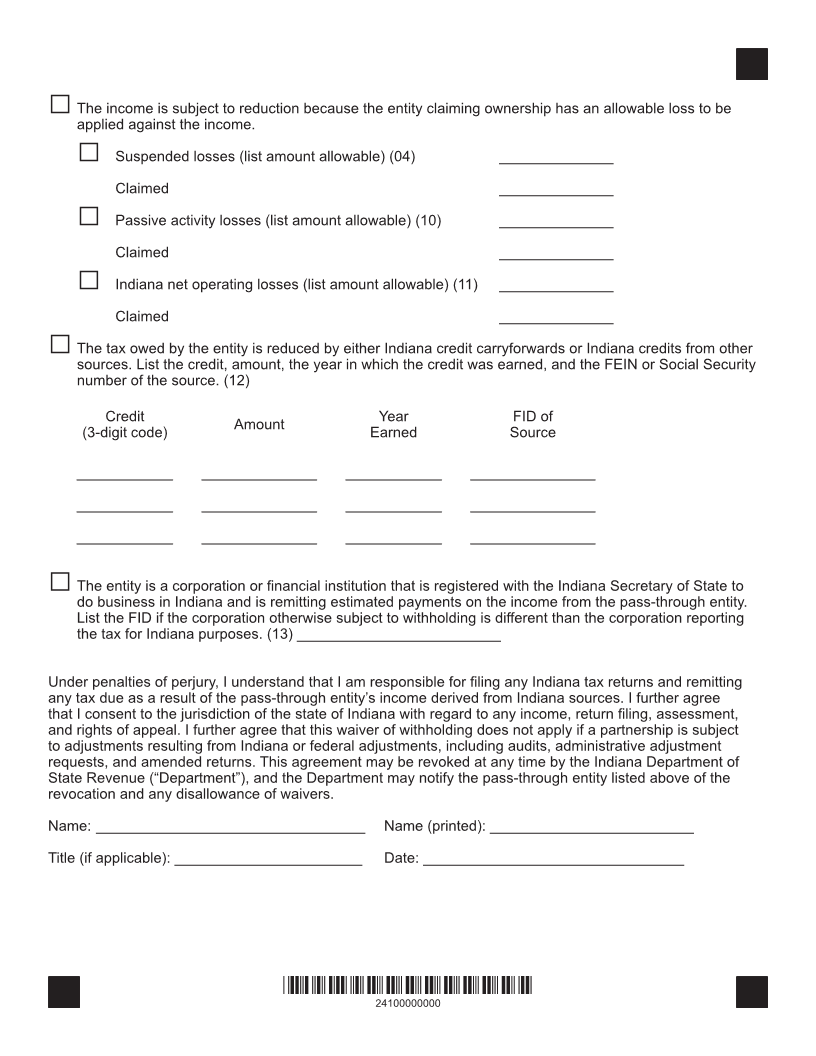

covering multiple years, failure to complete the affidavit in If you are claiming an exemption because of an allowable

a timely manner will result in the affidavit being treated as loss, you are required to specify each amount of loss that

void for that taxable year. is potentially applicable against the income from the pass-

through entity.

IMPORTANT: In the event of an amended return by the

pass-through entity or a department adjustment to If you are claiming that you have a credit that (1) is from

the pass-through entity, this affidavit will not relieve another entity or (2) is a carryforward from a previous year,

the pass-through entity of withholding based on the regardless of whether the credit was generated by this

amended return. Further, this affidavit cannot be used pass-through entity, list each credit separately. Use the

to relieve a partnership of any tax otherwise due as three-digit code assigned to the credit by the department.

a result of adjustments if the partnership elects to be A list of available credits for a nonresident can be found in

taxed at the partnership level. the relevant instruction booklet for the nonresident’s normal

return filing.

*24100000000*

24100000000

|